The Simple Math Behind Starting A Side Hustle – Income Generation & Diversification

I talk about side hustles a lot on WebMonkey.

I think the world of online money making is generally interesting and fun, so I argue that starting a side hustle or developing new income streams is a worthwhile (and fun) endeavor for anyone to take part in.

That being said, I understand that it can be intimidating to take the first step.

I was in the conundrum-camp just 9 months ago when I decided to give starting my own blog a shot. I also had no idea what I was getting myself into when I decided to start my own dropshipping business or when I tried (and failed) at shipping POD items on Etsy.

After succeeding and failing at a variety of businesses and ventures, I’ve ultimately learned that it doesn’t really matter as long as you are persistent.

Get as many irons in the fire as you can…throw things against the wall and see what sticks. That’s the name of the game when it comes to side hustling.

Eventually, you will find what works best for your given skillet and desires. I’ve launched blogs or Amazon affiliate websites before, but this is the niche and platform that has worked for me (it took a few years to find…I launched my first website when I was 16).

Anyway, I was recently having a conversation with a friend where I encouraged them to start their own Etsy shop.

Inevitably, the conversation touched upon 2 questions:

- How much money could they make by opening an Etsy shop?

- Would the whole thing be worth it?

After giving those questions some thought, I wanted to break down the simple math behind starting a side hustle in this post because I don’t think it is as complicated as people might think.

This post will contain:

- The simple math behind starting and benefiting from a side hustle.

- What side hustles help protect us from.

- Side hustling for income diversification?

- Some quick suggestions on how to make more money and financial independence.

Let’s get to it!

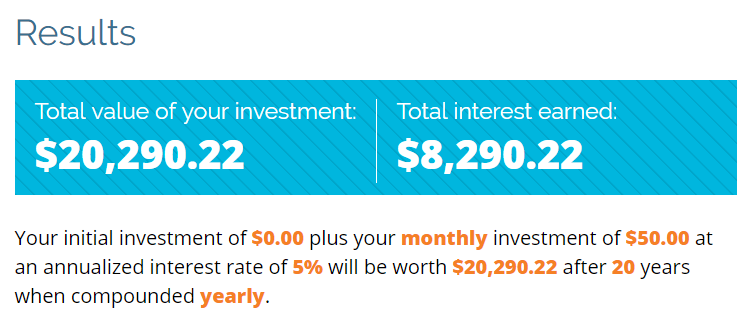

The Simple Math Behind Starting a Side Hustle – $50/Month

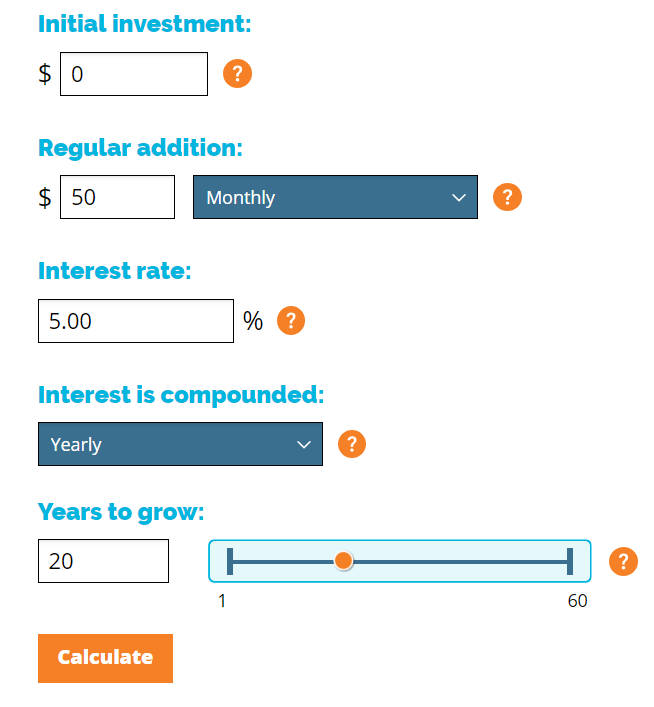

Before I get into the nitty-gritty details of this quick math, I want to outline what assumptions and tools I am using:

- I am using this compound interest calculator from getsmarteraboutmoney.ca.

