How Does Chime MyPay Work? – Chime MyPay Review

If you’re like many Americans who are living paycheck to paycheck, chances are there are some weeks that you just fall short on funds. Whether it’s being able to pay rent, emergency medical bills or an unplanned car repair, sometimes you just need money right now.

Fortunately, solutions like Chime MyPay can potentially help you out. This new feature from Chime lets you borrow up to $500 against upcoming pay. And you don't have to worry about a credit check or interest payments.

This guide is covering how Chime MyPay works, its fees, and how it stacks up against the competition so you can make the right choice.

Want more fast money ideas? Checkout:

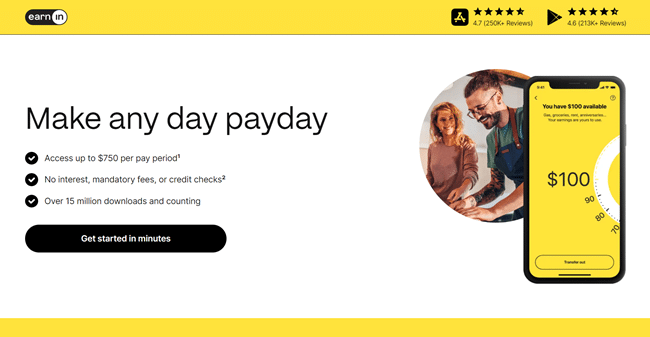

- EarnIn: Borrow up to $750 against an upcoming paycheck!

- TurboDebt: Get quick debt relief help if you have $10,000+ in debt!

What Is Chime MyPay & How Does It Work?

Chime is a user-friendly, low-fee banking solution that's best known for its checking and savings account. And it recently released Chime MyPay, it's cash advance feature, to thousands of members in dozens of different states.

Chime MyPay lets you borrow up to $500 against future pay. There's aren't mandatory fees, interest charges, or a credit check requirement. And this is a useful tool to get quick money if you're in a financial pinch.

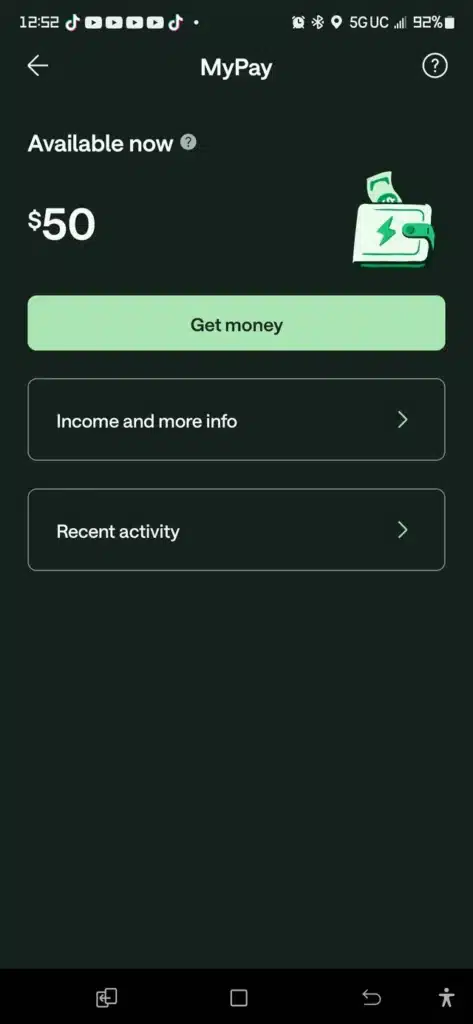

How much you can borrow depends on your income and banking history. Chime says most members start with credit limits between $50 to $100. But limits can increase as soon as your next pay cycle and over time.

If you've used apps like EarnIn or Dave, then Chime MyPay should feel pretty familiar. And we like this feature because it advances money without fees in as little as 24 hours. Alternatively, you can pay a flat $2 fee for an instant advance.

What Are Chime MyPay's Requirements?

In order to join Chime MyPay, you have to be 18 or older and live in a state where Chime MyPay is currently available. You also need an active Chime checking account since this is where MyPay funds deposit.

Additionally, Chime MyPay requires earning a certain amount per month in direct deposits. This is how Chime determines how much you can advance. Currently, you must have:

- At least two qualifying deposits of $200 or more per deposit within the last 34 days

- One qualifying deposit of $200 or more plus additional information like your work email address during enrollment

- One qualifying deposit of $200 or more per deposit in the last 34 days from a government benefits payer

These are fairly lenient requirements. And Chime MyPay, alongside apps like Cleo, is one of the few advance apps that also accept benefits payments. And if you're a gig worker or have lower income, you can still qualify for MyPay.

Note that MyPay isn't available in these states currently: CO, CT, GA, HI, IL, MA, MD, ME, MN, MT, NJ, NM, NV, SD, VT, WA, WI, or WY. However, Chime is working to expand this feature.

Chime MyPay Fees & Deposit Times

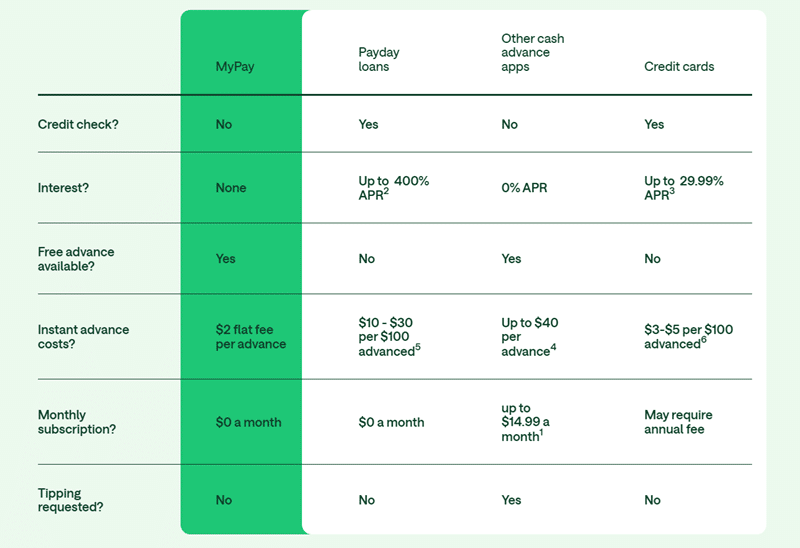

Chime MyPay doesn't charge interest or mandatory fees. There's no membership fee either, and Chime doesn't ask for tips like other cash advance eithers. Instead, it charges a flat $2 fee for instant advances but offers free advances if you wait about 24 hours.

Other apps like Super.com, Brigit, and Empower all charge monthly fees. And similar apps like EarnIn don't have mandatory fees but still ask for tips.

This low-fee structure is our favorite aspect of Chime MyPay. However, you have to be an existing Chime customer, so this is part of the deal.

What Other Features Does Chime Offer Members?

Some of Chime's other notable features and perks include:

- Early Pay Direct Deposit: Get your paycheck up to two days early with this Chime account feature.

- Free ATM Network: Avoid paying ATM fees with a network of more than 60,000 fee free ATMs.

- Easy Cash Deposits: Chime users can make cash deposits at more than 75,000 locations, including CVS and Walmart.

- SpotMe: Want to prevent overdrafts? This special Chime feature allows users to overdraw their account up to $200. You need to pay this amount back from your next pay deposit; however, it can be helpful in emergencies and saves you money on overdraft fees.

- Secured Chime Credit Card: Looking to build your credit? Chime can help you move money from your Chime account to a secured credit card. Credit payments are reported to the credit bureaus, so using this card and making on-time payments can help you improve your credit score.

If you're tired of bank fees and are looking for an easy-to-use online solution, Chime could be for you. Although we prefer Current for banking needs since it also has cash advances but also has a nice $50 sign up bonus and pays 4% APY on savings.

The Best Passive Income Ideas For Beginners.

How Does Chime MyPay Compare to the Competition?

Chime MyPay is an affordable option for fee-free cash advances, but it does require users to have a Chime bank account. Plus, there are plenty of other powerful advance apps you can consider as well.

Some of our favorite alternatives to Chime MyPay include:

- EarnIn (best overall)

- Cleo (best for gig workers)

- Dave (best for side hustlers)

- Klover (best for low-income users)

- Current (best for banking)

- Possible Finance (best for flexible repayments)

- Brigit (best for building credit)

- Beem (best for discounts and perks)

EarnIn is our top pick overall. But MyPay is very competitive due to its low fees and lenient requirements.

Check out our guide on the top cash advance apps that work with Chime for some alternatives.

The Best $100 Loan Instant Apps.

What Happened to Chime My Paycheck?

Chime MyPaycheck is being discontinued and replaced by Chime MyPay. You can check your app and join a waitlist to access MyPay or learn when this feature becomes available in your state.

How To Get Started With Chime

Ready to get started with Chime MyPay? Here’s how to request your first cash advance, assuming you have an active checking account and are eligible for MyPay:

- Login to your Chime account and see how much cash is available to you via MyPay.

- Choose how much cash you need.

- Scheduled the advance. Money is typically deposited into your Chime account within 24 hours for free, but if you need the money sooner, you can pay a rush fee of just $2 per advance.

Your cash advance (along with any rush fees) will be deducted from your Chime account after your next direct deposit. Users who repay their loans promptly may qualify for larger amounts in the future.

Also remember: most users don't qualify for the full $500 limit, so you might see $20 to $100 or some lower amount as your first advance limit.

Is Chime MyPay Worth It?

Chime MyPay is worth it if you're a Chime customer and need some quick cash to cover bills and other expenses. And this cash advance feature is competitive enough to warrant signing up for Chime already if you're not a customer.

In contrast, Chime MyPay isn't worth it if you don't want to open a Chime checking account. And it's not a long-term financial solution either.

Pay advances are never a long-term solution. Howeve,r they can be helpful during the occasional financial emergency. Chime MyPay gives users an easy way to access a portion of their pay early without high fees or credit dings.

Hopefully, our Chime MyPay review helps you decide if this feature is right for you.

Want more quick money wins? Checkout:

- The Top $25 Cash Advance Apps.

- Oasis Cash Advance Review – Is It Worth It?

- The Best Free Money Making Apps.

- How To Make $500 A Day.

Chime MyPay Disclaimers:

MyPay™ line of credit provided by The Bancorp Bank, N.A. or Stride Bank, N.A. MyPay services

provided by Chime Capital, LLC (NMLS 2316451).

To be eligible for MyPay, you must receive Qualifying MyPay Direct Deposits to your Chime Checking Account as set forth in the MyPay Agreement. A Qualifying MyPay Direct Deposit is a deposit from an employer, payroll provider, gig economy payer, government benefits payer, or other permitted source of income by Automated Clearing House (“ACH”) or Original Credit Transaction (“OCT”). Your MyPay Credit Limit and Available Advance Amount may change at any time. MyPay is a line of credit and available limits are based on estimated income and risk-based criteria. Eligible members may be offered a $20 – $500 Credit Limit per pay period. Your Credit Limit and Maximum Available Advance will be displayed to you within the Chime app. MyPay is currently only available to eligible Chime members in certain states. Other restrictions may apply. See Bancorp MyPay Agreement or Stride MyPay Agreement for details.

Option to get funds instantly for $2 per advance or get funds for free within 2 days. See Bancorp

MyPay Agreement or Stride MyPay Agreement for details.