Is Possible Finance Legit & Worth It? Our Honest Review

Possible Finance is a financial app designed for people who need fast cash but may not qualify for traditional credit or loans. And it helps people get quick money to cover bills and expenses without taking out very expensive loans.

There's no credit check requirement either. Plus, there's even a way to improve your credit score with a credit-building card.

But Possible Finance isn't the best choice for everyone. And that's why our Possible Finance review is covering its fees, how it works, and how to decide if you should sign up.

Want more fast money ideas? Checkout:

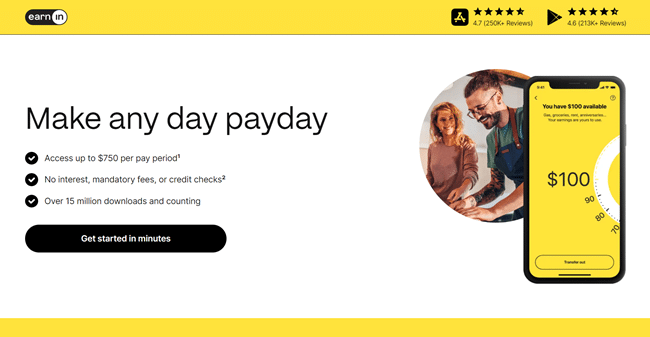

- EarnIn: Borrow up to $750 against an upcoming paycheck!

- TurboDebt: Get fast debt relief assistance if you have $10,000+ in debt!

Key Takeaways:

- Possible Finance offers short-term loans of up to $500

- There's no credit check requirement or interest

- Possible also offers a credit-building credit card

- Fees are $8 or $16 per month plus origination fees

- Possible Finance can be a useful lending option but shouldn't be relied on for regular income

Is Possible Finance Legit?

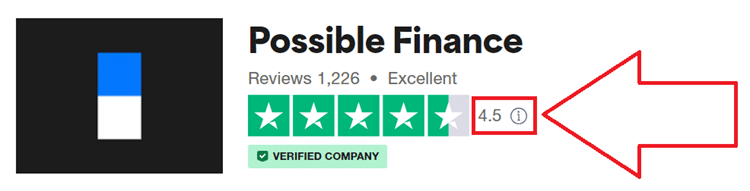

Possible Finance is legit and lets its members borrow up to $500 and build their credit. The company has also been around since 2017 and has an excellent 4.5-star rating on Trustpilot, with over 1K reviews.

If you need to pay rent, bills, or emergency expenses, turning to a company like Possible Finance can be a good idea. After all, it has easier lending requirements than traditional loans and can be a much cheaper alternative to something like a payday loan.

Possible Finance's goal is to help its members escape a cycle of endless borrowing. And it's similar to cash advance apps that let you borrow money without going through a credit check.

That said, its fees are still relatively high. Plus, if you need to borrow more than $500, it may not be the best fit, as that’s the borrowing limit in most states.

What Is Possible Finance & What Does It Offer?

Possible Finance was founded by Tony Huang and Tyler Conant with a mission to help lower-income individuals access short-term loans without the burden of exorbitant interest rates or late fees.

You can borrow up to $500 with a Possible Loan. The loans are simple and transparent, with a flat monthly fee and an origination charge in lieu of interest, all managed through an easy online process.

This is similar to advancing apps like EarnIn or Dave, which let you borrow up to $750 and $500 respectively. Except Possible Finance is a loan that just has a more “fair” repayment plan than traditional loans.

Anyone living in the following states can apply for Possible Finance if they're 18 or older: Alabama, California, Delaware, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nevada, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah, and Washington.

There’s no credit check, and no minimum credit score is required to qualify. Along with short-term loans, Possible Finance also offers a credit-building credit card to help users improve their financial standing.

Let's take a look at these two products in more detail.

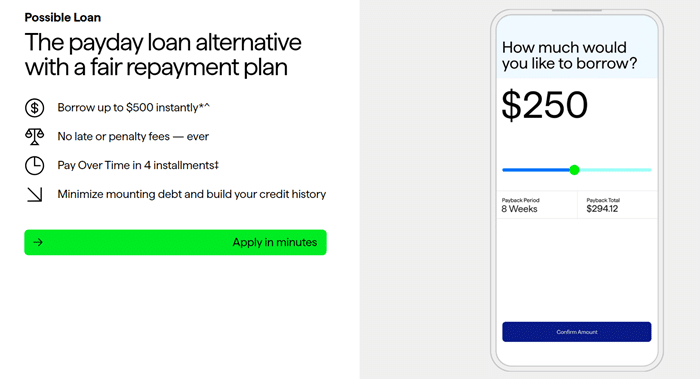

1. Possible Loan

The Possible Loan is the app's most popular feature. Its main appeal is that you can qualify for a short-term loan without a credit check. Here are all the important details you need to know:

- Borrowing Limits: Possible loans typically cap out at around $500, but the specific loan amount will vary by state. For example, in California, the maximum you can borrow is $250.

- Term Length: Loans are repaid over 8 weeks in four equal installments. Plus, there's a 29-day grace period where you can change your payment due dates without any penalties.

- APR: There are no interest charges. Instead, you pay a monthly fee of $8 or $16 – plus an origination fee.

- Origination Fees: These are charged on top of your monthly fee and vary from state-to-state. In some states, origination fees range from $15 to $20 for every $100 borrowed, and in others, it's a flat 25% of the loan amount.

- Prepayment Penalty: You can pay off your loan early with no penalties.

- Late fees: Nope! There are no late fees.

The term length plus grace period is one of the main selling point. Plus, there aren't late fees or prepayment penalties.

However, Possible Finance fees are a bit high if you're only borrowing a bit of money. After all, the monthly fee plus origination fee can be a high percentage of your total loan if you're only borrowing $100 to $200 or a similar amount.

This is also why we suggest trying cash advance apps like Cleo, Super, or EarnIn if you're employed and can borrow money against an upcoming paycheck.

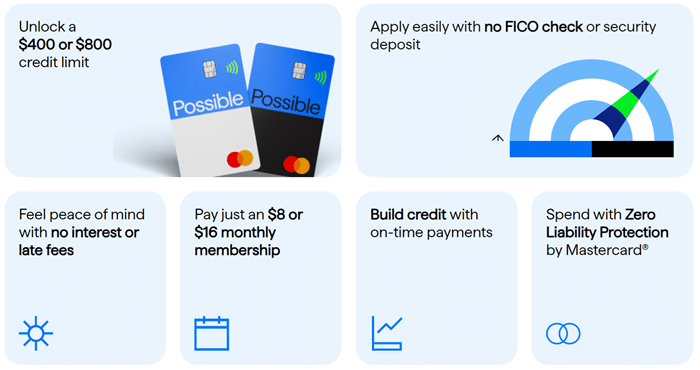

2. Possible Card

Possible Finance also offers the Possible Card, a credit card designed to help build your credit over time.

With the Possible Card, you get either a $400 or $800 credit limit. The card is interest-free, but you have to pay a monthly membership fee of $8 (for the $400 limit) or $16 (for the $800 limit.)

Payments are reported to the TranUnion credit bureau, which can help build credit history and boost your credit score over time. However, it’s important to note that missing payments can have the opposite effect, hurting your credit score.

Fortunately, Possible offers features like auto-pay to avoid missing payments and a “Pay Over Time” option, allowing you to carry a balance to the next pay period, making it easier to stay on track.

Just like with the Possible Loan, there is no credit check required. But, to qualify, you need to show proof of earning at least $1,000 per month for the past three months.

💵 The Best Apps To Borrow $200 Instantly.

Possible Finance Requirements

You don't need to have a minimum credit score, or even any credit history at all, to apply for a Possible Finance loan. The company doesn't run a hard credit check, but it may perform a soft inquiry, which won’t affect your credit score.

That said, there are still some eligibility criteria that you'll need to meet in order to qualify for a Possible Finance loan. Specific Possible Finance requirements may vary by customer and state, but the most important factor is your bank account activity. To qualify, you’ll need to show:

- A steady income of at least $750 a month (for the Possible Card, it’s $1,000 per month)

- Two to three months of consistent income

- A positive account balance

If you don’t meet these criteria, Possible Finance allows co-signers to help you qualify. And, if your application is denied, you can reapply after three days – but, you'll need to improve your financial situation in the meantime.

If you have less regular income, we suggest trying advancing apps like Cleo and Klover. These apps have more lenient requirements and let you borrow up to $250 and $200 respectively.

👉 How To Get $500 By Tomorrow.

How To Get Started With Possible Finance

The process for applying, receiving, and repaying a Possible Finance loan is simple and all handled through the app. Here’s how it works:

- Download the app and sign up. The Possible Finance app is available on Google Play and the Apple App Store. It's free to sign up and only takes a few minutes. But, you will need to provide some personal info, like your ID or driver’s license number and your Social Security number. So, be sure to have these on hand.

- Enter your financial information. These may include your bank account number, employment details, and proof of recent direct deposits.

- Find out if you're approved. You might be wondering: how long does Possible Finance take to approve? After submitting everything, most people will get an instant decision, though in some cases it may take up to a day. If approved, review your Possible Finance loan offer to decide if you want to proceed. If denied, you'll get an explanation as to why, and you can reapply after 72 hours.

- E-sign your loan documents and receive the loan. If you accept the offer, you have three days to e-sign the loan documents. Once that’s done, the money will be sent either to your bank account or directly to your debit card, usually arriving within one to two business days.

- Pay it back. Repayment on your Possible cash advance starts about a week later, and you'll make four equal payments over the next two months. Your payments will be reported to TransUnion and can affect your credit score.

Pros & Cons

Pros:

- A more affordable solution to payday loans

- Flexible 8-week repayment terms

- Zero late fees, APRs, or penalties for early repayment

- Instant decisions with fast disbursement

- You can also improve your credit with Possible Finance

Cons:

- High origination and monthly fees

- Loan amounts capped at $500 (in most states)

- Limited state availability

- No phone-based customer service

Who Should Use Possible Finance?

Possible Finance is ideal for people with a steady income but a low or non-existent credit score who need a small loan to get through a temporary financial rough patch. In other words, it's best for those who need fast cash but can’t qualify for traditional loans.

While it’s a much better alternative to high-interest payday loans, it’s important to explore other options first, like personal loans or borrowing from friends or family, since Possible Finance does charge pricey fees. You might also want to check out other apps like Possible Finance, such as cash advance apps, to compare costs.

Finally, you likely won't qualify for a loan from Possible Finance if you're a gig worker or unemployed. You need steady income and a positive bank balance to qualify.

It's also important to note that the lending app is designed to help with short-term money issues, not as a long-term solution for ongoing financial problems. If you find yourself needing loans repeatedly, it may be time to look for more sustainable financial solutions.

👉 The 75+ Best Side Hustle Ideas To Make Money.

The Best Apps Like Possible Finance

Possible Finance can be a good solution if you're in a financial pinch. But it's far from your only option to borrow.

Some of the best apps like Possible Finance you can use include:

Also note that options like Buy-Now-Pay-Later (BNPL) solutions like Affirm or Klarna are also popular alternatives to Possible Finance. And you can always try other lending apps or traditional loans.

💵 The Best $100 Cash Advance Apps.

Other Possible Finance Reviews From Customers

Possible Finance is BBB-accredited with a B-rating and a customer rating of 4.43 (out of 5) stars from 319 reviews. They are also highly-rated on the Apple App store, with 4.8-stars across 109K reviews and on the Google Play store, with 4 stars out of 52K reviews.

Many positive reviews like how easy Possible Finance is to use and how quickly they fund you. In contrast, negative reviews usually relate to the approval process or somewhat high monthly fees.

Is There Customer Service?

Yes, Possible Finance offers customer service via email at: [email protected] or through their in-app chat service. However, there is no customer service phone line you can call if you need assistance.

Is Possible Finance Worth It?

If you’re in a tight spot and need quick cash but don’t qualify for a traditional loan, Possible Finance could be worth it. The lending app's low eligibility requirements, with no credit check, make its loans accessible for many people who would otherwise struggle to get some financial relief. Plus, there aren't late fees or interest charges, which is a big plus compared to payday loans.

However, it’s important to remember that while there’s no interest, the loan isn’t free. You’ll still have to pay origination fees and a monthly service fee, which can add up. And it's very expensive if you're only borrowing a bit of money.

If you only use it occasionally and can repay the loan quickly, Possible Finance might be worth it. But if you have other options, like borrowing from a friend or getting a lower-cost personal loan, you might want to consider those first. Or, consider looking into other loan apps like Possible Finance to find which one works best for you.

Want even more ways to earn? Checkout:

Possible Finance Review

Name: Possible Finance

Description: Possible Finance offers a more affordable lending option to payday loans plus the opportunity to improve your credit score.

Operating System: Desktop, Android, iOS

Application Category: Loan Apps

Author: Tom Blake

-

Borrowing Limit

-

Ease-Of-Use

-

Requirements

-

Fees