Moka App Review (Mylo) – Automatic Saving & Investing For Canadians

When it comes to learning how to invest, I think it can be difficult to know where to begin.

Financial literacy is, unfortunately, not taught in school. Plus, if you have a limited amount of money to start investing with, it might seem like there's no point in trying.

However, if you want to build wealth, putting your money to work for you is imperative.

Even if it's only a humble amount to start with, getting the ball rolling for your financial future is better than sitting on the sidelines.

Now, if you're a Canadian who wants to learn the basics of investing without requiring significant upfront capital, you have some options.

With the Mylo app, now rebranded as Moka, it's easy to invest your spare change and automatically get in the habit of saving.

Time to break down how this app works and the facts you need to know in our official Moka app review!

What Is Moka (Mylo)

The Mylo app, which is now called Moka, is a Canadian spare change investing app that began in 2017.

Mylo actually made an appearance on Dragon's Den, the Canadian equivalent of Shark Tank, and ultimately secured a $400,000 deal for 5% of the company with 3 Dragons.

Since then, Mylo has grown to become an immensely popular Canadian investing app, and has recently rebranded to Moka after expanding to France and adding some nifty new features.

Now, I used to be against spare change investing apps like Acorns that helped people get started with investing by rounding up spare change.

In my mind, apps like Moka provide a service you can already do on your own through DIY investing…so why pay an app to do this for you?

However, I've come to realize that the benefit of platforms like Moka is that they help beginner investors learn how to get started; which is a pretty valuable service in and of itself.

So, if you want to start investing with Moka, here's what you need to know!

How Does Moka Work?

In a nutshell, Moka makes investing automatic by making it easier to regularly put money aside to grow your portfolio.

To accomplish this, Moka makes use of spare change investing.

In other words, when you make a purchase, Moka rounds up that purchase to the nearest dollar and invests the difference for you.

So, if you buy a sandwich for $6.20, Moka will round to $7 and deposit that additional $0.80 automatically into your Moka account.

Your spare change accumulates throughout the week. On Monday, Moka withdraws that money from your linked checking account and invests it into your investment account automatically.

There's no need to take action, think, or put time aside to plan your investments; Moka keeps you on track throughout the week.

Note: If Moka detects you're short on funds, they don't withdraw your money so you don't have to worry about overdraft fees.

Additionally, Moka offers other ways to grow your wealth, including:

- One-Time Boosts: You can deposit a specific amount to your Moka investment account whenever you choose.

- Recurring Investments: Set a weekly amount to deposit automatically alongside your spare change round ups.

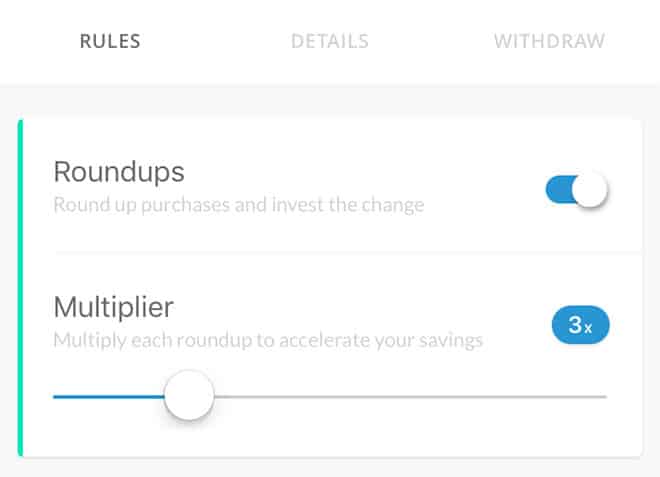

- Roundup Multiplier: If you want to invest faster, you can change your Moka round up multiplier. For example, a 5x or 10x would make a $0.80 round up turn into $4 and $8 respectively.

It's a fairly simple system, but ultimately, it works if you can't get in the habit of putting money aside yourself.

Types Of Moka Portfolios

I thought it made sense to get into what you're actually investing in for this Moka review before digging into the easy stuff, like how to open an account.

See, spare change apps don't do anything revolutionary.

In fact, these apps largely invest in low-fee ETFs, or exchange traded funds, that independent investors can purchase and sell themselves.

However, the idea behind Moka is to make things easy and to build good habits…if you're a DIY investor, this app isn't for you.

Anyways, there are several pre-constructed portfolios to choose from for your investments:

- Conservative: Entirely for saving money automatically; this is just a savings account.

- Conservative-Moderate: 60% bonds and 40% savings.

- Moderate: 60% bonds and 40% stocks.