- I am assuming a current initial investment amount of $0.

- I am assuming all of the money from side hustling is added to an investment portfolio each month (or that you contribute an equivalent amount to your portfolio if side hustle money is for paying off bills).

- I am assuming a 5% annual return rate. This is a conservative estimate, and more than reasonable.

- I am giving the portfolio 20 years to grow.

Now, let’s say you started a simple side hustle that started netting you $50 of income every single month.

This $50 might not seem like much, but then again, that’s $600 of extra income each year.

And when you plug in these numbers into the compound interest calculator…

Some pretty awesome returns come out!

It might sound absolutely crazy or even impossible, but if you invest $50 a month at a 5% annual rate of return, you will earn more than $8,000 in interest over 20 years.

Additionally, your investment portfolio as a whole would increase by more than $20,000; all from a simple $50 a month side hustle!

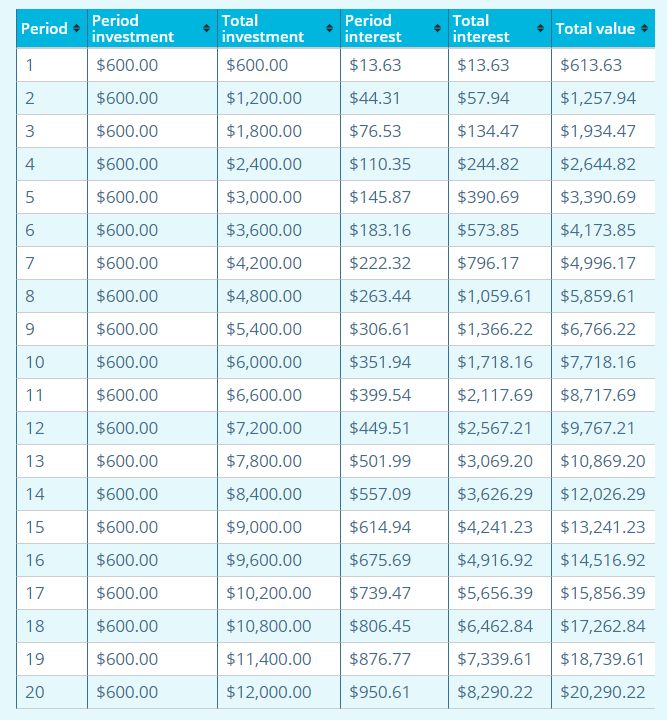

If you don't believe the math, just checkout the year-by-year breakdown:

The simple fact is that compound interest and time is the most powerful combination side hustlers have in their arsenal.

It doesn't matter if you are trying to reach financial independence or if you just want to make more money: investing and a long time frame are a killer duo!

So, what are some viable side hustle ideas for making $50 a month?

There are some very simple ones:

- You can spend a few hours at a myriad of gig-economy related jobs.

- You can work overtime or pick up one more shift.

- You can start a phone farm/use passive income apps or websites on a laptop to earn some money.

- You can try your hand at selling items on Etsy or other marketplaces.

The Simple Math Behind Starting a Side Hustle – Other Income Levels

Alright, while making $50 a month from side hustling is a great start, it's also reasonable to expect that you can make more money and increase your portfolio worth.

Let's take a look at a few more monthly earning thresholds!

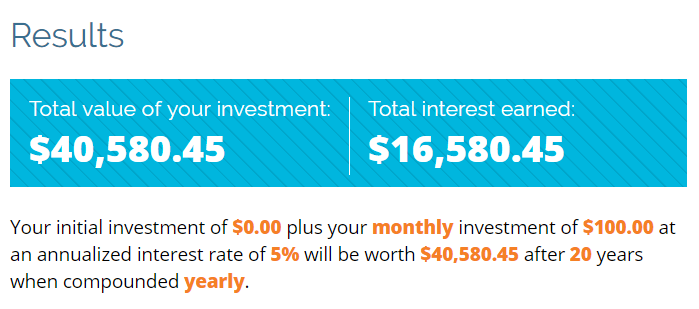

Earning $100/Month from Side Hustling

If you invested $100/month at a 5% annual rate of return, you would earn more than $16,5000 in interest in 20 years and reach $40,500 in portfolio value!

