How To Invest 200k – 9 Realistic Methods To Try

I talk about how to create passive income a lot on WebMonkey.

In fact, I'd say trying out new passive income ideas is one of the main reasons I even started WebMonkey in the first place.

And when it comes to creating new income streams for yourself and building wealth, investing is certainly one of the most common strategies out there.

But if you have a large lump sum to invest to create income, it can be difficult to know exactly where to start.

So in this post, I'm covering some of the best ways to invest 200k.

If you're wondering how to invest $200,000 and want to explore several opportunities, this is definitely the post for you.

Let's get to it.

The Best Ways To Invest 200K

One quick note before jumping into the different ways to invest 200k.

You should always consider your financial goals, risk tolerance, and how passive you want different investment ideas to be before proceeding.

Additionally, note that I'm not a certified financial planner and that you can always talk with a financial planner or wealth advisor to get more tailored advice for your specific situation.

With these notes in mind, let's dive into different options for how to invest $200,000.

1. Real Estate

One common strategy for investing $200,000 is to invest with real estate investing platforms.

With these platforms, you can buy shares in income-generating real estate properties and then earn income through dividend payments and from your shares appreciating.

Typically, real estate investment companies companies invest in multi-family homes or commercial real estate to generate rental income.

Overall, the entire process is pretty similar to investing in real estate investment trusts (REITs), although there are plenty of these companies on the market these days.

One popular player in the space is Fundrise, and this platform lets you invest starting with just $10.

Fundrise invests in a variety of properties that generate income and pays shareholders with quarterly dividends.

Fundrise invests in a variety of properties that generate income and pays shareholders with quarterly dividends.

Historically, Fundrise returns about 8% per year. You pay 1% in management fees, which is fairly standard in the world of real estate crowdfunding.

Fundrise can have higher-performing years however, and in 2021, the platform returned 22.99% on average for investors.

But the nice thing about Fundrise is you only need $10 to start investing, so it doesn't have to make up your complete $200,000 investing strategy.

Ultimately, companies like Fundrise provide an easier way to add real estate to your portfolio, so it had to make the cut for this list of ways to invest 200,000 dollars.

Learn more about investing with Fundrise!

Disclaimer: This is an endorsement in partnership with Fundrise. We earn a commission from partner links. All opinions are my own.

2. Dividend Stocks

Another common strategy for investing 200k is to invest in dividend-paying stocks.

Plenty of financial independence retire early (FIRE) advocates enjoy this strategy, and the idea is to invest in companies and ETFs that pay you a regular quarterly or annual dividend.

You can then reinvest your dividend income back into additional shares or potentially use the income to help cover annual living expenses.

This is also where the power of time and compound interest can really work some magic.

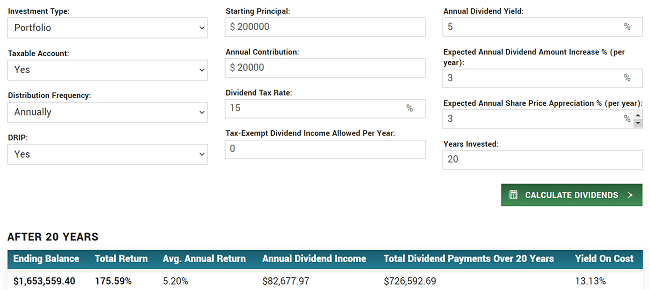

For example, take a look at this dividend income calculator from Market Beat:

It shows how investing $200,000 into dividend stocks with a 5% annual dividend yield can generate $1.6 million and $82,000 in annual dividend income after 20 years.

Granted, this calculator assumes a few figures:

- $20,000 in annual contributions

- Dividend reinvesting

- 3% annual dividend amount increase

- 3% annual share price appreciation

But even if you tweak the numbers a bit, there's no denying that investing $200,000 into dividend stocks and ETFs is a very realistic way to create a new income stream for yourself.

Need a helping hand? Checkout The Motley Fool for stock research advice and tools!

3. An Online Business

One of the more creative ways to invest 200k is to invest in an online business.

This is honestly an investing idea I want to try in the near future, and the idea is to buy or fund an online business to generate extra income.

There are plenty of examples of online businesses you could invest in as well:

- Income-generating blogs

- Shopify ecommerce stores

- Amazon affiliate sites

- Etsy print on demand businesses

Personally, I plan on buying a blog on a marketplace like Flippa sometime in the next two years or so.

And, with $200,000, you could probably buy a blog that's generating around $5,000 to $6,000 per month in revenue.

So, if you bought an online business, put in resources and time to scale it, you could recoup your investment or even flip your money by selling off the asset down the line.

This method to invest $200,000 takes more skill, time, and involves some risk.

However, I think it's an investing idea that has tremendous upside potential, especially if you're investing in digital assets you already work with and understand.

4. A Rental Unit

Like real estate crowdfunding, another idea to invest $200,000 dollars is to purchase a rental unit so you can become a landlord.

Traditionally, real estate has been a reliable vehicle to generate wealth, and it's still a method many people use to diversify their income.

A perfect example of this is house-hacking with a duplex.

The idea here is to buy a duplex with a downpayment and then rent out half of the home to tenants to help cover your mortgage.

In some markets, the rental income might be able to cover most or even all of your monthly mortgage payments, essentially letting you live “for free.”

This video from YouTuber Shelby Grosch provides an excellent overview for the cost of house hacking a duplex and tips anyone getting into this sort of thing needs to know:

Over time, you can even consider renting out both parts of the duplex if you move elsewhere, turning your initial property into a 100% income-generating asset.

5. Equity In Small Businesses

Like investing in your own business, another way to invest 200k is to help fund small businesses.

And you don't need to be a Shark Tank host or venture capital firm to invest in businesses as a way to put your money to work.

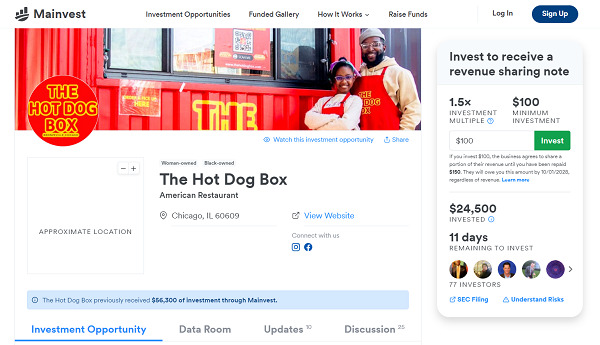

In contrast, you can use companies like Mainvest to invest in a variety of small businesses across America that are generating revenue but need capital to scale.

Mainvest only requires $100 to begin investing, and it's possible to double your money if you invest in the right business on the platform.

In a nutshell, Mainvest lets you invest in different businesses that pay you a certain investment multiple.

Examples of businesses you find on the platform include:

- Bakeries

- Breweries

- Real estate developments

- Restaurants

Mainvest opportunities aim for a 1.5x to 2x on your investment, and you can also feel good that you're helping small business owners succeed.

One Mainvest business I found recently is a Father-daughter hot dog business.

As you can see, this opportunity pays out a 1.5x investment multiple and has currently raised $24,500 from 77 investors.

Investing $200,000 into one business is unlikely since most Mainvest listings don't require that much funding.

But you can always spread out all or some of your $200k investment to fund several businesses.

It's also worth noting that Mainvest only accepts around 5% of applicants to its platform and also includes SEC filings and information to help you with due diligence.

Of course, there are still risks to investing with Mainvest, but it's definitely a more interesting way to invest $200k.

Learn more about investing with Mainvest!

6. ETFs & Index Funds

Like investing in dividend stocks, another common strategy for investing 200k is to invest in various ETFs and index funds.

Personally, this is one of the main ways I invest, and I like that it's more hands-off than individual stock investing.

This is also a very common long-term play; you basically park your money in different ETFs and index funds, hope for around 7% annual return per year, and enjoy the compound interest for the next 30-40 years or more.

Overall, if you're looking for a more laid-back way to invest 200,000 dollars, ETFs, index funds, or even mutual funds could be the right choice.

7. Crypto Interest Accounts

Unless you've been living under a rock the last few years, you probably know that cryptocurrency is all the rage these days.

Between popular cryptos like Bitcoin and Ethereum rising in price and the surge of NFT interest, there's a lot of interest in all things digital assets.

And, cryptocurrency is also one new passive investment idea I've been experimenting with lately.

The main experiment I'm trying is to use Nexo, a crypto interest account, to earn daily interest on some Cardano I own.

So, I bought some Cardano on Coinbase, deposited it in my Nexo interest account, and I now earn around 8% APY on my Cardano.

I only bought $500 of Cardano, so this is a small test and nothing too crazy.

