Is Beem Legit & Worth It? – Our Honest Review

Need $20, $40, or even $10 in a pinch? Beem offers cash advances to help you out when money is a bit tight.

But is Beem legit and worth using? After all, its Everdraft feature can spot you cash but comes with a pricetag.

Our Beem review is covering how this app works, its main features, and how you can decide if it's right for you.

Want more effective ways to earn? Checkout:

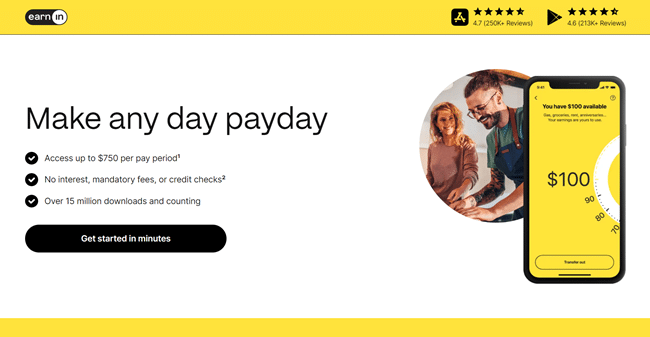

- EarnIn: Borrow up to $750 against an upcoming paycheck!

- Freecash: Get paid real cash for downloading apps and playing games!

Key Takeaways:

- Beem offers cash advances from $10 to $1,000

- Other perks include sending money, insurance deals, cash-back offers, and gaming rewards

- Plans start at $0.99 monthly and cost as much as $12.97 a month

- There's no free Beem plan

- We think Beem is a bit pricey because of low advance limits for most users and high express deposit fees

What Is Beem & What Does It Offer?

Beem is a cash advance app available for Android and iOS that's similar to apps like EarnIn and Dave. However, the app is also packed with other features, like a high-yield savings account, cash games, credit monitoring, and even insurance products.

You can download Beem for free if you live in the United States. Once you create your account, you can begin exploring its range of features, which includes its cash advance feature and the ability to easily send/receive money and split bills.

However, all Beem features require a paid plan, which start at $0.99 per month and get as high as $12.97 per month. I'll cover plans later on, but it's worth noting.

First, I'll dive into Beem's main features so you know what else this app offers.

Beem Everdraft

Beem's Everdraft feature lets you borrow anywhere from $10 to $1,000 from an upcoming paycheck. Like other popular advance apps, you don't pay interest or go through a credit check. Instead, how much you can borrow depends on your Beem plan and payment history.

With Beem's Lite Plan, which costs $0.99 per month, you can only borrow up to $10. The Plus Plan, which costs $5.97 monthly, unlocks up to $50. So, you need to pay $12.97 per month for the Pro Plan to get up to $1,000 in advances.

This is a higher monthly fee than competitors like EarnIn, Klover, and other apps require. But a $1,000 limit is higher, albeit not every user qualifies for this amount.

Also note that Beem can connect you to various personal loan offers. This is similar to all-in-one finance apps like MoneyLion, but the loans you qualify for depend on your payment history and other factors.

💵 The Best Apps To Borrow $200.

High-Yield Savings Accounts

Beem also offers access to savings accounts with 5% APY and above. To put things in perspective, most brick-and-mortar banks don’t even offer 1% APY. This means you’ll make $5 on every $100 you save, per year, so it’s a pretty good deal all around.

However, this high-yield savings account feature isn't managed by Beem. They just present you with links to other banks that offer these rates, including Current, SoFi, UFB Direct, CitBank, and ValleyDirect, just to name a few.

These accounts are still an awesome way to make passive income. But you don't need to pay for Beem to find these offers.

👉 Get A $50 Bonus From Current & Earn 4% APY!

Beem Arcade

Beem's Save & Earn section has a few ways for its members to make and save more money.

For starters, it has a coupons and cash-back deals section that's basically a clone of Capital One Shopping and Rakuten. Not bad.

It also has the Beem Arcade. This section contains arcade and real money games where you can earn rewards for gaming.

This is a cool concept. However, there are tons of higher-paying apps that pay you for playing games. And I prefer using platforms like Freecash or Kashkick to find gaming offers.

Insurance Deals

Beem promotes health insurance premiums starting at under $3, but instead of offering its own plans, it connects you with options from other providers—similar to the savings accounts we mention above. We couldn’t find any of the $3 offers, but we did see plans from Kaiser, CVS, Aetna, and UHC plans with $350 premiums and deductibles of $4,000 or more.

We did see some short-term health insurance plans from Allstate for $99 with $10,000 deductibles. Allstate’s dental plans stood out, offering coverage from $16 to $35 per month, with no deductibles and up to $1,500 in benefits. Then there were the term life insurance plans. The best one (in our opinion) was $37 for $100,000 in benefits.

But again, this is just Beem getting paid to promote some of its partners. It's packed with other features too, like car insurance deals, credit monitoring, job-loss and disability protection, and even a tax-filing service. But it just connects you to partners for pretty much all of these add-ons.

Beem Pricing & Plans

Beem Plans costs between $0.99 per month to $12.97 per month if you pay monthly. Paying annually lets you save $2 per year on the lowest plan and up to $56 on the most expensive plan.

Here's a look at what each Beem Plan provides:

| Beem Lite | Beem Basic | Beem Plus | Beem Pro | |

| Monthly Cost | $0.99 | $2.47 | $5.97 | $12.97 |

| Everdraft Limit | $10 | $50 | $100 | $1,000 |

| Instant Advance Fee | Starts at $0.99 | $4 | $4 | $2 |

| Job Loss & Disability Protection | No | No | Claim up to $500 | Claim up to $1,000 |

| Personal Loans | Yes | Yes | Yes | Yes |

| Car Insurance Deals | Yes | Yes | Yes | Yes |

| Health Insurance Deals | Yes | Yes | Yes | Yes |

| 5% Saving Accounts | Yes | Yes | Yes | Yes |

| Tax Filing | $9.99 | $9.99 | $9.99 | $9.99 |

| Credit Monitoring | No | Yes | Yes | Yes |

Let’s talk about a few important caveats about Beem’s cash advance feature, Everdraft. Accessing up to $1,000 instantly sounds exciting, but that’s an oversimplification of what Beem offers. The actual amount varies based on your checking account activity; namely, the size of the payroll deposits you receive from work.

And while the tiers suggest that you can borrow larger amounts if you pay for a better subscription, we found this wasn’t always the case. For instance, after we signed up for both the Basic and Plus Plans, we could only access $20 at a time, based on our checking account activity.

Now let’s talk about the cost of actually getting these cash advances. As the saying goes, there’s no such thing as a free lunch. While withdrawal fees are advertised as starting at 99 cents, most users will face a $4 instant transfer fee if they want the money deposited into their account the same day.

Granted, cash advances are free if you can wait the three to five days for it to be sent via ACH. But if you need money now, you need to pay the instant transfer fee. Another drawback was that not every plan had a monthly subscription option. While the first three tiers allow you to pay monthly, the Pro tier requires you to make an annual commitment.

Overall, Beem's monthly fees and instant transfer fees seem pretty steep, especially for small advances. And this is why we don't think Beem holds up very well against other cash advance apps.

💵 How To Borrow $500 Instantly.

Is The Beem App Legit?

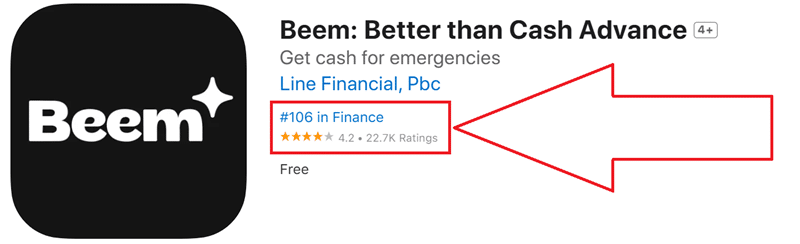

Beem is legit and is a versatile cash advance app that's packed with features. It also has 23,000 ratings on the Apple store with an average 4.2-star review. And it’s even trending at #108 in the finance category.

That said, Beem only has 32 reviews on TrustPilot with a “poor” 2.3-star rating. While this isn’t horrible, it’s certainly not great. And many users complain about the high fees and low cash advance limit.

We really suggest using alternatives like EarnIn or Dave if you're just looking for advances.

Beem Cash Advance Requirements

Beem uses a third-party app called Plaid to review your checking account and see how much you get paid to determine your borrowing limit. This can create problems if you are a gig worker or freelancer who gets paid through PayPal or CashApp since your income is irregular.

You can increase your advance limit over time as you build up payment history. Once you takeout an advance, you automatically pay Beem back once your next paycheck comes in. If your account is in the negative that day, Beem keeps trying to withdraw the payment every day until it is fully repaid.

Beem also needs access to your bank account and a photo ID (like a driver’s license) to verify your identity. This process can take 24-48 hours. The bank account is verified by making two small deposits. Unfortunately, the processing time means that if you need money right away, Beem won’t be a quick solution.

Extra Reading – How To Make Money In One Hour.

Pros & Cons

Pros:

- Access cash advances quickly

- Easily send and receive money to other Beem users

- Access a variety of other financial products and services

- Make money with games and cash-back deals

- Beem is available for Android and iOS

Cons:

- Beem doesn't offer free plans

- Low cash advance limits for most plans

- Most of Beem's “features” are just affiliate partners

- High instant deposit fees for Beem cash advances

The Best Apps Like Beem

If you want to explore all of Beem's features, you'll be busy because this app is packed with them. However, we don't think it's the best borrowing solution due to its high fees.

Some of the best apps like Beem you can consider include:

- EarnIn (best overall)

- Cleo (best for gig workers)

- Dave (best for side hustlers)

- Brigit (best for building credit)

- Klover (best for low-income individuals)

- Current (best bank with cash advances)

- Chime MyPay (best for low fees)

Ultimately, you should always consider the fees and your total advance amount whenever using any of these apps. The last thing you want is to pay super high fees when only borrowing a small amount of money.

👉 The Best $100 Instant Loan Apps.

Is There Customer Service?

There is customer service support via email and phone. You can email [email protected] to receive a response within 24 hours, or you can call 323-641-4224 for immediate assistance.

Who Can Sign Up?

Anyone over the age of 18 with a checking account can sign up for Beem. Just remember that you need to verify your identity and connect your bank account to the app to use it.

Is Beem Worth It?

We’ve tried a lot of cash advance apps, but is Beem worth it?

Well, the Beem Everdraft borrowing amounts and subscription tiers seem to be mediocre at best. The lowest subscription tier is pretty much useless, and the middle tiers are very average. While the top tier offers a decent cash advance, it’s only available with an annual subscription. For many users, the cost of the annual fee is higher than what they can actually borrow at one time.

The extra bells and whistles offered seem more like Beem’s attempt to collect affiliate link money rather than provide a genuinely valuable service. The disability insurance may be a different story since Beem provides that directly, but you can only find out if you’re subscribed to the top tier subscription. Generally speaking, disability or loss of work insurance might be worth the $25 per month. However, some people will tell you that worker’s compensation and unemployment insurance already cover these potential events.

While we can’t give Beem the most stellar review, it's a decent app. We just feel that there are better options out there, especially if you’re looking for a cash advance feature. If your W2 payroll deposits are sufficiently high, you may find that Beem’s Everdraft limits are worthwhile—here’s no harm in downloading it yourself to see.

Want even more ways to earn? Checkout:

- How To Make Money Without A Job.

- The Best Apps That Lend You Money Without A Job.

- Is Varo Legit? The All In One Advance App.

Beem App Review

Name: Beem

Description: Beem is a cash advance app for Android and iOS that also offers insurance discounts, cash-back deals, savings accounts, and other perks.

Operating System: Android, iOS

Application Category: Cash Advance Apps

Author: Tom Blake

-

Cash Advance Limit

-

Fees

-

Ease-Of-Use

-

Other Features