How To Invest 40k – 10 Realistic Methods To Try

So, you have $40,000 in extra cash and you're wondering how to put your money to work.

The great news is there are many ways to invest 40k that you can use to start building wealth. Some of these methods are more passive than others, and some carry different risk-versus-reward ratios than others.

But at the end of the day, investing beats hidings money under your mattress! So, let's dive into how to invest 40k so you can make your money work for you!

The Best Ways To Invest 40K

Before we jump into what to do with 40k, it's important to determine a few things about your investing style:

- Risk Tolerance: Are you comfortable with lots of risk for more growth potential? Or do you prefer safe, steady investments with lower returns? It's important to know your level of risk tolerance as an investor so you can invest accordingly.

- Investing Timeframe: Investing for the short-term is much different than investing for 5-10 years or longer. Typically, short-term investments should be safer while long-term investments can take on a bit more risk.

- Overall Goal: Are you investing for retirement, a new car, or just to build wealth? It's important to know your specific goals and what sorts of returns you're looking for.

Also note that you should speak to a financial advisor or investing professional if you have questions. I am not a financial advisor, and you should always do your own research and due diligence when making financial decisions.

Alright, let's move onto how to invest $40,000!

1. Stocks & ETFs

One of the most straightforward ways to invest 40,000 dollars is to invest in stocks and exchange-traded funds (ETFs.)

Stocks let you own a part of a company. And ETFs are funds that often contain numerous stocks or other securities to provide investors with more diversification.

You can even invest in things like dividend stocks that pay you quarterly or annual dividends from company profits. And the great news is investing in stocks or ETFs is easy these days.

You can likely start investing without paying commissions through your bank. And there are plenty of commission-free brokers out there that you can try as well.

If you need a helping hand on where to start, you can always speak to a financial advisor at your bank. There's also a wealth of information online about how to research stocks.

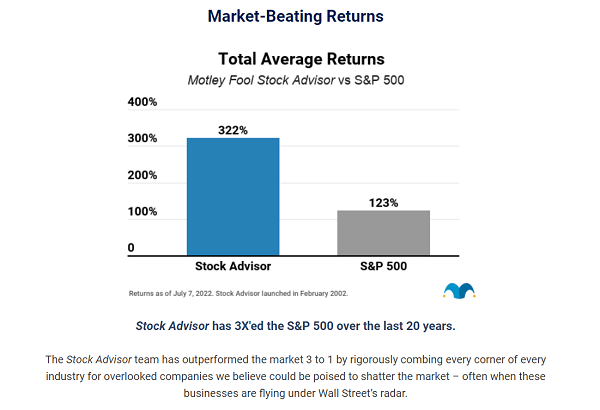

Services like The Motley Fool are also excellent stock advisory services that provide monthly stock picks to help you build your portfolio.

Overall, you have so many options for starting out with stocks and ETFs, and there's so much valuable information online about the subject.

The Best Income Generating Assets To Buy.

2. Real Estate

If you want to invest 40k in real estate, you actually have plenty of options.

This surprises many investors since traditionally, you needed a lot of capital to get involved with real estate.

However, thanks to the rise of real estate investing platforms, you can add income-generating real estate to your portfolio with small amounts of capital.

For example, Fundrise lets you invest in real estate projects starting with just $10. So it's a beginner-friendly way to add real estate to your portfolio.

Investments generally include multi family homes, office buildings, and other commercial real estate developments. You get paid quarterly dividends, and you can also earn from your shares appreciating.

Investments generally include multi family homes, office buildings, and other commercial real estate developments. You get paid quarterly dividends, and you can also earn from your shares appreciating.

Fundrise returns around 8% to 11% annually on average, and you pay a 1% management fee per year.

If you want to invest and make money daily, it's a great option thanks to the dividend payment structure. There are numerous other real estate investing companies out there too, like RealtyMogul and Arrived.

Both platforms also have excellent commercial real estate opportunities, although you need $5,000 to start investing.

But the bottom line is you can invest $40,000 in real estate or even much less thanks to these new investing platforms.

Learn more about investing with Fundrise!

Disclaimer: This is an endorsement in partnership with Fundrise. We earn a commission from partner links. All opinions are my own.

3. Use A Robo-Advisor

If you want to make money on autopilot, it's hard to beat investing with a robo-advisor.

Robo-advisors use algorithms to pick investments that match your goals and level of risk tolerance.

It's basically like working with a financial advisor, except the fees are generally much lower and you don't need much money to start.

One popular robo-advisor and way to invest 40k is Betterment.

From there, you can invest in different Betterment portfolios which are largely comprised of ETFs and bonds.

What's cool about Betterment is that there are plenty of portfolios to choose from, including options like:

- Betterment Core: Contains low-cost funds and is globally diversified.

- Socially Responsible Investing: Choose from three different SRI portfolios, including a climate impact portfolio.

- Innovative Tech: Invest in world-changing technology companies.

Betterment charges 0.25% annually for portfolios under $100,000, which is only $100 in fees per year if you invest $40,000.

You also get features like automatic portfolio rebalancing and tax-loss harvesting, so it's an excellent all-around robo-advisor you can try.

4. Alternative Investments

For a more exciting way to invest 40k, you can explore various alternative investment options.

Alternative investments can include anything from farmland to fine wine. And some investors use these sorts of non-traditional investments to diversify their portfolios and potentially outperform the market.

Thankfully, you don't need to find these alternative investment opportunities yourself either.

Companies like Yieldstreet specialize in alternative investments, and its entry-level Prism Fund only requires $500 to get started.

- Artwork

- Crypto

- Private equity

- Real estate

- Short-term notes

- Supply chain financing

Different funds have different investing minimums, and some require $10,000 to $15,000 to get started.

But you can always invest 40k or less into one or two funds to add some variety to your portfolio.

Companies like Alto IRA also let you invest in numerous alternative investments, just in your IRA.

Between these two companies, there are plenty of ways to add different asset classes. And you can invest $40,000 or even less if you just want to dabble with this type of investing.

5. Fixed-Income Investments

Fixed-income investments provide a steady stream of income for more stability and less risk.

Some investors use fixed-income investments if they're investing for the short-term. This is because the low volatility reduces the risk they lose money when they need it for an upcoming expense.

Examples of popular fixed-income investments include:

- Bonds

- Certificates of Deposits (CDs)

- High-Yield Savings Accounts

The main downside of investing $40,000 this way is that your returns are generally quite low; think 0.50% to 1.5% at most.

And during periods of high inflation, these sorts of returns aren't doing you much good.

That said, you can always invest a portion of your 40k nest egg in fixed-income investments for less risk and some predictable returns.

6. Cryptocurrency

Digital assets like crypto and NFTs have been the hottest investing trend for the last few years.

And while crypto markets have been hurting in early 2022, you can still consider crypto as a way to invest $40,000.

Exchanges like Coinbase make getting started easy, and you can invest in 150+ cryptos starting with just $2.

- 1inch

- Algorand

- Bitcoin

- Cardano

- Dogecoin

- Ethereum

- Litecoin

- Solana

- Uniswap

You can also stake certain cryptos to earn up to 5% APY. If you want to earn passive income, this sort of feature is what you want in an exchange.

I've been using Coinbase and also companies like Nexo, which lets you deposit different cryptos to earn daily interest.

Overall, crypto is a fun and exciting way to diversify your portfolio. Just make sure you're comfortable with the volatility and actually research the projects you're investing in.

7. Paying Off Debt

One of the best ways to invest $40,000 dollars could actually be to pay off some debt you have.

High-interest debt makes it very difficult to build wealth since you always have to worry about making payments.

So, if you have a windfall of $40,000, you could prioritize paying off things like credit card debt or any student loans you might have.

Some people also pay off their mortgages faster, but depending on your rate, this might not be so urgent.

8. Your Education

Another way to invest 40k that could have life-changing impact is to invest in your education.

Higher-education isn't always the right choice. But if your current job doesn't pay a salary or wage you think is high enough, education can help unlock more opportunities.

And you don't have to go to a super expensive, four-year program either.

Even completing one or two-year certifications at a community college can unlock a variety of higher-paying jobs.

We have lots of content on this blog you can explore on this topic as well like:

- The Best Jobs That Pay $5,000 A Month.

- The Best Jobs That Pay $10,000 A Month.

- 10+ Jobs That Pay $100+ Per Hour.

9. Index Funds

An index fund is a fund that's built up of investments to make it match an underlying index. For example, there are index funds that mirror the S&P 500 or various asset classes.

People like index funds because they're often low-fee and also provide diversification.

So, if you want more diversification, this is a reliable way to invest 40k.

Vanguard has some popular index funds, as do brokers like Charles Schwab and Fidelity that you can explore.

10. An Online Business

One final option for investing 40k is to use the money to fund some sort of online business.

Now the great thing about making money online is that you often don't need this type of capital to get started.

However, if you want to start an ecommerce business, you can use some of your capital to fund initial inventory or equipment you might need.

As for how you sell, ecommerce platforms like Shopify or Etsy are great starting points.

Esty is interesting because you can also try Etsy print on demand selling, reducing your need for upfront inventory so you can spend more on marketing or potential help for the business.

You can also explore other options like buying an existing online business or blog.

Marketplaces like Flippa let you buy and sell blogs, ecommerce stores, domain names, and even mobile apps.

I only recommend buying an existing online business if you have experience with running one.

However, this is definitely a more entrepreneurial way to invest $40,000.

Tips For Investing $40,000

Now that you know some of the best ways to invest 40k, here are a few tips to keep in mind during the process:

- Seek Advice: Asking a financial planner for advice or using platforms like robo-advisors can help keep you on track and invest in assets that match your goals.

- Diversify: You don't have to invest 40k into one single asset. You can try numerous ideas to diversify your portfolio.

- Keep Researching: Part of responsible investing requires staying on top of new trends, regulations, and opportunities. So, make a habit of reading investing news and check your portfolio every once in a while.

Frequently Asked Questions

How Can You Invest 40K In Real Estate?

The easiest way to invest in real estate with 40k is to use investing platforms like Fundrise or RealtyMogul. You can also look to invest in other REITs through your broker if it supports this.

What's The Most Passive Investing Option?

Options like ETFs and real estate crowdfunding are very passive investing options. Using robo-advisors like Betterment are also completely hands-off. In contrast, investing in stocks or a small business likely takes more monitoring.

Final Thoughts

I hope our guide on how to invest 40k helps you find some ways to make your money generate income for you.

Investing is a foundation of wealth building. And thanks to technology, you have plenty of options for getting started.

Just remember to speak to a financial advisor or professional if you need advice on which investing paths are right for you.

Thank you for reading!

Looking for other wealth-building ideas? Checkout: