How To Invest 150K – 9 Realistic Methods To Try

Maybe you've been saving up for a while and you're wondering how to invest 150k. Or, perhaps you've had a windfall of cash and are looking to put your money to work.

Whatever the case, there are so many ways to invest $150,000 these days thanks to technology.

Some of the options are more traditional investments while others involve alternative asset classes or even online businesses. But if you're wondering how to invest 150k to start earning passive income, this is the post for you.

The Best Ways To Invest 150K

Before we dive into the best ways to invest 150k, it's important to determine a few things:

- Investing Goals: What sorts of returns are you looking for with your investments?

- Timeframe: How many years do you have to put your money to work before you need it for a major purchase or retirement?

- Risk Tolerance: Do you want safer investing ideas, or are you comfortable with taking on more risk for higher growth potential?

These factors ultimately help you decide which types of investments are right for you.

Note: I'm not a financial advisor, so you can also consider seeking professional help from an advisor. You should also do your own research, due diligence, and know the risks of investing in various asset classes before making a decision.

1. Income-Generating Real Estate

One of the most popular ways for investing $150k is to invest in income-generating real estate.

In some markets, $150,000 is enough for a down payment on a rental unit. So, you can always consider going the landlord route or buy a duplex and rent out one of the units for some house-hacking action.

But if you don't want to actually become a landlord, you still have options.

With real-estate investing platforms, you can invest in income-generating real estate like multifamily homes, office buildings, and other commercial real estate developments.

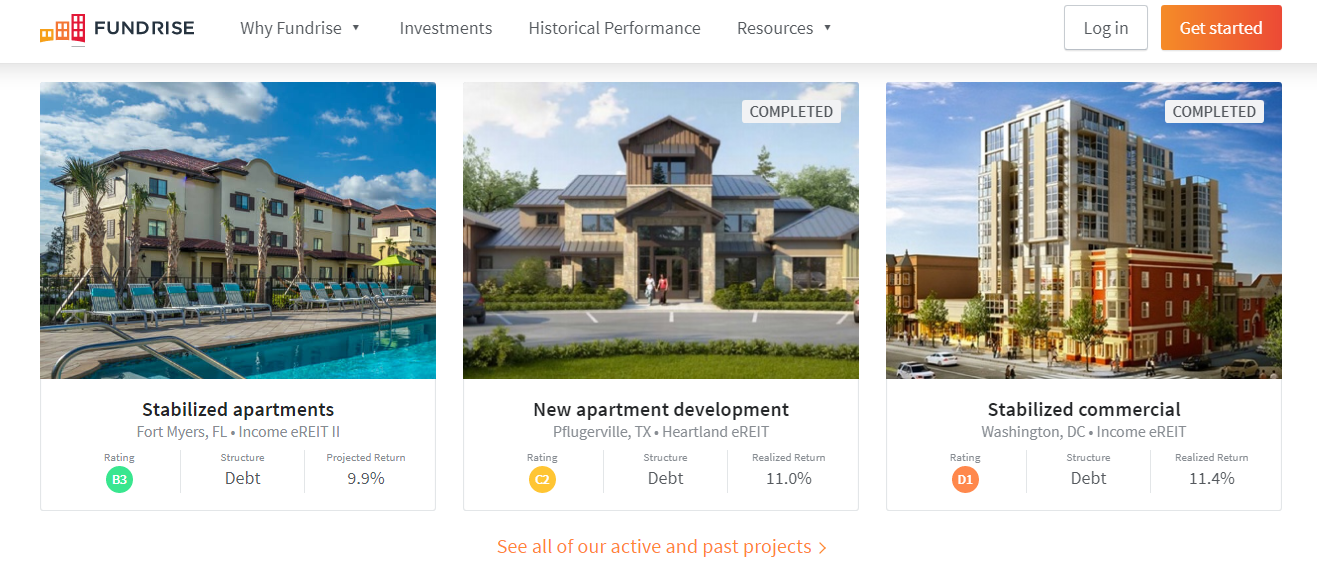

Companies like Fundrise are popular in this space, and you can start investing with just $10 to begin building wealth.

Fundrise pays investors with quarterly dividends, and historically, it's returned around 8-9% annually.

Fundrise pays investors with quarterly dividends, and historically, it's returned around 8-9% annually.

There's a 1% annual management fee, and Fundrise invests in a variety of properties and deals so you can diversify your portfolio. And, Fundrise also has a secondary marketplace where you can sell shares which helps with liquidity.

Fundrise is just one example. Companies like RealtyMogul and EquityMultiple have even more commercial real estate opportunities, although each requires $5,000 to start investing.

In any case, all three companies are ways to invest $150,000 and add income-generating real estate to your portfolio.

Disclaimer: This is an endorsement in partnership with Fundrise. We earn a commission from partner links. All opinions are my own.

2. Stocks & ETFs

If you want another straightforward option for investing $150,000 dollars, you can always invest in stocks and ETFs.

ETF investing is mostly how I invest since it's quite hands-off and is a popular long-term investing strategy.

But you can also look into dividend-paying stocks, growth stocks, or any individual stock in a company that's publicly traded that you're interested in.

Choosing specific securities to invest in is ultimately up to you. This is why some people use stock advisor services like The Motley Fool or stick with ETFs so you get more diversification.

As for how you actually start investing, there are numerous options.

Many people just invest in a brokerage account their bank offers, and this is what I do with TD.

You can also use commission-free brokers like M1 that let you invest in stocks and ETFs without paying high fees.

Ultimately, stocks and ETFs are a popular long-term investment choice for good reason.

And if you invest in dividend-paying assets, you can even create a new income stream and make money on autopilot.

3. Use A Robo-Advisor

One of the most popular investing trends these days is to invest with a robo-advisor.

A robo-advisor is like an automated financial planner. In other words, it helps you choose investments that match your overall goals and level of risk tolerance.

People like robo-advisors because they're easy to use and also more affordable than traditional financial planners.

Betterment is one of the most popular robo-advisors out there, and it's an excellent way to invest $150,000.

There are two different plans as well with different price-points:

- Digital Investing ($0 to $99,999): Pay 0.25% annually.

- Premium Investing ($100,000+): Pay 0.40% annually and get access to human financial advisors as well.

Betterment also provides automatic rebalancing, dividend reinvesting, and strategies like tax-loss harvesting to optimize your portfolio.

The fact you can start with $0 is also beginner-friendly, and with $150,000 dollars, you can unlock the Premium Investing side of the platform.

For keeping your investing plans on autopilot, this is definitely one of the better options.

4. Your IRA

Investing in tax-advantaged accounts like a Traditional or Roth IRA is a great way to save for retirement.

So, if you're trying to invest 150k and want to put some of that money to work for your future, an IRA is definitely a good call.

Many people invest in stocks and ETFs within their IRA account just to take advantage of tax benefits.

And these days, numerous self-directed IRA companies let you invest in alternative assets as well.

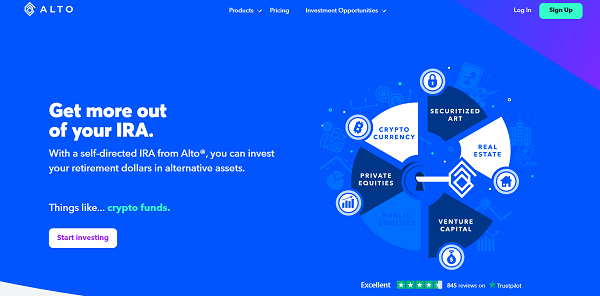

For example, Alto lets you invest in 75+ different alternative assets within your IRA.

Examples of asset classes you can invest in include:

- Artwork

- Crypto

- Debt

- Energy

- Fine wine

- Private equity

- Real estate

- Start-ups

The crypto-side of the company is quite cool, and Alto CryptoIRA supports 150+ digital assets you can invest in.

Investing $150,000 purely into alternative assets can be risky since many of these asset classes are more volatile.

But if you want to add some diversification and take advantage of tax benefits, companies like Alto are a great starting point.

5. Small Businesses

Have you ever seen Shark Tank? Or have you ever thought about investing in small businesses to help them grow?

Well, another way to invest $150k is to help fund small businesses.

Historically, people have done this by acting as venture capitalists and funding businesses in exchange for equity. That's the Shark Tank model.

But these days, you have plenty of other options at your disposal, so you don't need to have a professional network with these sorts of opportunities.

For example, Mainvest lets you invest in growing U.S. businesses starting with just $100.

When you invest, you're debt-investing, and the businesses owe you a certain multiple back within a designated time frame.

Mainvest targets 10-25% returns for investors, and the maturation period for loans is normally a few years.

What's nice about Mainvest is that you can invest in numerous businesses like:

- Cafes

- Bars

- Breweries

- Bakeries

- Food trucks

- Restaurants

- Real estate developments

Mainvest only accepts around 5% of applicants as well, so many of the businesses are growing and profitable already but need funding to expand.

Investing in small businesses carries risk since businesses can go bankrupt. In this case, it's highly unlikely you can get all your money back.

However, Mainvest has plenty of documents to help you with the due diligence process. And this is definitely an exciting option for investing 150k that can also make a difference.

6. Cryptocurrency

Investing in digital assets has been all the rage the past few years. And even though crypto markets are dipping hard at the time of writing, you can consider adding some crypto to your portfolio for diversification.

A simple way to dabble in crypto is to use an exchange like Coinbase to buy different assets.

Coinbase lets you start trading with just $2. You can also stake different cryptos to earn up to 5% APY.

For example, I'm using Nexo, a popular crypto interest account, to earn daily passive income on some Cardano I own.

Nexo pays me about 7% APY on my Cardano, but it pays 15% or more on certain tokens.

I like Nexo because you don't have to lock-in your crypto either and it pays out interest daily.

Of course, crypto investing is volatile and carries risks. But you can use a portion of the $150,000 investment to diversify in digital assets.

7. Index Funds

Index funds are funds that are comprised of assets to match an underlying market index. For example, people can invest in index funds that mirror the S&P 500 or Nasdaq.

The advantage of index funds is that you get a lot of diversification. If you don't want to pick your own stocks and keep things simple, they're an appealing option.

Fees for index funds are generally lower than actively managed funds and things like mutual funds, so you save money in the long-run.

This might not be the most exciting way to invest $150k, but it's a proven strategy that's great for long-term investors.

8. An Online Business

If you're still wondering how to invest $150,000, you can always consider buying a profitable online business.

People do this all the time by purchasing ecommerce stores or even blogs from other people.

In fact, I've had numerous offers for WebMonkey in the past four years.

Marketplaces like Flippa are incredibly popular for this, and you can find a range of ecommerce stores and blogs for sale.

So, with $150,000, you could probably buy a business making $6,000 in average monthly profit on the high-end.

Of course, a lot of factors go into valuing an online business. Seasonality, traffic and revenue growth direction, and market risks all playa role.

But if you want to branch into online business, you could use your investment as capital to acquire an existing one. Just note: I recommend having some experience in running an online business before investing in one as an owner.

Extra Reading – How To Make $100K A Month.

9. Fixed-Income Investments

One final way to invest $150,000 dollars is to turn to fixed-income investments.

The advantage of fixed-income investments is that they, well, provide stable and predictable income.

The trade-off is that returns are normally lower than stocks, ETFs, and real estate on average because of the added security.

Examples of popular fixed-income investments you can consider include:

- Corporate and government bonds

- Certificates of deposits (CDs)

- Preferred shares

- Treasury bonds and bills

Some people also treat high-yield savings accounts similarly and park extra cash there to at least earn something.

These are viable vehicles to invest $150,000. However, be careful with low returns from fixed-income investments during periods of high inflation.

Frequently Asked Questions

What's The Most Passive Way To Invest $150,000?

Options like real estate investing with Fundrise or robo-advisors like Betterment are completely passive. Investing in stocks and ETFs can also be passive, but you have to do upfront research to find the right companies or funds.

How Can I Invest 150K To Generate Income?

Investing in dividend-paying stocks or assets like real estate that produce cash flow are examples of investing for income generation. Some people even invest all of their money this way and try to live off of dividend income or other sources from their investment portfolio.

Final Thoughts

I hope this guide for how to invest 150k helps you decide on how you can make your money work for you.

There are so many options out there these days because of technology. And nothing stops you from trying several ideas so you're not putting all your eggs in one basket.

Just remember: you can seek professional financial advice as well, and always do your own research and due diligence.

Best of luck!

Looking for more wealth-building ideas? Checkout: