Hurdlr Review – Business Expenses & Mileage Tracking for Side Hustlers

I was approached by a Hurdlr representative 2 months ago via email. They asked me if I would mention Hurdlr on WebMonkey since it could be a great app for side hustlers who are looking to track mileage, business expenses, and save money when filing their taxes.

I’ve finally had time to install the app to play around with it and read some other reviews, and I’ve decided to write a quick Hurdlr review since anyone participating in the gig economy might find this useful.

Plus, as tax season and the new year are fast approaching, I think it is a great time to reflect on personal finance matters or side hustle successes from the previous year while also planning ahead for a great year.

I’m not being compensated financially for this post, although I will include a Hurdlr affiliate link which might benefit me financially.

Anyway, onto the Hurdlr review!

This post will contain:

- What is Hurdlr?

- What the Hurdlr app does.

- Hurdlr pricing..

- Who should use this platform.

- Pros, cons, and alternatives.

Let’s get to it!

What is Hurdlr?

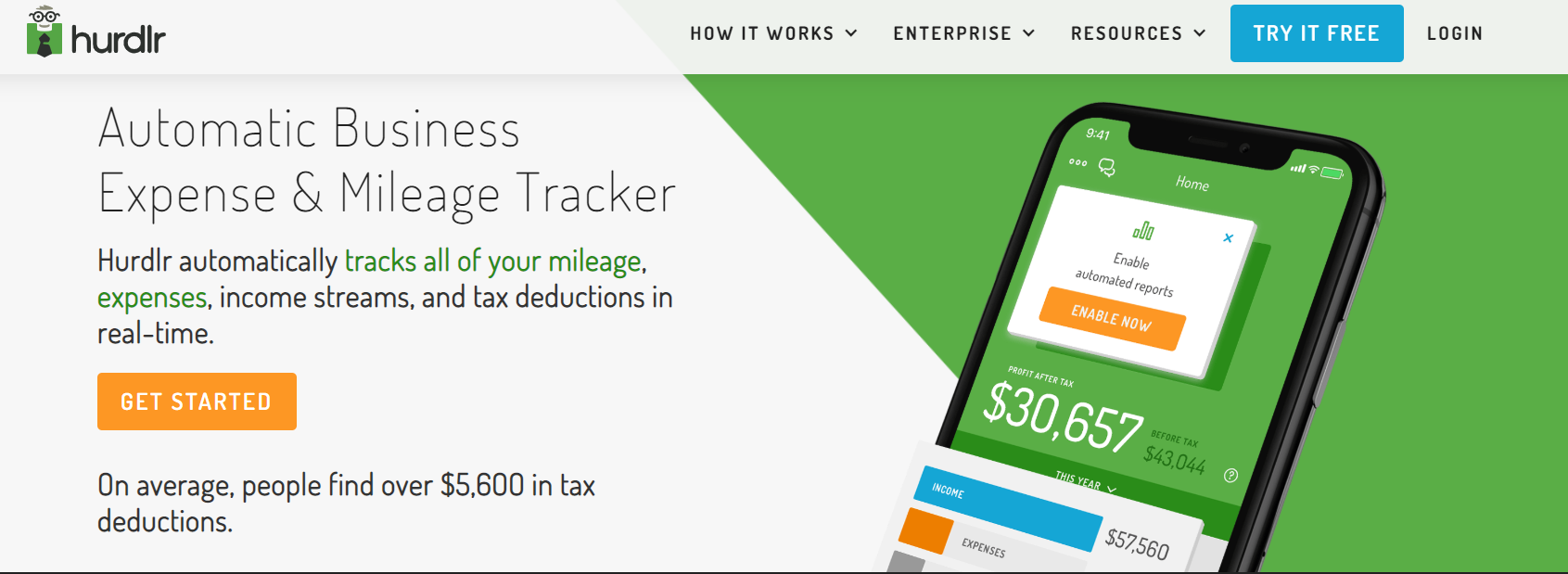

Hurdlr is an automatic business expense and mileage tracker that is designed to help entrepreneurs or side hustlers organize their expenses and save money through tax deductions.

The Hurdlr app is available on both IOS and Android, and according to Hurdlr’s website, the Hurdlr app tracks over $8bn in finances and has saved users a total amount of $300 million.

