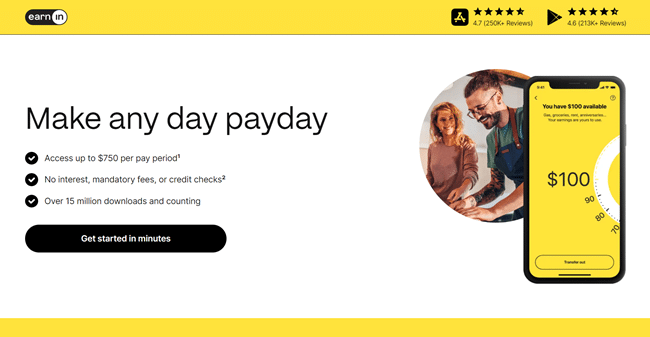

Is EarnIn Legit & Worth Using? – Our Honest Review

EarnIn is a legit and leading cash advance app that lets users borrow up to $750 against an upcoming paycheck. And it's a popular way to get quick money if you're in a pinch and need to cover bills.

But how much does EarnIn cost? And is this financial app a good way to hold yourself over until your next paycheck?

In this EarnIn app review, I'm explaining how EarnIn works, what its fee structure is, and how to ultimately decide if this app is worth using.

Key Takeaways:

- EarnIn lets users borrow $100 per day – up to $750 – against an upcoming paycheck

- There's no interest or credit check to borrow

- New users qualify for $85 in advances on average when they first sign up and build their limit over time

- EarnIn charges optional tips and a $3.99 Lightning Speed fee if you want money instantly

- Other features include tip jars, overdraft protection, and credit scores

Is EarnIn Legit?

EarnIn is legit and provides an easy, affordable way for its members to borrow cash against an upcoming paycheck. It also has a 4.1 star rating on Trustpilot and is one of the most popular cash advance apps due to its transparent fee structure and high cash-advance limit.

Furthermore, EarnIn has 2.9 star rating on the Google Play Store, and 4.7 star rating on the Apple App Store. Overall, users are happy with how easy the app is to use and the fact you can borrow up to $750 between pay periods.

If you need money to pay rent or other bills and are in a pinch, we think EarnIn is a good solution. It's also cheaper than options like payday loans or going deeper into credit card debt.

That said, cash advance apps can encourage a cycle of over-borrowing. This is why it's important to save money and build up an emergency fund so you don't have to rely on borrowing.

What Is EarnIn & What Does It Offer?

EarnIn is a FinTech company that specializes in paycheck cash advances. It began in 2013 and has quickly become one of the most popular apps in the industry, with over 19 million downloads and 2.5+ million users.

The main reason people use EarnIn is to access up to $750 of an upcoming paycheck per pay period. But the app also has other features to help you save, avoid overdraft fees, and even to track your credit score.

I'm going to cover how each of these main features works. Then, I'll explain EarnIn's fees, pros and cons, and how to decide if this app is right for you.

Cash Advances – EarnIn Cashout

EarnIn Cash Out is its cash advance feature that lets you access up to $750 against an upcoming paycheck per pay period. Specifically, you can transfer up to $100 per day to your linked bank account for a total of $750 in a given pay period.

We love this feature because EarnIn doesn't charge interest and there's no hard or soft credit check.

Instead, you connect the bank account where you receive your paychecks to EarnIn. The app then analyzes your payment history and determines how much you're eligible to advance. As long as you have a consistent pay schedule and make at least $320 per pay period, you can be eligible for an EarnIn cash advance.

Here's how EarnIn's cash advance works from start to finish:

- Add your info and verify your paycheck information

- Transfer up to $100 per day (up to $750 per pay period) to your bank account or however much you qualify for

- Receive your cash advance for free within 1-2 business days or pay for Lightning Speed instant deposits

- Repay your cash advance when your paycheck arrives

A few things to note. Firstly, if you want to avoid fees, you have to wait 1-2 business days for your advance. Otherwise, you pay a $3.99 flat fee for Lightning Speed deposits. You also have the option to tip between $0 and $13 per advance.

For first time borrowers, it can take 2 to 3 days for EarnIn to verify your info. Also note that members qualify for $85 in advances on average when they first sign up, so it can take time to build up to the $750 limit.

Pro Tip 💵 We don't suggest tipping. EarnIn is a FinTech business, not a waitress at your local diner. If you decide to tip, calculate the percentage of your tip versus your advance so you're not tipping a ridiculously high percentage.

Early Paychecks

Another nifty EarnIn feature is its Early Pay feature. This lets you get your paycheck up to two days earlier. All you have to do is pay a flat $2.99 fee to get your money sooner.

This feature doesn't involve changing banks. Your direct deposit simple routes through EarnIn and then transfers to your bank after you pay the fee. EarnIn works with Evolve Bank & Trust as its partner bank to create a no-fee deposit account for funds to flow through.

👉 How To Get $500 By Tomorrow.

EarnIn Tip Yourself

If you want to save more money, you can try EarnIn's Tip Yourself feature. This tool lets you create up to 5 financial goals as “Tip Jars” and then set money aside in these jars to work towards your goals.

You can tip between $1 to $50 per day in total for all your jars. And there's a maximum of $2,000 in total savings you can set aside.

This feature is nice if you want to build your emergency fund or save up for something specific like a vacation. However, we recommend parking your money in a high-yield savings account like Current or one you find through Raisin instead.

Current has a nice $50 bonus for new customers and lets you earn 4% APY on up to $6,000. And Raisin helps customers find the best high-yield savings accounts on the market. So, both these options put your money to work and are better than EarnIn's saving solution.

You can also try out budgeting apps too. We recommend using Rocket Money if you want a helping hand in reaching specific savings goals.

👉 The 12 Best Income Generating Assets.

Balance Shield

EarnIn Balance Shield sends you alerts when your balance is low to help you avoid overdraft fees. You set an alert threshold between $0 to $500. And if you reach overdraft range, EarnIn lets you get $100 from your on-demand pay automatically to prevent your from getting hit with fees.

EarnIn says this saves its customers almost $540 per year by avoiding overdraft fees. Not bad!

Credit Monitoring

EarnIn has a nice credit score monitoring feature we also like. It provides access to your Vantage Score 3.0 from Experian. You can also view your credit history and usage and get alerts about any changes.

There's no hard or soft pull to use this feature. However, Experian is only one of three major credit bureaus, so this tool is a nice-to-have but isn't the full picture.

💵 We recommend using CheckFreeScore.com to get a comprehensive credit score and ongoing monitoring. You can take advantage of its $1 7-day trial today to get an updated score quickly.

EarnIn Fees & Pricing – How Much Does EarnIn Cost?

EarnIn doesn't charge any fees or interest on its cash advances. Instead, it uses a “Pay What's Fair” model where customers can tip $0 to $13 per cash advance based on what they think is fair. You can also pay a $3.99 flat fee for Lightning Speed deposits on your advances.

If you're willing to wait a couple of business days, EarnIn's cash advance can be completely free. And even if you pay for Lightning Speed, a $3.99 fee is probably much cheaper than turning to expensive options like payday loans or personal loans.

At WebMonkey, we still think starting side hustles and finding ways to get quick money without borrowing are great ideas. But if you're out of options, apps like EarnIn can be an affordable, temporary solution.

EarnIn App Requirements & Eligibility

Here are EarnIn's requirements to borrow money against an upcoming paycheck:

- Have a U.S. bank account you use for direct deposit that can be verified

- Prove that you have regular pay schedule (at least $350 per pay period)

- Live in the United States

- Be 18 or older

- Have a valid U.S. phone number

- Have a fixed work location or employer-provided email address

Also note that EarnIn doesn't accept Supplemental Security Income (SSI), unemployment wages, veterans benefits, or disability pay.

Furthermore, people making money in the gig economy, like with apps like Uber or DoorDash, won't usually qualify for EarnIn.

How Does The EarnIn App Work?

Wondering how does EarnIn work? Here is a breakdown of how its entire cash advance process works:

- Download the EarnIn app for free on Android or iOS.

- Create an account with your email and phone number.

- Connect your employment and bank information. This helps EarnIn get the information they need to approve the loan. It will take 2 to 3 days to verify your banking information.

- Share your earnings in the app. To do this you can submit an electronic time sheet or use the Automagic Earnings feature.

- Request a withdrawal. To request funds, click the cash out button when you are logged into your account. The amount of funds that will be available will depend on how often you are paid and how many hours that you’ve worked. There are also daily and pay period maximum withdrawals.

- EarnIn will withdraw your payment on the date, as well as any additional fees on the day of your next deposit.

Your EarnIn payments take 1 to 3 business days to arrive. This advance can be repaid via automatic withdrawal from your bank account once you get your paycheck.

Pros & Cons

Pros:

- High cash advance limit

- Optional tipping method

- No interest or credit check requirements

- Easy to use

- Easy eligibility requirements for advances

- Other useful features like Balance Shield and credit reports

- Lightning Speed fee is affordable

Cons:

- Tips can be a high percentage of your total advance if you aren't careful

- EarnIn is only available in the United States

- EarnIn doesn't work with SSI, disability pay, veterans benefits, or unemployment wages

- Users qualify for under $100 in advances on average when they first sign up

What Are The Best Apps Like EarnIn?

EarnIn is one of WebMonkey's favorite cash advance solutions. But it's far from the only player in the industry.

Some other apps like EarnIn that can help you out include:

- Dave (best runner-up)

- Cleo (best advance app with budgeting tools)

- Super.com (best cash advance app with extra earning features)

- Klover (best for low-income users)

- Brigit (best for building credit)

- Yendo (best credit card with cash advances for vehicle owners)

Of course, you can also explore other options. There are tons of side gigs that pay in a day or two, like doing local cash gigs. You can also ask your friends or family to spot you. Finally, there's options like your credit card or personal loans.

👉 How To Make $1,000 In 24 Hours.

Other EarnIn App Reviews From Customers

What do customers say about EarnIn? Highly rated, this money lending app has a 4.1 out of 5 stars on Trustpilot. EarnIn has a 3.11 out of 5 stars with the Better Business Bureau with an A+ rating.

Reviews for EarnIn are largely positive. Users are happy that they can access the funds that they need and feel that EarnIn customer service reps are helpful. People also like how easy the app is to use.

Most negative EarnIn reviews come from customers who don't qualify for an advance due to income requirments. Or, some customers are unhappy because they don't qualify for the full $750 amount.

Is There Customer Service?

You can reach customer service by contacting support via the app. Chat support is available 24/7, which is a perk. You can also call EarnIn at 888-537-9883 or by emailing [email protected].

Is EarnIn Safe?

The EarnIn app is safe and provides a secure way for its members to borrow money against an upcoming paycheck. The app doesn't run a soft or hard credit pull, and it also protects users data and privacy by encrypting data and using secure servers.

The company has come under fire in the media over its optional tipping model. Critics claim that optional tips exploit customers by tricking them into tipping a way higher amount than they should. And EarnIn has been part of class action lawsuit relating to lending laws.

Personally, I think criticizing its optional tipping model is insane. Don't tip if you don't want to. And if you decide to tip, calculate the percentage of your tip versus the cash advance and tip what you feel is reasonable.

👉 The 20+ Highest Paying Apps.

Is EarnIn Worth It?

EarnIn is worth it if you want an affordable, fast way to cover bills, expenses, and financial emergencies. And we think it's one of the best cash advance apps on the market because of its $750 limit and transparent fee structure.

It also has lenient requirements; earning $350 in steady paychecks is the bare minimum to begin qualifying. And while not every user gets the full $750 amount, you can gradually increase your limit over time.

In contrast, EarnIn isn't worth using if you don't have regular income or a job. Users without employment simply don't qualify for its advances. And we don't suggest using apps like EarnIn to replace saving money and building an emergency fund.

👉 Get started with EarnIn today!

Want even more useful money guides? Checkout:

- What To Do When You're Struggling With Money.

- How To Get Free Money.

- How To Start Investing For Daily Income.

EarnIn Disclaimers:

1: EarnIn is a financial technology company, not a bank. EarnIn services may not be available in all states. Bank products are issued by Evolve Bank & Trust, Member FDIC.

2: Subject to your available earnings, Daily Max and Pay Period Max. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

3: EarnIn does not charge interest on Cash Outs. EarnIn does not charge membership fees for use of its services. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

4: Fees apply to use Lightning Speed. Lightning Speed may not be available to all Community Members. Cash Outs may take up to thirty minutes, actual transfer speeds will depend on your bank. Restrictions and/or third party fees may apply, see Cash Out User Agreement for details.

Earnin App Review

Name: EarnIn

Description: EarnIn is a cash advance app that lets users borrow up to $750 in a given pay period with paying interest or going through a credit check.

Operating System: Android, iOS

Application Category: Cash Advance Apps

Author: Tom Blake

-

Cash Advance Limit

-

Requirements

-

Fees

-

Ease-Of-Use