Is Credit Genie Legit & Worth It? – Our Honest Review

Credit Genie is a fintech app that offers users cash advances on their paychecks of up to $100 without charging interest, transfer fees or checking your credit score. The company was founded in 2019 and is based out of Philadelphia, PA and claims to have over a million users.

But is Credit Genie legit and worth using? And how does this app compare to the numerous competitors that also help you access quick cash?

Our Credit Genie review is sharing how this app works, its pros and cons, and how to ultimately decide if it's right for you.

Want more fast financial help? Checkout:

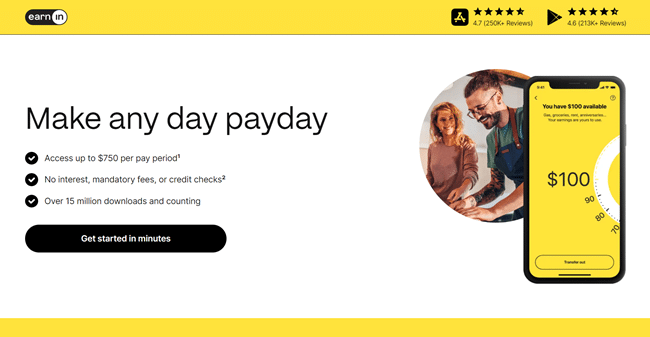

- EarnIn: Borrow up to $750 against an upcoming paycheck!

- TurboDebt: Get fast debt relief help if you have $10,000+ in debt!

Key Takeaways:

- Credit Genie offers cash advances up to $100

- Users must pay a $4.99/month or $3.49/bi-weekly fee to use the service

- Fairly easy process to sign up

- The company receives mixed customer reviews

- We don't recommend using Credit Genie due to high fees and a low advance limit

Is Credit Genie Legit?

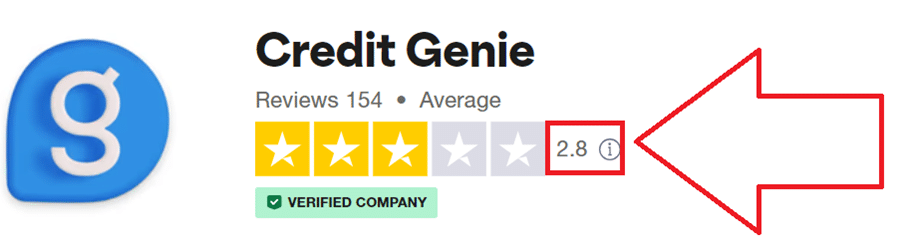

Credit Genie is legit, but it's one of the worse cash advance apps on the market. Its main drawbacks are a low cash advance limit and very high fees. Plus, it has an average 2.8 star rating on Trustpilot, with many negative reviews from customers.

Credit Genie’s website says that users can get advances between paychecks of up to $100, but many users said they were surprised to learn that they qualified for much lower amounts, some as little as $10 or $20.

Other users cite issues with the repayment process, saying that the app will change the agreed-upon repayment date or that there’s no option to pay back their advance earlier. Also, there’s no live customer support option, so many users were upset that they had to wait days for a response to their questions and concerns.

At WebMonkey, we think apps like EarnIn and Cleo are much better options than Credit Genie. You can also read our guide on the best $200 cash advance apps for much better alternatives to Credit Genie.

What Is Credit Genie & What Does It Offer?

Credit Genie is a cash advance app that lets members borrow up to $100 against an upcoming paycheck. It doesn't charge interest or hidden fees. There's no credit check requirement to borrow money either.

The app is available on both Android and iOS devices. And if you've used similar apps like Dave or Super.com, then the whole cash advance process should feel pretty familiar.

Once you download Credit Genie, you connect your bank account to the app. From there, Credit Genie analyzes your account and determines how much you're eligible to advance.

Your limit is based on several factors including the average amount of your regular payroll deposits, your overall spending habits, your average account balance, your history with repayments, and other risk factors. It’s also worth noting that the services on this app aren’t available to those who live in Connecticut, Maryland, Nevada, or Hawaii.

In addition to the cash advance feature, Credit Genie also offers a few other financial services. For instance, the app sends you alerts when it notices you’re at risk of overdrafting your account. Users also have access to Credit Genie “Insights” feature where you can track your spending patterns with the app which can make you more aware of your saving and spending habits and help set up realistic budgeting goals.

The app also provides financial tips on how to pay off debt faster, and there’s an “Offers” feature that links users to third-party offers from its partners which are often products and services intended to help people get out of debt.

However, this is a cash advance app first and foremost. If you need cash to pay rent or other bills, borrowing money against a future paycheck can be super helpful. However, Credit Genie has one of the lowest total advance limits and isn't worth using in our opinion.

Get $500 By Tomorrow With These Ideas!

Credit Genie Cash Advance Requirements

Credit Genie is available to download and use in most U.S. states as long as you're 18 or older. You can download it for free for Android or iOS. From there, you link your bank account to the app. Your linked bank account must also meet the following requirements:

- Have been active for at least three months

- Show recurring monthly payroll direct deposits of over $600 each for at least three months

- Show at least four direct deposit payments in the last three months, with one occurring within the previous 17 days

- It is not a joint account and you are the sole owner named on the account

These requirements are pretty lenient. However, if you have less regular income, you likely won't qualify for a Credit Genie cash advance. In this case, apps like Klover or Cleo are likely better choices since they have more lenient requirements.

