How To Invest 300K – 10+ Realistic Methods To Try

So, you have $300,000 and you're wondering: how on earth do I invest this type of money?

Figuring out how to invest $300k isn't an easy feat. After all, this is a massive sum of money.

But the great news is that there are so many different investing ideas you can explore these days. And some are great for passive income, while others are more hands-on.

If you're ready to look at ways to invest 300k, this is the post for you.

The Best Ways To Invest 300K

If you want to make money on autopilot, some of the passive investing ideas in this post are where you should start.

In contrast, some ideas for investing $300k involve buying businesses so you can turn an already profitable side hustle into an income stream.

Whatever the case, the idea is to make your money work for you so your wealth generates more wealth!

Note: I am not a financial planner, and you should never hesitate to ask a financial planner or professional for advice. Also do your research and due diligence when deciding how to invest $300k.

1. Real Estate

Real estate investing is a classic way to invest $300k, especially if you use real estate investing platforms and invest across multiple properties.

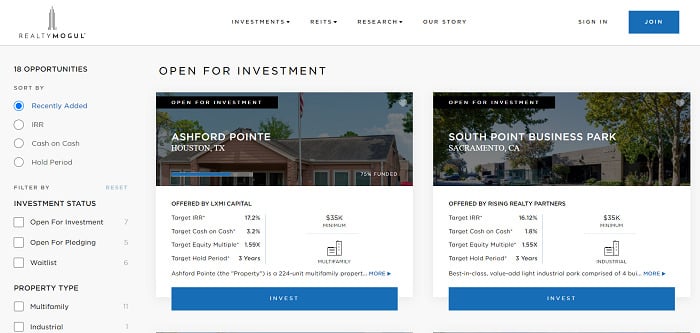

RealtyMogul is one example of a popular crowdfunding company you can use to invest $300,000 dollars. And it specializes in commercial real estate deals across the United States.

- Multi-family homes

- Industrial buildings

- Offices

- Self-storage

- Residential projects

Each investment has a different investing minimum, target equity multiple, and target hold period.

What's nice is that many RealtyMogul properties only have target holding periods for a few years, meaning they try to generate serious returns in a short amount of time.

There's a $5,000 investing minimum, and you pay around 1% to 1.25% annually in management fees.

RealtyMogul also has REITs you can invest in that are collections of real estate properties. There's an income and growth REIT, so you can focus on what's right for your investing goals.

But RealtyMogul is just one example of a popular real estate investing company you can use to invest $300,000.

If you want lower investing minimums, Fundrise lets you invest in income-generating real estate with just $10.

Overall, you can use a variety of companies to add real estate to your portfolio without having to become a landlord yourself.

Overall, you can use a variety of companies to add real estate to your portfolio without having to become a landlord yourself.

Learn more about RealtyMogul and Fundrise!

Note: This is an endorsement in partnership with Fundrise. We receive compensation if you sign up with provided links. All opinions are my own.

2. Stocks & ETFs

One of the simpler ways to invest $300k is to invest in stocks and exchange-traded funds (ETFs).

This is a foundation of wealth building for many people. And if you want to invest and make money daily, investing in things like dividend-paying stocks and ETFs is right up your alley.

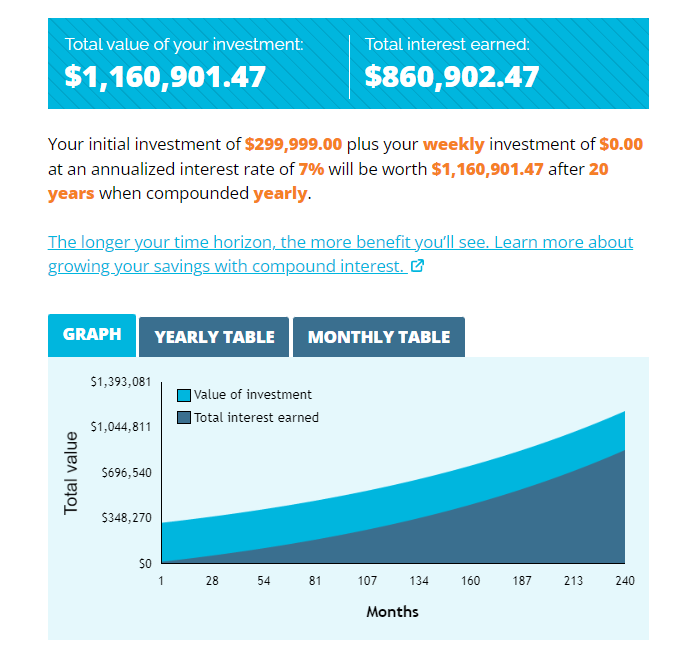

And you'd be amazed at what the power of time and compound interest can do for your $300,000.

For example, if we assume a 7% annual rate of return, your $300k nest egg can turn into over $1 million within 20 years:

This also assumes you don't make any additional contributions. But if you invest in a mix of growth stocks and dividend-funds, you can at least reinvest your dividend income into more shares.

The bottom line is investing in stocks and ETFs is one of the best ways to invest $300k if you want to keep things simple and stick to a game plan.

You can likely start investing by opening an investment account with your bank. There are also plenty of commission-free brokers that you can use.

Additionally, if you need a helping hand, you can try services like The Motley Fool which helps provide stock recommendations and research to help investors learn. You can also decide to speak to a financial advisor at your bank.

Which stocks and ETFs you decide to invest in is up to you, and you should always do your research or consult a financial professional.

The Best Cash Flowing Assets To Buy.

3. Robo-Advisors

If you like the idea of investing in ETFs and stocks but want a helping hand, you can always consider using a robo-advisor.

Robo-advisors are similar to financial planners except they use technology to invest in assets that match your investing goals and level of risk tolerance.

People like robo-advisors because they work on autopilot and are often very low-fee.

Betterment is an example of a leading robo-advisor, and it's definitely a viable way to invest $300,000 dollars.

This robo-advisor has nine different portfolio strategies for investing your money, including options like:

- Betterment's core ETF portfolio (low cost and global diversification)

- Innovative technology ETFs

- Climate impact

- Socially responsible investing

- Target income (for lower risk and more stable income)

You answer a questionnaire to help Bettement pick the right investments for you.

There's a $0 funding requirement, so you don't have to invest your entire $300,000 to start.

As for pricing, Betterment has two tiers:

- Digital Investing ($0 to $99,999): Pay 0.25% annually.

- Premium Investing ($100,000+): Pay 0.40% annually and get access to human financial advisors as well.

The fact you can get human financial advisor access with Premium Investing is a selling point.

Betterment also automatically rebalances your portfolio and uses strategies like tax-loss harvesting to maximize gains.

If you want a completely passive option for investing 300k, robo-advisors could be the right choice.

Learn more about investing with Betterment!

4. Small Businesses

Another way to invest $300k is to help fund small businesses that need capital to grow.

This is a strategy that can potentially double your money as well depending on how successful the business you fund is and the terms you agree on for lending them capital.

The first route would be to take on more of a venture capitalist role and to find and fund startups or profitable businesses yourself.

However, if you don't have a network of entrepreneurs and other VCs to turn to, it might be hard to find investing opportunities.

Alternatively, you can use companies like Mainvest that let you invest in already-profitable small businesses.

Mainvest has a $100 investing minimum. The platform highlights successful small businesses that need additional capital to keep growing.

Mainvest has a $100 investing minimum. The platform highlights successful small businesses that need additional capital to keep growing.

Examples of businesses you find on Mainvest include:

- Bakeries

- Breweries

- Cafes

- Food trucks

- Restaurants

Each listing has a target return, funding requirement, and time-frame.

Additionally, Mainvest only accepts around 5% of business applicants, so only the most promising businesses make it through and list.

Investing in small businesses is still riskier compared to many business ideas. But if you're investing 300k or more, it's still a viable option.

Learn more about investing with Mainvest!

5. An Online Business

If you're feeling a bit entrepreneurial, you can always buy a small business as a way to invest 300k.

People do this all the time and invest in already-profitable ecommerce stores, blogs, and other online businesses.

And this is easier to do than you might think.

For example, marketplaces like Flippa have a host of profitable online businesses and blogs that you can buy. Listings range from $100 to $1 million or more, but $300,000 can get you a very profitable online business.

So with a $300,000 investment, you can probably buy a business that's generating $12,000 per month on the high end and $7,500 per month on the low end.

A lot of factors determine how valuable a site is, like seasonality, traffic growth trend, and risks.

You should also have experience with growing a website or online businesses before buying one in my opinion.

But for a less traditional method for investing 300k, you can consider buying an online business, be it a blog or ecommerce store.

6. Cryptocurrency

If you're still wondering how to invest $300,000 dollars, you can always consider crypto as an alternative asset class.

Crypto investing has been all the rage within the past few years. In fact, Bitcoin is the single best performing asset of the last decade.

And what's amazing about the world of crypto and decentralized finance (DeFi) right now is that you have so many investing and passive income options.

For example, you can keep things simple and invest in dozens of different cryptos by using exchanges like Coinbase.

Alternatively, you can use crypto interest accounts from companies like Nexo and earn 15% APY or even more on certain coins.

For example, I recently deposited about $500 worth of Cardano that I had bought on Coinbase into my Nexo account.

Now, my Cardano earns about 8% APY and pays me daily interest into my Nexo account.

These are just examples of how you can invest in income as a nice passive side hustle.

Of course, how much of your portfolio you invest into crypto is up to you. But it's an exciting asset class and potential way to invest $300k.

7. Real Estate Rentals

Real estate crowdfunding helps you add real estate income into your portfolio without having to actually own and manage property yourself.

But if you don't mind dealing with tenants and repairs, you can always invest $300k into a rental unit and create a new income stream for yourself.

A lot of young adults and couples do this too by buying a duplex and renting out the basement to a tenant to help cover the mortgage.

This type of “house hacking” is a popular strategy. And in many low-cost-of-living (LCOL) areas, $300,000 is more than enough to put a down payment on a duplex and put a serious dent in paying it off.

Of course, the downside to buying property with $300,000 is that you have to manage that property. This means paying taxes and dealing with tenants.

But if you want an asset with the potential to appreciate and generate cash flow, you can consider getting into the rental game.

8. Alternative Investments

One more unique way to invest $300k is to invest in a variety of alternative assets.

Cryptocurrencies are what I'm focusing on these days. However, there are so many other options to explore.

Examples of popular alternative assets people invest in include:

- Artwork with companies like Masterworks

- Farmland with companies like AcreTrader

- Fine wine with companies like Vint

- Precious metals

- Rare collectibles like sports cards, vintage cars, or even things like Pokemon cards

You can invest in these assets on your own or through companies that specialize in them.

For example, companies like Alto let you invest in 75+ alternative assets in your IRA, including crypto, farmland, fine wine, and artwork.

Alto actually partners with many of the alternative investment options listed above. But it lets you take advantage of tax-advantaged accounts like a Traditional or Roth IRA.

Alternative assets can be a riskier way to invest $300k because these assets are typically illiquid, meaning it's harder to sell them if you need cash.

However, alternative investment platforms help reduce this risk since many have their own marketplace where you can sell shares to other investors.

We like Alto for alternative investing, but there are so many ways you can begin to dabble in this sort of thing.

9. Debt Investments

One more idea for investing 300k is to invest in debt rather than equity.

People do this with real estate investing all the time.

For example, companies like Groundfloor let you fund real estate development projects starting with just $10.

In exchange, you earn interest on your loan. According to Groundfloor, the platform has returned around 10.5% annually on average.

However, since Groundfloor only has a $10 minimum, investors can mitigate risks by funding multiple loans. This way, a single default doesn't drain your portfolio.

You should still consider the risks of any investing idea and do your research. But perhaps a portion of the $300,000 investment nest egg could go into an idea like real estate debt.

10. Index Funds

One strategy for investing $300,000, albeit a more boring one, is to invest in index funds.

An index fund is a mutual fund or exchange-traded fund that is comprised of stocks that match an underlying index.

As an example, you can invest in index funds that mirror the S&P500, or index funds from companies like Vanguard.

Index funds typically charge fees of around 0.20%, which is often higher than strict ETFs.

However, these fees are still lower than many actively managed funds or mutual funds, so it's a nice middle ground in the investing world.

11. Retiring With Geo-Arbitrage

One final and somewhat out-of-the-box idea for how to invest 300k is to use it to help fund your retirement.

In many countries, $300,000 isn't enough to retire on. However, this sum of money is enough to retire in countries with very low cost of living.

And even if it's not enough to retire fully, many advocates of FIRE, or financial independence and early retirement, promote ideas like Barista FIRE.

With Barista FIRE, you basically save up a decent nest egg that you invest. You then work a part-time job, like being a barista, to cover some of your monthly expenses.

So with $300,000, you might be able to take a permanent or extended break from work and could live somewhere else for a while.

I lived in Colombia for a few months when I was starting freelance writing, and it was one of the best decisions I've ever made.

Of course, you need to do your research and create a strict budget for your $300k so the math all checks out.

But depending on your monthly expenses and any additional income sources you create, 300k could mean semi or full retirement in some parts of the world.

Extra Reading – The Best Online Jobs That Pay Daily.

Tips For Investing $300,000

Now that you know what to do with 300k, here are a few tips you can keep in mind when making your choices.

- Speak With A Professional: For large sums like $300k, it pays to speak to a financial professional. Don't be afraid to seek out a financial planner or advisor. Or, at the very least, look for online robo-advisors or companies that offer tailored financial advice if you're lost.

- Diversify: Another tip is to diversify your investments so you're not putting all your eggs in one basket. This could mean investing in stocks with M1, buying some crypto, and dabbling in real estate with RealtyMogul.

- Keep On Reading: Financial literacy takes time and effort. And new opportunities pop up all the time, so get in the habit of reading finance and investing news or some classic investing books.

Extra Reading – How To Turn 10k Into 100k.

Frequently Asked Questions

How Can I Invest $300k In Real Estate?

There are several ways you can invest $300,000 into real estate. Simple options include investing with real estate investing companies like Fundrise or RealtyMogul. But in some areas, you can also buy a duplex or rental unit and rent it out to tenants to create a new income source.

Can I Retire On 300K?

A $300,000 dollar nest egg isn't normally enough to retire on in certain countries with high costs of living, but it all depends on your monthly expenses. If you're frugal and don't have any dependents, it could be enough. And you could also consider geo-arbitrage and settle in another country or area where you have far more purchasing power with your currency.

Extra Reading – How To Quickly Turn 10k Into 20k.

Final Thoughts

I hope this guide on how to invest 300k gives you some ideas for how to put your money to work.

There are honestly so many investing opportunities these days thanks to technology, so take advantage of some!

And, as mentioned, never hesitate to seek financial advice from a professional, and do your due diligence!

Thanks for reading!

Looking for more wealth-building ideas? Checkout:

- The Best Ways To Flip Your Money.

- The Best Jobs That Pay $10,000 A Month.

- How To Make $100,000 A Month.