Empower Cash Advance Review – Is It Legit & Worth It?

Empower is a legit and popular cash advance app that lets its members borrow up to $300 instantly while also accessing a line of credit. And it's designed to help its members smooth their cash flow and make ends meet while improving their credit.

But is the Empower cash advance app worth using? And how does it compare to its competitors?

Our Empower app review is sharing how this app works, its fees, and how to decide if it's right for you.

Key Takeaways:

- Empower offers instant cash advances of $10 to $300

- Credit lines from Empower grow up to $1,000 over time

- Users access multiple repayment options for credit lines

- Empower’s automated savings feature helps build smart savings habits

Is Empower Legit?

Empower is legit and lets its members borrow up to $300 in an advance to help cover bills. The app is also highly rated on both app stores, with a 4.7 star rating on the Google Play Store and 4.8 star rating on the Apple App Store.

However, Empower also has a 1.9 star rating on Trustpilot, with many negative reviews. Many users complain that they can't access cash advances and that customer service is extremely poor.

Apps like Empower can be useful if you need to pay rent, bills, or cover sudden expenses. But when they don't actually help you advance cash, they're far less useful.

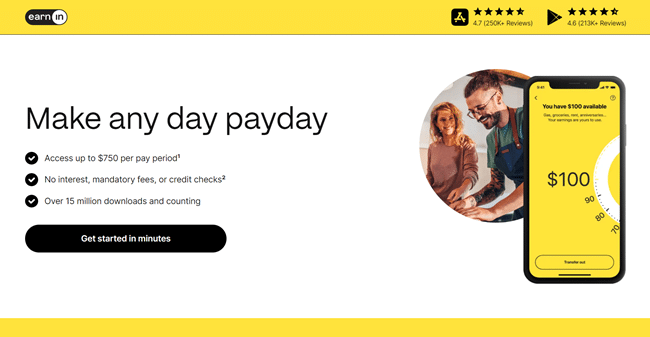

At WebMonkey, we ultimately prefer apps like EarnIn and Dave. Both have higher advance limits and also have way higher ratings on Trustpilot than Empower.

What Is The Empower App & What Does It Offer?

Empower is a financial technology company that specializes in cash advances and lines of credit. And it's not to be confused with the Empower budgeting app, which used to be called Personal Capital.

Like other apps in the space such as Cleo and Klover, Empower's goal is to help its members make it to their next paycheck. It's a way to access quick cash if you're in a pinch.

The app also has other tools to help members save money and track spending. And I'll cover its main features, as well as fees and requirements, below.

1. Empower Cash Advance

Empower's cash advance feature lets you borrow between $10 and $300. However, not all users qualify for the full $300. In fact, you'll likely qualify for far less and then have to build your advance limit over time.

Once you sign up, Empower connects to your bank account and analyzes data like your recurring bills and bank deposits. It then determines how much you're eligible to borrow based on this data, so steady paychecks and responsible spending habits can lead to a higher advance limit.

This is the same system similar apps like Super.com and Brigit use. If you don't receive steady paychecks, you likely won't qualify for an Empower cash advance.

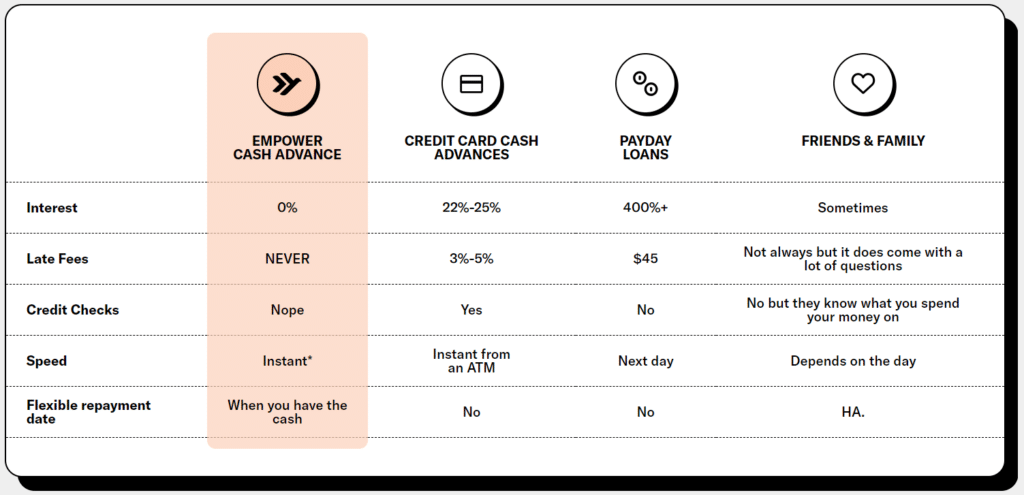

But if you do qualify, it's a useful tool. Cash advances from Empower have no interest, late fees, or credit checks. In most cases, you get your cash advance within 15 minutes of requesting it.