Credit Genie Fees & Pricing

Credit Genie costs $4.99 per month or $3.49 biweekly to “maintain the bank connection” that lets you take out cash advances. The company doesn't clarify which fee you pay, instead stating that “the frequency with which [the fee] will be charged will be disclosed to you through the Mobile App.”

Many other cash advance apps charge a monthly fee. For example, Brigit costs $8.99 per month to unlock cash advances. And apps like Empower costs $8 a month. However, EarnIn, our favorite advance app, doesn't have mandatory fees and just asks for tips instead!

However, most apps have a much higher advance limit than Credit Genie. Plus, you typically get other products and services from it such as budgeting tools or complimentary credit score monitoring. Also, if you sign up for the app, connect your bank account, and are then not approved for an advance, you are still responsible for paying the monthly fee which will be automatically withdrawn from your account.

On top of that, Credit Genie charges extra fees if you want an express advance. Standard advances are made to your linked bank account and show up within one to three business days. If you need your money faster, you can pay a small fee (undisclosed on the website) and get your money transferred to you within one business day.

However, even with the express fee, you have to make your request by 2:00pm EST if you want to receive your money by 9:00pm that same day. If you make your request after 2:00pm EST, then the money won’t show up until 9:00pm at the latest the next business day. There is also an option to pay an instant fee and have the money delivered to a linked debit card within 30 minutes, but the amount of this fee is also undisclosed.

In my opinion, Credit Genie's fee structure is outrageous. And if you don't qualify for the full $100 advance limit, your monthly fee is even more outrageous from a percentage perspective.

The Best Ways To Get $1,000 In 24 Hours.

The Best Apps Like Credit Genie To Try Instead

We don't think Credit Genie is a good app. It's super expensive, doesn't clearly disclose fees, and has a very low advance limit.

Thankfully, you can still get quick money to cover bills. Here are some of the best apps like Credit Genie to use instead:

- EarnIn (our top pick)

- Current (best banking option)

- Super (best for cash-back deals)

- Dave (best for side hustlers)

- Cleo (best for gig workers)

- MoneyLion (best full-service app)

- Yendo (best credit card with advances)

All of these apps can let you borrow more than Credit Genie does. And options like EarnIn are way more affordable.

Of course, you can always try a new side hustle to make the extra cash too. But when it comes to advance apps, try these options before Credit Genie.

The Best Apps To Borrow Money Without A Job.

Is Credit Genie A Scam?

Credit Genie isn't a scam and lets its qualifying members borrow money. However, that still doesn’t mean it’s a good choice for those looking for the best cash advance app.

For the associated fees and the small advance limit, there are better options out there for most consumers like the Dave or EarnIn app, both of which maintain positive reviews from their customers. Plus, Credit Genie receives mixed customer reviews with people citing issues like trouble getting a hold of customer service, a lower-than-expected advance limit, or unclear communication about repayment dates. All said, even though Credit Genie is not a scam, you may want to look at your other options before signing up for the service.

Pros & Cons

Pros:

- Easy sign up process

- Very simple app to use

- Credit Genie doesn't charge extra fees or interest

- No credit check requirement

Cons:

- Low cash advance limit

- High monthly fee

- Unclear fee structure

- Expensive express fees

- Limited customer service

- Poor Credit Genie reviews on both app stores and Trustpilot

Is There Customer Support?

Yes, there is customer support available for Credit Genie users, but it’s very limited. There is a chat feature on the company’s website that you can access, but this doesn’t lead you to live support. Instead, it redirects you to the website’s FAQ page or helps you fill out and submit a ticket submission form that will be reviewed by a customer service representative and then someone will contact you back with an answer.

Alternatively, you can send an email to [email protected] where there are representatives working Monday through Friday between 9:00 AM and 5:00 PM EST. There is no way to call the company to speak with someone directly at this time.

The Best Free Money Apps That Pay Instantly.

Is Credit Genie Worth It?

We don't think Credit Genie is worth using due to its low advance limit and super high fees. Plus, there are so many negative reviews online, and most users won't qualify for the full $100 advance limit anyway.

You can use this app if all other cash advance apps have failed you. However, you should calculate Credit Genie's fees as a percentage of your advance. You might find it's incredibly high for the low amount you borrow, so keep this in mind.

Again, EarnIn is our top pick instead of Credit Genie. And Cleo is our favorite if you have more irregular income.

Hopefully, our Credit Genie review helps you decide if this app is right for you!

Want more useful money guides? Checkout:

- The Best $25 Loan Instant Apps.

- The Best Lending Apps That Work With Chime.

- The Best Apps To Get $100 A Day.

- The Top Secret Websites For Making Money.

Credit Genie Review

Name: Credit Genie

Description: Credit Genie is a cash advance app that lets its members borrow up to $100 against a future paycheck.

Operating System: Android, iOS

Application Category: Cash Advance Apps

Author: Tom Blake

-

Cash Advance Limit

-

Fees

-

Ease-Of-Use

-

Requirements