Hurdlr also states that on average, their users can find over $5600 in tax deductions (I assume this is for full-time entrepreneurs or freelancers).

Hurdlr Features – Expense Monitoring, Mileage Tracking, & More.

The Hurldr app is all about automating processes and centralizing data so you can save money and time. In order to accomplish this goal, there are a number of core features that make Hurdlr incredibly useful for side hustlers.

Mileage Tracking

Hurdlr is a great app for mileage tracking app because the app can automatically log your miles with a simple start and stop feature.

If you have frequent business trips or drive a lot for your work, it can be immensely tedious to track your miles manually or with other apps. Hurdlr simplifies this process ensuring you never miss out on potential tax deductions.

This feature is hands down one of the most valuable features. If you drive for Uber or DoorDash, it is vital to track your mileage and expenses so you can claim these as business expenses when filing your taxes (plus these are good numbers to know, anyway).

![]()

To track your miles with Hurdlr, simply leave the app running in the background of your phone. Hurdlr will document mileage between start and stop points and all you have to do is inform the app if a trip was related to your business or not.

By tracking your miles meticulously, you can maximize your tax deductions since the IRS rate per mile is currently $0.575/mile as of 2020. This adds up surprisingly quickly, especially if you drive to meet clients or work for a ride-share company.

Automatic Income & Expense Tracking

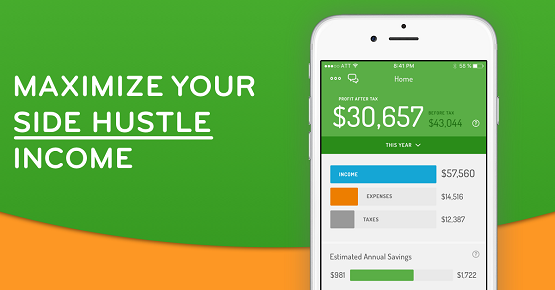

Hurdlr is a great mileage tracking app, but it’s also useful for entrepreneurs looking to efficiently track their income and expenses while on the job.

Hurdlr allows users to monitor their income, which is an important part of securing as many tax deductions as possible. Once you enter some basic income information into the app, it can also deduct any expenses or income tax from your total income to provide an accurate picture of your earnings.

Additionally, Hurdlr’s API can also connect to payment platforms like PayPal, Sqaure, Freshbooks, and Uber to monitor any side hustle income you are making. Plus, Hurdlr can also connect to pretty much every major U.S. and Canadian bank to further monitor your income.

Once Hurdlr is connected to your payment platform or bank of choice it can start to monitor expenses and categorize them accordingly.

Any time you fill up on gas during business trips or incur some business related expense, Hurdlr can keep track of all the numbers for you. If you pay for a business expense in cash you can also log that information into the app manually.

Ultimately Hurdlr is a decent way to automatically track all of the income and expenses related to your business or side hustle.

Calculate Taxes-Owed

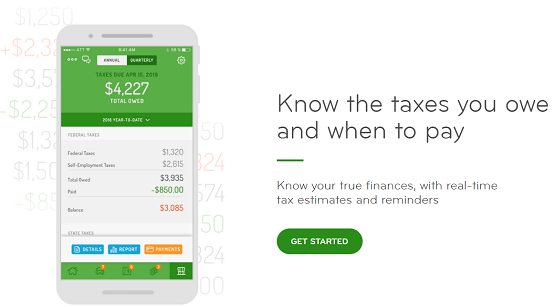

Since the Hurdlr app can track your income, it also has the ability to automatically calculate the amount of taxes you will owe.

Self-employed individuals generally have some different tax requirements than individuals who are employed by a business. According to the IRS: “as a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly.”

If you aren’t good at tracking your income and expenses as a freelancer, tax time might bring on a whole lot of frustration. Hurdlr simplifies this entire process and is able to give you a general idea of what you should expect for your tax season.

With Hurdlr, self-employed individuals get real-time quarterly tax estimates. Plus, Hurdlr still automatically tracks your income, expenses, and possible tax deductions. This is far easier than manually tracking everything and having a constant worry about how much you owe in taxes.

If you use a CPA (certified public accountant) you can also email Hurdlr reports to them to make life easier for everyone involved. Plus, you can also email yourself reports or monthly breakdowns of your income and expenses to monitor how your business or side hustle is doing.

Hurdlr Pricing – Free & Premium Plans

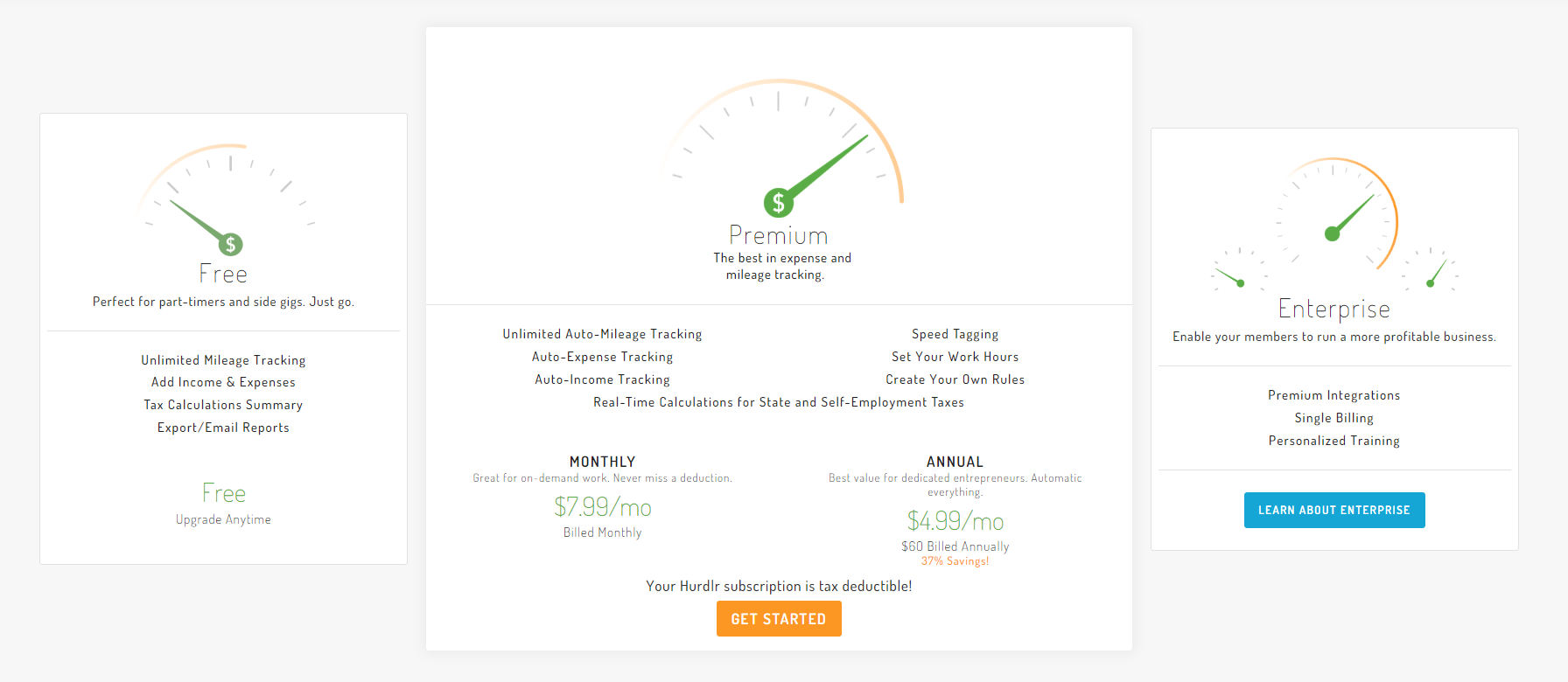

Hurdlr is a free app that works on a ‘freemium’ model, meaning some of their features are locked behind a paid subscription. However, both the free and paid version of the app are pretty solid.

With the free version of Hurdlr, users can use:

- Unilimited semi-auto mileage tracking.

- Basic income and expense tracking.

- Real-time tax estimates.

- Downloadable/email reports.

With Hurdlr premium, users can also use:

- All free Hurdlr features.