However, for investing $200,000, there's a lot of potential to generate yield and some serious gains through crypto.

I cover my Nexo passive income experiment in one of my YouTube videos as well if you want to learn more.

Of course, you need to consider your level of risk tolerance and also do your due diligence on various cryptos and lending platforms.

But you can always use a portion of your $200,000 to invest in crypto and put the rest towards more traditional investment ideas.

8. Real Estate Debt

If you're still wondering how to invest 200k, one idea you might not have thought about is to invest in real estate debt.

Unlike equity investing, real estate debt investing involves funding different real estate loans to earn interest on those loans.

Essentially, you're lending money to builders so they can construct new developments or renovate existing ones.

And like Fundrise, companies like Groundfloor help you get started with real estate debt investing with just $10.

Loans are typically short-term and are around 6 to 9 months. Loans also have various interest rates and levels of risk.

According to its website, Groundfloor has returned 10.5% annually on average to date.

Of course, debt investing has risks. For example, borrowers can default and then Groundfloor has to pursue foreclosure to try and get some of the money back.

However, since Groundfloor has a $10 minimum, you can build a basket of real estate loans to invest in.

This is definitely on the riskier side of ways for investing 200k, but it's another idea that's worth considering if you're looking for short-term investments.

9. Alternative Investments

When you think about how to invest 200k, ideas like investing in fine wine, artwork. and rentable assets might not be top of mind.

However, there are plenty of alternative asset classes you can consider to invest 200k.

Here are some popular alternative investment ideas:

- AcreTrader: Invest in income-generating farmland and earn annual cash dividends.

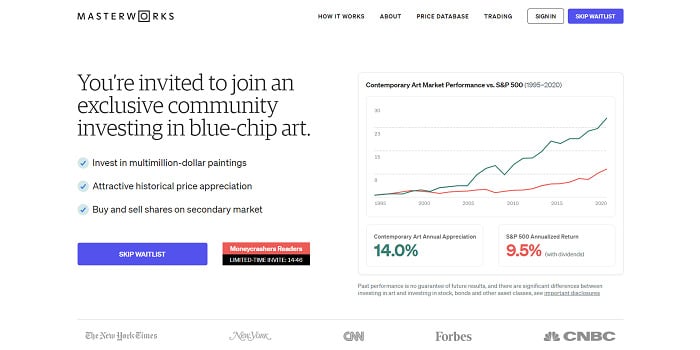

- Masterworks: Lets you invest in shares of fine artwork.

- Vint: Invest in a portfolio of fine wines.

For example, people purchase cars to rent out on Turo, or even purchase homes to rent out on Airbnb.

The bottom line is there are a lot of alternative investment ideas you can try to put your money to work for you.

Extra Reading – The Best Passive Side Hustle Ideas.

Tips For Investing $200,000

Now that you know where to invest 200k, here are a few tips you can keep in mind during the process!

- Ask For Advice: Don't be afraid to ask for professional financial advice from a CFP if you need a helping hand.

- Know Your Investing Style: Determine your level of risk tolerance and how much volatility you can handle before investing $200,000 (or any amount!)

- Diversify: One strategy some investors use is to create a more diversified portfolio. So, you can try dividend stocks, ETFs, Fundrise, crypto, and numerous asset classes. Just make sure you do your research so you know what you're investing in.

Extra Reading – How To Turn $10,000 Into $100,000.

Frequently Asked Questions

Is 200K Enough To Invest?

200k is definitely enough money to invest. In fact, many investing ideas only require $10 to start, so this amount of money is more than enough to start investing to build wealth.

What's The Best Way To Invest 200K For Passive Income?

Investing in securities like dividend-paying stocks and ETFs is one method to invest 200k to earn passive income. Real estate investing companies like Fundrise are also very passive options.

What's The Best Way To Invest 200K For The Short-Term?

Short-term investments should generally be safer, more conservative investments as you might have to sell your investments to use the money in the near future. This is why many people invest in things like bonds, CDs, or even park cash in a high-interest savings account.

Extra Reading – How To Double $50,000.

Final Thoughts

I hope our guide on how to invest 200k helps you come up with a strategy to put your capital to work for you!

As mentioned, don't hesitate to seek professional finance help by speaking to a financial advisor.

You should also do your due diligence and read as much as possible about any investment idea before proceeding.

Best of luck with your investing journey!

Looking for other money-making ideas? Checkout: