Sick Of Having No Money? 12 Tips For When You’re Struggling Financially

At some point in time, I think most people experience financial stress.

It doesn't matter if you're a broke college student, young adult, or are dealing with some sort of debt or major expense in your life; money can be tough sometimes.

But if you're struggling financially and are sick of having no money, you're not out of luck. In fact, you can get your finances back on track and relieve some stress if you follow a game plan.

Want some fast money-makers? Checkout:

- Freecash: Play games and download apps to earn cash!

- EarnIn: Borrow up to $750 against an upcoming paycheck!

12 Moves To Make If You're Struggling With Money

1. Create A Budget

If you're tired of being broke but don't have a budget, you've actually lost the right to complain in many ways. This is because having a budget is critical to saving more money each month and knowing where your money actually goes.

After all, without a budget, you have zero idea about where your money is going each month. You also have no clue about your fixed expenses or spending categories that are giving you some trouble.

So, the first step to get back on track when you're broke is to start with the basics.

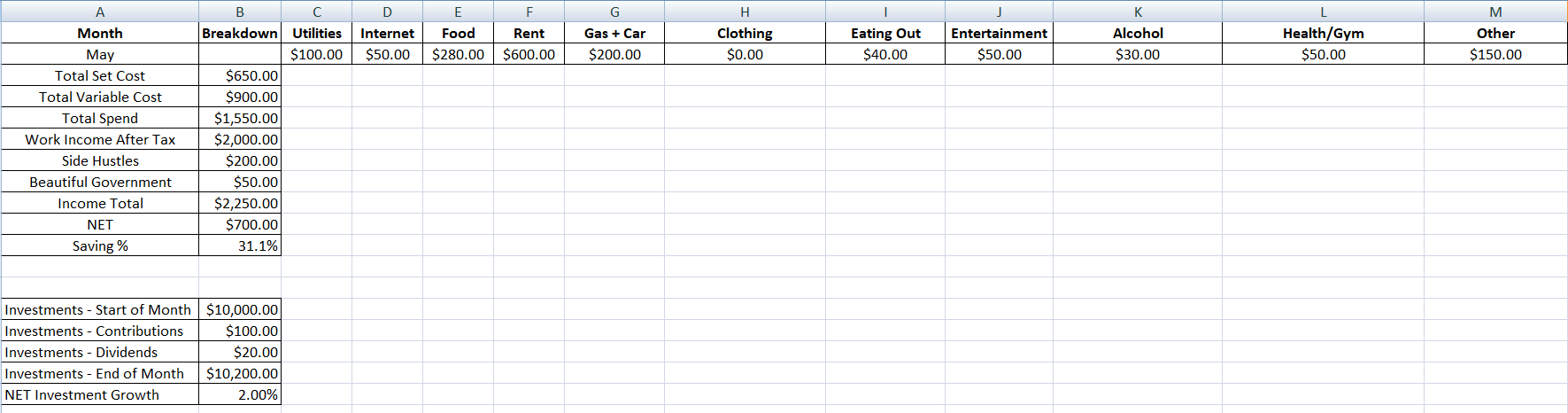

For me, a simple Excel spreadsheet is how I track my monthly fixed and variable expenses:

You can do the same, or you can try budgeting software like Rocket Money or You Need A Budget. The goal is to get a comprehensive understanding of your finances so you can begin making a game plan.

Now, this might seem counterproductive since you don't have much money to begin with, but trust me, this is important.

When I was a student, I started working at Starbucks and an advertising agency to pay for tuition and bills. Even though I didn't have a lot of discretionary income, a budget helped me identify some problem areas of spending (food and beer) and helped me cut back on spending.

🚀 Start saving with Rocket Money!

2. Try A Side Gig

If you're currently unemployed, finding stable employment is probably the first goal if you're able to work. Even if it's a basic job you don't like, having regular income is the first step to get back on track with your finances.

Now, if you're still struggling financially and have a budget, the next thing you can try is boosting your income.

Starting a side hustle is one of the best ways to create more disposable income for yourself, which you can use to pay down bills, chip away at debt, and buy groceries each month. Some popular side gigs you can consider include:

- Delivering food for DoorDash or Uber Eats (you can even do this by bike!)

- Trying gig apps like walking dogs with Rover.

- Offer a local service, like babysitting or tutoring.

- Try handyman tasks with apps like Taskrabbit.

- Trying out microtask websites to make some spare cash.

- Making money with online surveys.

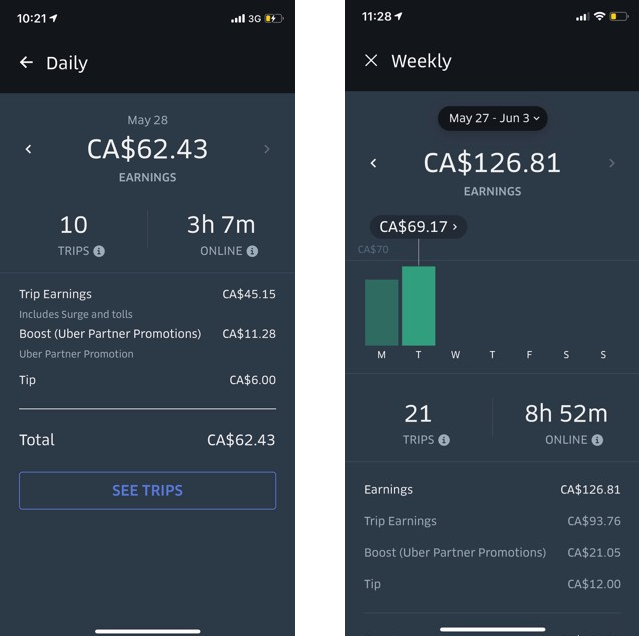

When my friend was trying to make ends meet living in Toronto, he ended up biking for DoorDash and Uber Eats to make extra money:

You get the idea, and every little bit helps. At one point when I was in college, I was working a 40 hour paid internship, an online job for an advertising agency, and I was starting my blog to make extra cash. It was exhausting at points, but it definitely helped alleviate some financial stress.

Start making money with Uber Eats!

3. Look For Help

If you're tired of struggling financially, you might be able to get a quick leg up if you search for programs that assist lower income households and individuals.

There's already a variety of government programs for low income households, including:

- Supplemental Nutrition Assistance Program (SNAP), or food stamps

- Medicaid and health insurance marketplaces

- Educational grants and scholarships

- Subsidized housing

- Social security income for low-income seniors and adults with disabilities

- Welfare and TANF

You can also look for city-specific programs in your area, or visit a local Goodwill or humanitarian shelter for information. The point is, if you're truly broke and struggling, there are resources that are there to help.

They might not fix everything, but don't be afraid to seek help if you need it.

Extra Reading – How To Get Free Money.

4. Build An Emergency Fund

It might sound a bit ridiculous to say that saving money is what you should do if you're completely broke. However, it's important to build an emergency fund over time that can cover a few months of expenses or unexpected expenses if disaster strikes.

I mean, picture a world in which you're broke and your car breaks down. If you don't have an emergency fund, this means putting repairs on credit or, even worse, turning to payday loans.

These interest rates then make matters worse, and all of a sudden, you're struggling with debt because you couldn't pay for a $600 car repair out of pocket.

Building an emergency fund is tough when you're living on a low income. But it's important to slowly chip away at this goal. Even if you can put away $20 or $50 per month and slowly grow that amount, it's important.

If you live in the United States, you can use companies like Current and earn 4% APY on up to $6,000, so it's a great option to park some extra savings.

I like Current since it doesn't charge any fees. And new members can also get a $50 sign up bonus by signing up with the code ‘WELCOME50' and setting up a qualifying direct deposit.

Again, don't touch this money unless you absolutely need to. Instead, let it sit and earn passive income and only use it for emergencies.

👉 How To Get Out Of The Rat Race.

5. Eliminate Vices

If you're sick of being broke but still spend a lot of your money on vices, you once again have lost some of the right to complain.

Unless you're dealing with an addiction, there's absolutely no reason to spend money on certain vices if you're broke. Some examples include:

- Smoking

- Alcohol

- Lottery tickets and gambling

Again, all three of these categories can be addictions, so this is admiteddly a tough category to talk about.

This is just one of those things where if you need to be brutally honest with yourself and to cut back on a certain category of spending, that's just how it is.

6. Live Like A Minimalist

Minimalism is becoming more popular these days. In fact, you've probably seen some memes of San Fran millennials who make $120,000 a year as a software engineer but insist on living in an empty apartment.

While this is funny, you also have to admit that living like a minimalist has some inherent financial advantages. I mean, you're theoretically buying fewer material things, so that's an immediate way to save money.

A lot of minimalists also try to derive enjoyment from what already exists around them, like nature or spending time with friends and family. Call it corny, but hey, maybe switching up your mentality a bit could help you if you're currently broke!

7. Pickup A Second Job

Like starting a side gig, picking up a second job is a great thing to do when you have no money.

Ideally, your second job has a flexible schedule or set hours that don't interfere with your primary job. This is why I like online jobs or gigs like freelance writing since I'm in control of my own schedule.

If this doesn't work, you can also try asking for more shifts or picking up overtime whenever possible to make some extra cash each month.

Pro Tip: Find flexible, high-paying online jobs with FlexJobs, one of the leading remote job boards.

8. Tackle Debt

If bad debt is the reason you're struggling to make ends meet, you need to figure out a debt repayment strategy.

One option is to start chipping away at debt slowly by using a debt payoff method. Two popular options include:

- The Debt Snowball Method. Popularized by Dave Ramsey, this method involves paying off your smallest debts first and to accelerate those payments into larger payments.

- The Avalanche Method. This method involves paying off your highest interest debts first. This is mathematically a smart way to go about debt, although the snowball method makes it easier to get excited since you pay off small debts quickly.

Both of these methods can help you if you're struggling financially and are stressed over debt. And once you tackle some of your highest-interest debt, you'll free up some monthly income and get some breathing room.

Pro Tip 💵 You can work with a company like TurboDebt if you have at least $10,000 in high-interest debt and are looking for relief.

9. Cut Down On Expenses

I mentioned creating a budget to help deal with money stress. But it's also important to reduce your monthly spending if you're really struggling with money.

Some of the easiest areas to reduce spending include:

- Cable TV

- Expensive phone bills (you can switch to Mint to save)

- Expensive beauty products or care

- Entertainment like going out to bars or clubs

- Dining out

- Streaming services or subscriptions you don't use

For me, spending less on dining has made a massive difference for my monthly finances. And I also switched to a cheaper phone and Internet plan last year to save more.

Pro Tip: You can use Rocket Money to find and cancel painful subscriptions and negotiate lower bills, all while tracking your monthly spending!

10. Take Responsibility

One of the best things to do when you don't have money is to also take some responsibility and action. Even if bad luck or outside events have put you in a tough spot, it's up to you to make a plan and to work to get things back on track.

Try to stay optimistic, and write out your plan for getting back on track financially. Even if you start with small goals, the important part is to actually set some goals and to begin working towards them.

11. Don't Neglect Your Health

Another important aspect out of all of this is to never neglect your mental and physical health.

This is, admittedly, very tough to do, especially if your diet takes a hit because you're struggling financially. It's important to try and eat a balanced diet that's as affordable as possible. I mention some strategies for this in my post on how to save money in college.

It's also important to stay active. You don't need an expensive gym membership or equipment to do this either; running outside or walking every day is a great way to ensure you're getting some steps in.

If you need some motivation, you can also check out numerous apps that pay you for working out or apps that pay you to walk for some added encouragement.

Extra Reading – How To Make Money With A Bike.

12. Try An Under The Table Job

Under the table jobs that pay cash are, in fairness, a tad sketchy. However, if you can find an occasional odd-job in your neighborhood, the cash can definitely help.

People need help all the time with things like landscaping, junk removal, cleaning, and other random gigs you'll see posted on websites like Craigslist.

If you find a decent paying cash gig in your area and have some free time, the effort could be worth the extra cash.

Extra Reading – 27 Apps That Pay You To Drive.

Final Thoughts

Financial stress is one of the most common forms of stress, and if you've ever worried about money, you know the feeling.

Thankfully, if you're sick of having no money, you have options to get back on track!

Between financial assistance programs, the gig economy, and tightening up on spending, it's possible to slowly build up your wealth over time and to start chipping away at debt.

You might not know what to do when you are completely broke, but the truly important thing is to start somewhere. As long as you create a game plan and stick to it, you'll make progress over time.

Extra Reading: