How To Invest $10 And Earn Daily (2025 Guide!)

A lot of people think that you need to be rich to begin investing. However, in reality, nothing could be further from the truth.

In fact, you can actually get started with amounts as low as $10, or even less in some cases! And that's why this post is covering some of the best ways to invest $10 and earn daily. If you want to invest $10 and create new income streams, this is absolutely the post for you.

How To Invest $10 And Earn Daily

Investing for income is a very popular strategy. But it's always important to outline your goals, risk tolerance, and to have realistic expectations. Once you do, you're ready to pick one or more of these beginner-friendly investment ideas:

1. Invest With Fundrise

One popular way you can invest $10 and earn income daily is to use real estate investing platforms like Fundrise.

With Fundrise, you can invest in income-generating properties starting with only $10. As a shareholder, you then earn quarterly dividends from the income properties produce.

Now this isn't an exact way to invest 10 dollars and earn daily since Fundrise pays quarterly. But it's still a popular way to diversify your income and to make money on autopilot.

Plus, Fundrise often has a $10 sign up bonus for new members. And you can always reinvest your income into additional shares.

Just note that Fundrise charges a 1% annual management fee and is only available in the United States. Also note that this is a Fundrise endorsement, and my blog receives compensation if you sign up with the provided link.

Learn more about investing with Fundrise!

2. Invest In Bonds

Bonds are a popular money producing asset class. And these days, you can fetch high returns and enjoy daily compounding interest, starting with only $10!

Enter Worthy Bonds – an investing platform that lets you buy bonds with only $10. It currently pays a whopping 7% APY, and you don't pay any fees either!

The fact bonds only cost $10 makes this an incredibly easy way to diversify your portfolio. Bonds have a 36-month maturity period, although you can withdraw them at anytime without paying penalties.

Start earning with Worthy Bonds today!

3. Dividend Stocks & ETFs

Plenty of dividend stocks and ETFs cost $10 or less. So, you can begin a modest investment portfolio and earn passive income without having a lot of starting capital.

Stash is a popular investing app that's available in the United States. And I'm including it in this article since it's a very beginner-friendly way to begin growing your portfolio. With Stash, you can invest in thousands of ETFs and stocks. And it only takes $5 to begin investing.

New members also get a $5 sign up bonus when they open and fund an account*. So, this is a nice way to get money for signing up while beginning your investing journey.

Stash also supports fractional shares which is beginner-friendly. The starter plan only costs $3 per month, so it's a great time to try out Stash.

4. High-Yield Savings Account

This idea is a good fit for investing $10 if you want to park your money somewhere to let it earn interest. And it's also a popular option if you want easy access to your money in case you need funds.

The great news is that there's also plenty of decent savings account options on the market that you can consider.

For example, companies like Current let you earn 4% APY on up to $6,000. There's no minimum deposit requirement either, so it's a realistic way to invest $10 and earn daily.

To sweeten the deal, Current also has a nice $50 sign up bonus. All you have to do is sign up with the code WELCOME50 and set up qualifying direct deposits of $200 or more within 45 days.

This is pretty easy to accomplish with funds from your day job or any side gig app. So you can get some quick cash with Current and then earn interest on your funds.

5. Fractional Shares

Fractional shares let you buy shares of some of your favorite companies without being rich.

This is because fractional shares are tiny portions of stocks. So, instead of buying an expensive stock like Amazon or Tesla, many brokers and investing apps just let you buy a fraction of these shares instead.

Oftentimes, investing platforms offer fractional shares at just $1 or $2, so it's a perfect way to invest $10. Several leading brokers and apps that support fractional share investing include:

As for what you invest in, it's entirely up to you. I stick with a range of dividend stocks and ETFs, but you can always do your own research or speak with a financial advisor if you need assistance.

Stock picking services like The Motley Fool are also worth considering if you want research and stock picks delivered to your inbox each month.

6. Acorns

Acorns help you can build good habits by rounding up the spare change from daily purchases and then investing it. All you have to do is sign up, connect your bank account, and let Acorns get to work.

For example, if you buy breakfast for $7.25, Acorns can round up that purchase to $8 and invest the additional $0.75 for you automatically. And I like Acorns since it has a variety of portfolios it invests in depending on your goals and risk tolerance. Portfolios are also composed of low-fee ETFs and bonds.

Plus, Acorns also has instant sign up bonuses a lot of the time for new members. And it's also rolled out a new shopping extension and cash back rewards platform to help people earn more.

Overall, if you want to invest $10 and continue to build your nest egg, Acorns is one popular passive income app you can consider.

7. Lend Out The Money

Now, this type of peer-to-peer lending is risky. After all, there's no real way to guarantee that the people you lend money to pay you the interest they owe or even pay you back whatsoever.

However, in communities like Reddit Borrow, some people are willing to take that chance.

With Reddit Borrow, you can lend out money to other people on the internet in informal loans. Members agree on loan terms and interest, and the entire process is done on a largely trust basis.

This is definitely one of the weirder ways to invest $10, and personally, it's not for me. But you can consider it if you want potentially outsized returns. And it's one way to make money on Reddit you might not have heard of.

8. Fixed-Income Investments

Like the name suggests, these investments pay a fixed amount over a certain time period. And some of them let you begin investing with only $10.

Several popular fixed-income investments you can consider include:

- Bonds

- CDs

- Money market fund and accounts

- Preferred stock

- Treasury bills

The downside of this method of investing $10 is that fixed-income investments often have lower returns in exchange for less risk. Additionally, you often lock up your money for months or years at a time.

You can also use Raisin to find the best high-yield savings accounts, money market accounts, and CDs to begin investing with.

It partners with banks and credit unions to bring its members the best rates, and it doesn't charge any fees. Plus, it only takes $1 to get started. Overall, if you want an easy way to invest $10 and earn daily, this type of passive income side hustle is a great way to start.

9. Start A Website

If you're interested in making money online, starting a website is one of the most lucrative options out there.

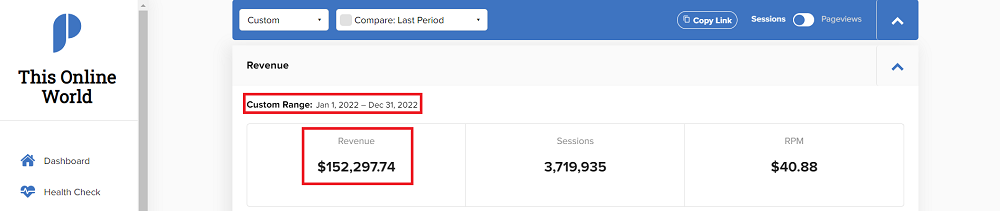

I'll give you a personal example. In 2018, I bought the domain name www.webmonkey.com for about $10. I spent a tiny bit more on some basic WordPress hosting with SiteGround, and I had my online business up and running.

That year, my blog made about $1,700. But in 2022, WebMonkey made $272,000. These days, my blog makes $1,000 a day or more between a combination of Mediavine ads and affiliate income.

And, blogging has completely changed my life. I can now travel the world, making money with my laptop, all from a very small starting investment.

Of course, growing a blog or any online business takes a lot of time and effort. So, it's a far less passive way to invest $10 for income.

However, I think this investment has the highest potential return. And you can always leverage an online business into landing an online job or sell it down the line to exit.

10. Buy And Flip Something

One final idea you can try is to use the money to start a small flipping business.

There are plenty of ways you can start. For example, you could find something of value at a pawn shop or local garage sale, buy it for $10, and then try to resell it online for a small profit.

If you're successful, you can then reinvest that money into even more things to flip and continue the cycle, slowly scaling your inventory.

I know a few people who purchase and resell wholesale products individually, so you can go down this path as well. And you can always buy products and then try reselling them on platforms like Facebook Marketplace or Craigslist.

Extra reading: How To Flip Money.

Tips For Getting Started

Now that you know how to invest $10 to earn daily, I want to share a few tips that I've found helpful over the years that you can keep in mind:

- Set Long-Term Goals: Investing $10 might seem inconsequential, but think of it as the beginning of a longer-term investing plan. Decide on your long term goals and break up that goal into smaller milestones.

- Stay Consistent: Consistency is key with any type of side hustle, including investing. It doesn't matter if you're using apps like Acorns or are sticking with a broker; stay consistent to stay on track!

- Do Your Research: Speaking with a financial advisor and doing your own due diligence is important when making any type of major financial decision.

Extra reading – How To Turn $10 Into $100.

Final Thoughts

I hope this guide on how to invest $10 and earn daily helps you find an easy way to make your money work for you.

Investing 10 dollars might seem like a drop in the bucket. But it's important to build good habits, and every little bit counts!

Just remember to set some goals and to ask for advice when you need it. And always do your research so you know how to invest $10 in a method that works for you.

Looking for more money-making ideas? Checkout:

Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. Investing involves risk and investments may lose value. Holdings and performance are hypothetical. Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value. This information is for educational purposes only and should not be construed as tax, investment, or legal advice.

*Offer is subject to T&Cs