Some viable side hustles I would recommend to make $100 a month in additional income include:

- Teaching English or other subjects online.

- Offering local services in your city, like lawn care, shoveling snow, gardening help, etc.

- Starting your own blog (it will take a few months to get running, granted, but if you check my recent income reports you'll see it is possible to earn $100-$300 a month from blogging within a year).

- Start writing on Medium (frequently…ideally several times a week until your income starts to pick up).

Earning $300/Month from Side Hustling

If you invested $300/month at a 5% rate of annual return, you would earn almost $50,000 in interest over 20 years and see your portfolio grow to more than $120,000!

Granted, it might take some time for you to develop a side hustle to a $300/month point, but it is possible!

Realistically, these are some side hustle ideas I could see generating $300/month:

- Finding work as a freelance writer (a lot of gigs can pay around $30/hour, so you would have to put in 10 hours a month to make $300).

- Finding other types of freelance work (social media management, web development, etc.)

- Selling products on Amazon (if you know what you are doing).

- Dropshipping (if you know what you are doing).

- Selling on Ebay (if you know what you are doing).

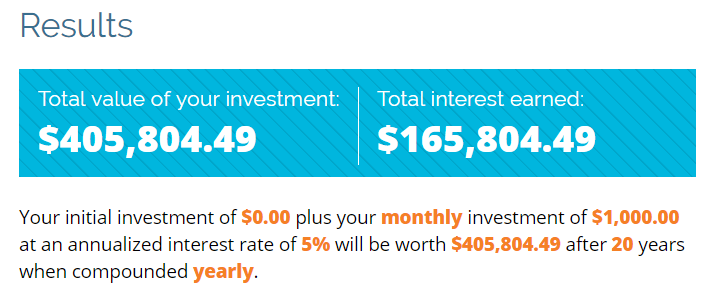

Earning $1,000/Month from Side Hustling

Alright, while this might be getting to the daydreaming phase for a lot of side hustlers, I think this $1,000/month benchmark really shows the power of compound interest in full.

Alright, while this might be getting to the daydreaming phase for a lot of side hustlers, I think this $1,000/month benchmark really shows the power of compound interest in full.

Personally, earning 165K in interest from side hustle work sounds like a dream come true. While I am still a long, long way off this mark, the numbers certainly serve as a nice goal to work towards!

However, I think it is fairly unreasonable to expect someone that someone with a 40 hour work week can earn an additional $1,000/month from gig jobs or anything that pays a lower hourly rate.

To earn $1,000/month as a side hustle, I imagine you would have to:

- Get into some sort of consulting on the side (SEO, digital marketing, project management, etc.)

- Offer copy-writing services or do landing page work for businesses (these can be some high paying contracts).

- Find some other way to offer a business your services, since businesses are more likely to have the capital to pay monthly contracts worth $1,000 or more.

Back in college, a colleague and I had $1,000 contracts for SEO and paid advertising work, and I have heard of copywriters earning some impressive amounts of cash.

Hell, even bloggers who dabble in sponsored posts can make a killing, so it is certainly possible to make the coveted $1,000/month mark with enough time and dedication.

But even if you can't make $1,000 a month in extra income, you see the point: any additional income can be immensely powerful when invested.

Now, while making extra money is always welcome, I also want to touch on a few other benefits of side hustling because this concept is much more powerful than just increasing your net worth.

Other Factors Side Hustles Protect us From

1 – Avoiding Debt or Paying Off Debt Faster

Due to life events or circumstances, not everyone is able to invest the extra money they make. This is absolutely normal.

However, earning even a bit of additional income every single month from a passive income source or side hustle can be immensely valuable.

While in school, I sold textbooks, did freelance digital marketing, started a blog, and entered marketing competitions to help make money in college.

Ultimately, that money went a long way in helping with the cost of tuition/textbooks and general life expenses.

Even a humble $50/month side hustle can help prevent $600 worth of debt each year, or cover an expense like a phone bill or part of the grocery bill.

And if you factor in the interest you end up paying on loans, each side hustle dollar that is spent on paying off debt or mitigating it in the first place is actually more valuable than the base dollar amount in a sense.

2 – Income Dips or Unemployment

I work at a digital marketing company where commission is a pretty important part of what I take home at the end of the month.

For anyone else in a commission-based job, seasonal work, or an industry that fluctuates with pay-rates, you know that income dips are just a fact of life…not every month will be the same.

Additionally, depending on what country you live in, health care or certain worker compensation laws may or may not assist you in the event you have to take extended amounts of time off from work.

And, finally, depending on your industry and the job market in your country, there are varying amounts of risk when it comes to losing your job entirely.

While I am a firm believer that honest, hard working people will always make it out okay at the end of the day, the simple fact is that one's income can take a sudden and unexpected hit for a variety of reasons.

In the worst case scenario, having additional income streams in your life can be a saving grace.

This is essentially income diversification 101, and if you can successfully develop multiple income streams, you are accelerating your path towards financial independence while simultaneously reducing your risks.

Even if a side hustle only bring in a few hundred dollars every now and again, you can use this money to help build up an emergency fund that will buy you more time in the event your income dips.

In a way, having a firmly established side hustle is like a financial safety net. The more money your side hustle produces, the better and wider your safety net is!

3 – Stagnant Growth & Lack of Learning

I once had an internship at an insurance company where I was a ‘Ratings Tester'.

In the job description, it said I would be helping the company improve upon their current insurance policy rating system, as well as devise some new components for how the company would develop new plans.

In reality, I spent 4 months making fake people in an imaginary script-based world, assigning them wonky insurance policies, and trying to break the system. It was pure quality assurance work and brute-force bug testing at its finest.

Needless to say, I was miserable.

I also wasted an internship, and didn't learn anything useful beside the fact that I will never work in insurance as long as I live.

However, while I was forced to toil away at the world's shittiest version of The Sims video game for 8 hours a day, at night, I did my own thing.

It was at this time I started doing freelance digital marketing, reading about passive income, and brainstorming money making ideas to try.

Spending time on the things I was actually interested in brought enjoyment into my life, taught me a variety of new skills, and helped keep me sane.

If you are ever caught in a period of time where you are not learning or have become stagnant, starting a side hustle is an immediate way to remedy the issue.

Even if you are currently employed at a job that isn't unbearable, if you aren't consistently learning new skills and honing your talents, you are losing a competitive advantage to the people who are putting in the extra work.

Your side hustle can even accomplish more than simple income generation.

If the skills you learn from starting your own business or online venture complement the skills you need to do your job, you might even become a more valuable employee.

Or, in an even cooler scenario, the skills you develop from starting a side hustle might allow you to receive a promotion at work or suggest new ideas that benefit the company you work for.

For college students who still have to enter the job market, this concept is even more important.

Unless you are in engineering, some science, or a trade, I believe colleges are generally doing a poor job at teaching students any hard skills (or even how to think…but don't get me started on this).

I'm finishing my degree in Psychology/Marketing, and if I hadn't had internships or side hustles, I wouldn't know a damn thing!

Starting your own business or trying to make more money in college will make you more prepared and qualified to enter the workforce, so make the most of of your college years and learn through trial by fire.

Final Thoughts on Side Hustle Math

While starting your own business or attempting to make money online can seem daunting at first, I think it is important to remember a few important things:

- It's alright to start out small.

- Your side hustle income doesn't need to replace your full-time income.

- Investing your additional income or paying off debt faster are some of the most important things you can do, financially speaking.

Even if your side hustle never amounts to more than a humble $50/month income boost, make it happen.

It is impossible to grow or develop new skills without putting in any effort, and you might be surprised at where you end up after putting in some time.

And one more thing…don't forget to have fun!

If you want to take your side hustle money and go out for a nice dinner or buy someone a thoughtful gift, go for it.

I think it is easy to get lost in the calculators and long-term picture, and all too easy to forget that life isn't just about reaching financial independence as fast as you can.

Sometimes, you just need to treat yourself or the important people in your life to new things and experiences.

I hope you have enjoyed this post, and thank you to everyone who stuck around to the very end.

Catch you all in the next post!