- Fully automated mileage and income/expense tracking.

- Speed tagging (quickly tag an expense as being business or personal).

- Custom rule sets.

- Detailed tax estimates and calculations.

- Work hour scheduling.

Hurdlr Pricing – Premium:

- $8/month for a month-to-month plan. Users can cancel anytime.

- $60 annually, which breaks down to $4.99/month.

Note: these prices are in U.S. dollars!

For Canadians, here is how Hurdlr's pricing breaks down:

- $80 CAD annual plan ($7 a month, most popular)

- $10 CAD month-to-month plan, cancel anytime.

Who Should Use Hurdlr?

At the end of the day, Hurdlr is a immensely useful app but only if you can make the most out of the tax deductions and income/expense tracking.

Hurdlr promotes their app to 4 main categories of people on their website:

- Freelancers.

- Realtors.

- Hosts.

- Drivers or couriers.

When you consider what Hurdlr can offer for each of these industries, it makes sense who should use this app.

Hurdlr is great for anyone who makes a full-time or substantial amount of income from their entrepreneurial side hustles or people in industries (like real estate) where you might have a lot of business expenses.

If you are consistently taking clients out for lunch or driving to home viewings as a real estate agent, Hurdlr could be a great way to log all of your expenses.

Similarly, if you rent out your house on AirBnB or drive a significant amount of hours for Uber, Lyft, or delivery services like DoorDash, Hurdlr can track all of your business expenses and mileage. Seriously, full-time drivers in particular really need to have some sort of mileage tracking app if they want to maximize their income.

If you don’t make a significant amount of income from side hustling or aren’t self-employed, Hurdlr isn’t for you.

Or, in other words, if you only drive for Uber once in a blue moon or rent out your home on AirBnB every few months, you can probably forget tracking everything and just do some…creative accounting…Yeah let’s call it that.

In other words save money through tax deductions by using Hurdlr, but don’t give away more personal information than you have to!

Hurdlr Pros, Cons & Alternatives

At the end of the day, Hurdlr is a freemium app that has a lot of awesome features and can save serious side hustlers a lot of money in tax deductibles. After all, the app does have a 4.5 star rating average across thousands of reviews on the Google Play Store and App Store.

However, Hurdlr also has other alternatives and it isn’t the perfect app for every side hustler.

HURDLR PROS

- The free version of the app offers very useful features and the premium version is not very pricey.

- Hurdlr is a great mileage tracking app that any serious courier or personal driver should consider.

- Income and expense tracking can be very helpful for individuals who struggle to keep track of these things on their own.

- Hurdlr can sync to various payment platforms, not just banks.

- Hurdlr’s automatic tax calculation can help freelancers prepare for tax season.

HURDLR CONS

- You need to run Hurdlr in the background of your phone, so keep this in mind for your battery life.

- Hurdlr isn’t too useful for side hustlers who don’t make significant income and are going to do some creative accounting.

ALTERNATIVE APPS & OPTIONS

If you are looking for other mileage tracking apps or ways to monitor your freelancing expenses besides Hurdlr, you can also research:

- MileIQ – a useful mileage tracking app.

- QuickBooks Self Employed.

- TripLog – another useful mileage tracking app.

- SherpaShare – a great mileage tracker for Uber or Lyft drivers in particular.

- Trackly.

- Stride Tax Mileage Tracker.

Again, since Hurdlr has a decent free version you might as well test it out to see if you like the app, because it never hurts to try before you buy!

Final Thoughts

If you are a serious side hustler who is looking to save money through tax deductions and accurately report your income/expenses, I’d seriously consider researching around to find the right app for you.

If you a fan of Hurdlr or want to try the app out for yourself, you can always start with the free version or on a monthly plan!

By tracking your business expenses/mileage and calculating the taxes you will owe when tax season rolls around, you will be able to save money and have a more accurate picture of how your business is doing. Plus, automating these processes will save you time and aggravation, which is also valuable.

Hopefully my Hurdlr review will help someone out there! I’ve never written an app review before, so let me know in the comments if this is useful content or something you aren’t a fan of!

Sign Up For Hurdlr Today

Thanks for reading! Catch you guys in the next post.