- Moderate-Aggressive: 40% bonds and 60% stocks.

- Aggressive: 20% bonds and 80% stocks.

Again, by stocks, Moka's referring to ETFs that essentially hold a basket of stocks.

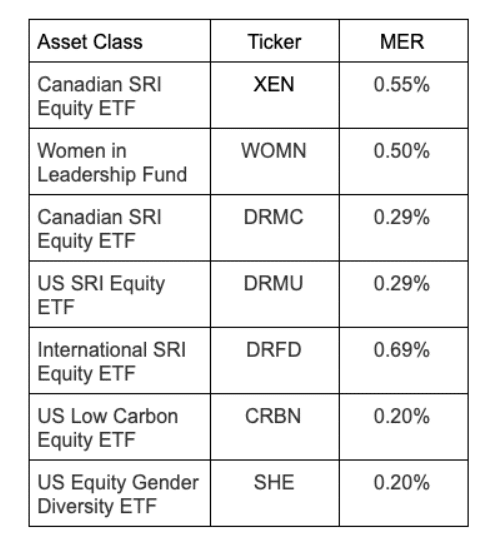

Here's a glimpse at the specific ETFs you invests in:

Again, there's nothing ground-breaking here: you can invest in all of these ETFs yourself or find a high interest savings account that works for you.

Additionally, I think Moka is a tad too conservative if you have a long investment time-frame, but as someone who almost solely invests in ETFs, that's just my opinion!

Other Moka App Features

Investing your money is the main pupose to using Moka.

However, there are several other features that Moka offers to help you build wealth and grow your savings.

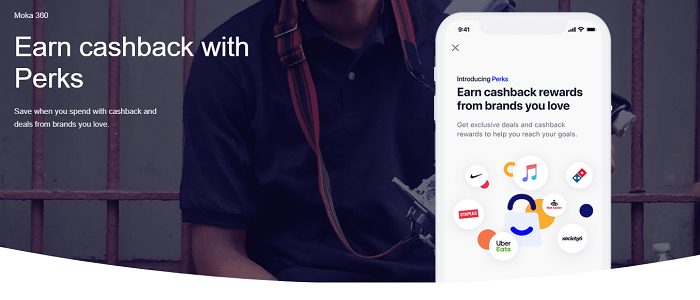

1. Moka Perks

One nifty Moka feature you might not know about is their cashback system, known as Moka perks.

According to Moka, “Perks are valuable cashback deals and discounts that help you save when you spend with brands you love.”

You have to claim a perk and shop through the Moka app to earn cashback.

Rewards credit in different amounts of time since merchants need to verify your transaction was complete and not returned.

Examples of some current brand partners where you can earn rewards include:

- Uber Eats.

- Apple Music.

- Hello Fresh.

- Domino's.

- Staples.

Reward apps are awesome, and Moka has found a way to sweeten the deal for their users, even if rewards aren't the sole focus.

New companies come and go, and the entire system is similar to reward apps like Drop and Bumped.

Ultimately, if you shop through your smartphone, Moka perks should be able to cover the cost of your $3 monthly subscription and then some.

2. Round Up To Give

If you want to become more charitable, Moka also makes it easy to automatically donate money to charity.

Moka partners with dozens of Canadian charities. You can easily set a donation goal and have Moka round up your spare change on the last Friday of each month to be donated.

It's a simple yet effective solution. Plus, Moka works with 86,000+ charities, so if you have one in mind, there's a good chance it's already partnered.

Moka also sends donation receipts through the app, which helps save money during tax season.

This feature isn't groundbreaking, but if you want to do some good, it's nice to have in your back pocket.

3. Socially Responsible Investing (SRI)

If you have ethical qualms or religious reasons that prohibit you from investing in certain companies or industries, you can still use Moka!

With the Moka SRI fund, your money is invested in ETFs that prioritize women in leadership, low carbon emissions, and other initiatives.

Here are the current Moka SRI fund companies.

Note that these are subject to change.

Again, you can invest in these companies on your own.

But if you want the Moka app to do all the work and to follow SRI investing, this fund is a decent option.

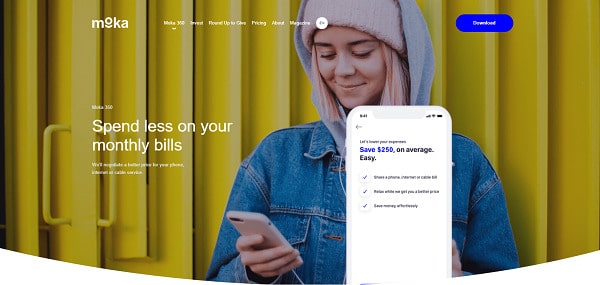

Moka 360 Review

There have been some exciting changes lately, so I thought it was about time I update our Moka review with the details!

In the past, Moka had a cashback rewards side of the platform known as Moka 360.

Well, let me tell you, Moka 360 has gotten a massive overhaul.

So, Moka 360 costs $15 per month, or $180 per year, making it a pretty expensive program to enroll in.

The question is, what extra features does Moka 360 have compared to your standard $3 per month Moka plan?

Well, for starters, Moak 360 lets you earn double the cashback for shopping at the brands you love compared to a standard Moka plan.

So, if you're currently earning a decent chunk of cashback from Moka Perks, calculate what doubling that would do to see how Moka 360 benefits you right off the bat.

Other features you unlock with Moka 360 include:

- A personalized debt repayment plan.

- Customized financial coaching.

- Bill negotiation for your phone, internet, and cable TV bills. According to Moka, they save users an average of $250 per year.

The financial coaching is somewhat similar to the Cleo app, and the debt repayment plan is similar to apps like Twine that let you set saving and debt payoff goals.

As for bill negotiation, Moka is similar to platforms like Billshark that negotiate bills on your behalf.

However, Billshark charges 35% of found savings, whereas Moka is a flat $15 per month…so Moka is likely cheaper upfront, although Billshark works with more types of bills.

Granted, $180 per year is very expensive for a premium plan that unlocks cashback and some financial planning tools.

However, if you successfully negotiate some bills, leverage cashback, and actually take advantage of Moka 360's financial advice, the cost could be worth it.

Plus, Moka 360 has a 200% money-back guarantee on fees.

Yes, the app states that you get a $360 refund if you don't save what you pay in your first year.

Ultimately, you have to decide if Moka 360 is worth it and if you'll actually use all of the features.

However, it's pretty cool to see new developments for this app, and I think the futur of Moka is bright!

How To Open A Moka Account

If you're interested in investing with the Moka app, the process of opening an account is pretty straightforward:

- Signup for Moka on their website.

- Connect your bank account. You also have to verify your identity by submitting a form of valid photo identification.

- Answer questions about your current financial situation, goals, and level of investment risk tolerance.

- Let Moka choose the right investment portfolio type for you.

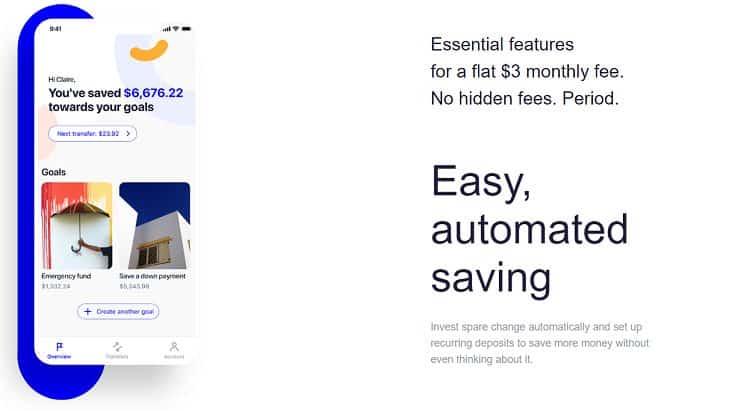

Goals are an important part of the sign up process since the app wants to understand exactly what you're saving for, how much money you need, and when you need the money by,

Based on your goals and investment philosophy, Moka can then choose an investment portfolio that works best.

You can add multiple goals, like saving for retirement and buying a house, so the app is quite flexible that way.

As for account types, Moka is also flexible.

Currently, you can open a TFSA or RRSP to benefit from tax-free investing. This is an excellent option if you're learning how to invest in college and want to maximize your investing returns.

How Much Does The Moka App Cost?

Nothing is free in this world, of course. If you want to invest with Moka, you're going to have to pay for it.

Currently, the Moka app costs $3 per month to use.

This number doesn't change depending on how much you invest, or even if you choose to invest at all.

Additionally, this fee doesn't include the management expense ratios, or MERs, of the funds you end up investing in.

So, you're looking at $36 per year if you want Moka to handle spare change investing for you.

This is more expensive than U.S. apps like Acorns, which have a $1 per month plan.

Plus, if you only invest a small amount of money, this is a massive fee when you look at it from a percentage perspective.

Pros & Cons

It wouldn't be a fair Moka review without covering some of the advantages and disadvantages of this saving and investing app.

The Pros:

- Build good financial habits by automatically investing

- Variety of portfolios to invest in

- Earn cash-back rewards with Moka perks

- SRI investing is available

The Cons:

- Moka 360 is fairly expensive

- General Moka monthly fees are also expensive if you just rely on spare-change roundups to invest

- You have less investing control than if you invest on your own or use more robust robo-advisor services

Moka is truly an app that's useful for building good habits and learning how to regularly invest, but the fees can get quite high percentage-wise if you just rely on rounding up spare change.

Frequently Asked Questions

Time to round off this review by tackling some of the most commonly asked questions about the Moka app!

1. Is Moka Safe?

If you're about security, that's a good thing: you should always know what kind of company you're sharing financial information with.

Luckily, Moka is legit and safe to use. The app uses the same level of encryption as any other FinTech app, and Moka doesn't sell your data.

In other words, expect 256-bit encryption, SSL connections, and internal security policies standards to ensure your information is never at risk.

To get all of the details, check out their privacy policy!

2. How Do I Cancel My Account?

You can withdraw your savings and investments at any time with Moka, and you're not contractually obligated to stick around.

If you want to cancel your account, contact [email protected] with the email address you used to create your account and ask for deactivation.

Alternatively, you can also pause auto deposits and round ups until you're ready to invest again.

3. Is There A Moka Promo Code?

If you know someone who uses Moka, they can refer you to the app so you earn a $5 signup bonus.

If you don't know anyone with a code, a quick search for Moka promo codes brings up plenty of links. I'm not sure if they work since the rebrand, but they're worth trying in any case!

Moka Alternatives

Unfortunately, there aren't many apps like Moka in Canada that focus on letting you invest your spare change.

For example, Acorns is the most similar Moka alternative, but it's only available in the United States.

If you want to learn how to invest and want to invest in portfolios that match your level of risk tolerance, your best bet is to use Wealthsimple, a popular Canadian robo-advisor.

Aside from that, most of the Moka alternatives you can use are other apps that help you earn cash-back rewards for spending, just like Moka perks.

Some of my favorite reward apps you can try include:

- Drop – My favorite reward app that lets you earn free gift cards for shopping online and playing mobile games.

- Caddle – A Canadian grocery reward apps that lets you earn cash for buying certain grocery products.

- Checkout 51 – Another reward app that pays you for buying groceries, everyday essentials, and gas.

- Rakuten – My favorite online shopping platform that pays you cash back for shopping at thousands of stores.

- Receipt Hog – A popular receipt scanning app that lets you earn PayPal cash and free gift cards.

Again, none of these are perfect Moka alternatives, but I seriously think using a robo-advisor or learning how to invest will serve you well. Plus, you can always use different reward apps to score some free money.

Who Should Use Moka?

In my opinion, Moka is perfect for anyone who is new to investing and needs help building good financial habits.

I like that Moka lets you set your own spare change round-up amount or make one-time or recurring contributions to keep growing your wealth.

I also like that there's a healthy variety of investment portfolios to match your goals and risk level.

However, at $3 per month for the basic plan, Moka is quite expensive fee-wise if you don't make your own contributions and rely on spare change.

I also think that if you're confident in investing on your own, there's plenty of zero-free brokerages you can use, or you can stick with your bank.

So, in short, the Moka app is perfect for beginner investors who want to get in the habit of investing.

If you're already investing or want to invest more significant amounts of money with something like Wealthsimple, Moka isn't for you.

Final Thoughts

At the end of the day, learning basic financial literacy and building good habits is crucial for wealth building.

Unfortunately, these fundamentals aren't taught in school. Therefore, if you don't take any initiative to learn, beginning to invest your money might seem like a daunting task.

Thankfully, apps like Moka and the FinTech space in general are making it easier for beginner investors to get started.

I don't think spare change apps are an investment and saving strategy you should use for your entire life…But hey, if you're just getting started, there's nothing wrong with giving them a try.

If you're a young Canadian or need a helping hand with getting your finances on track, try out Moka to build some good habits.

When you're ready for the training wheels to come off, you can always switch to a leading robo advisor like Wealthsimple or DIY investing.

Thanks so much for reading this Moka app review! If you have a favorite spare change investing app, I'd love to hear what it is!

Catch you guys in the next one.

Moka App Review

Name: Moka

Description: Moka is a Canadian spare change investing app that makes it easy to save money automatically. Round up your change and automatically invest in diversified portfolios.

Operating System: Android, IOS

Application Category: Investing

Author: Tom Blake

-

Features

-

Fees

-

Portfolio Variety

-

Investing Tools