Empower sets a repayment date, which you agree to when you accept your cash advance. When that date arrives, Empower automatically withdraws the amount of your cash advance from your linked bank account to pay it back. You can use the app to reschedule your repayment date if needed.

You may get an overdraft fee from your bank if you don’t have enough money in your account to cover your cash advance on your scheduled payment date. Fortunately, Empower reimburses your overdraft fee if you show customer support evidence of the fee being charged.

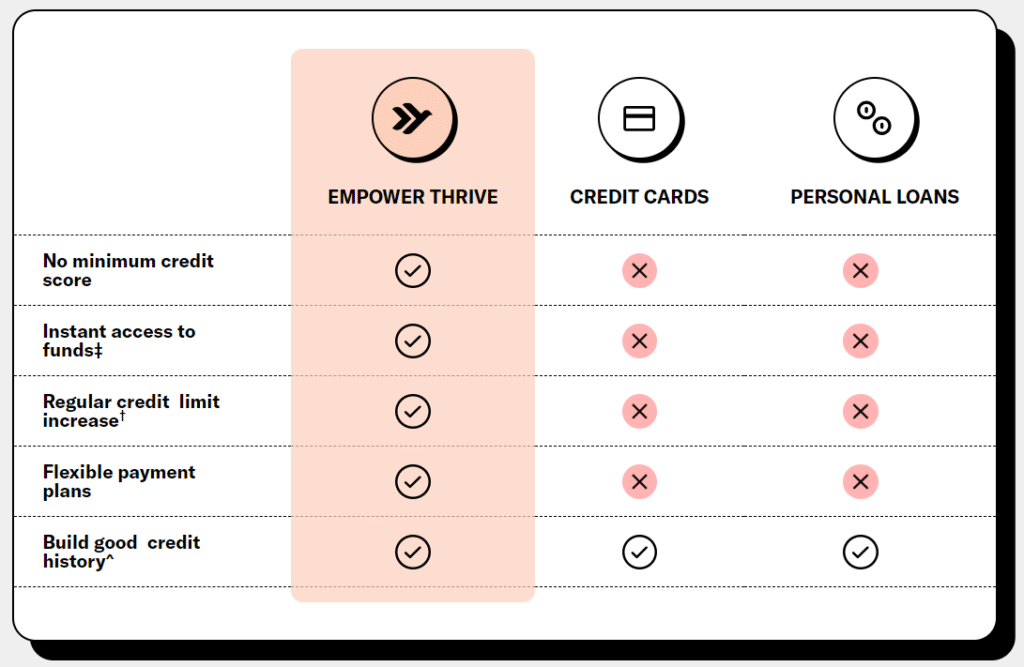

2. Empower Thrive

Empower Thrive provides instant access to a credit limit of $200 to $400. And members can increase this limit to up to $1,000 over time by making on-time payments.

Unlike many other lines of credit and credit cards, you don’t need a specific credit score to qualify for a Thrive line of credit. You can apply for Thrive in just a few minutes using the Empower app.

As you continue borrowing and paying off your credit line in time, you can build credit through Thrive. Empower regularly reports your activity to major credit bureaus, so you can see a boost to your credit over time by making on-time payments.

Note that you can’t use Thrive when you have a current cash advance, so you won’t see the option available in the app until you pay off your cash advance. This is to prevent users from over-borrowing money.

3. Automatic Saving & Budgeting Tools

Put your savings on autopilot with the Empower app’s automatic savings feature, which helps you save without thinking about it.

Empower learns your spending activities through your linked bank account and suggests a manageable savings goal for you. You’re free to adjust that suggestion or skip auto-savings altogether. If you select auto-save, Empower automatically transfers the amount you want on your preferred schedule to your savings account, which you can also open through Empower.

You can also access simple budgeting tools through Empower. See where you’re spending the most money, customize spending categories, and set limits for yourself within each category.

If budgeting is your main goal, apps like Rocket Money or YNAB are far better choices. But it's nice that Empower has some built-in tools to encourage saving.

The Best Reward Apps To Save & Earn.

Empower Cash Advance Requirements & Eligibility

There are several requirements to take out an Empower cash advance and become a member, including:

- Being 18 or older

- Having a U.S. bank account

- Having a valid Social Security Number

- Having a mobile phone that can receive SMS messages

As mentioned, you also need regular income from paychecks coming into your linked bank account for Empower to grant you a cash advance. This means irregular income from gig work, social benefits, or occasional cash transfers doesn't qualify.

If you don't qualify for Empower, we suggest trying Cleo since it has more lenient requirements. You can always check your status for a cash advance by clicking the “Check eligibility now” link in the app.

How Much Does Empower Cost?

Empower offers a free 14-day trial for new customers who haven’t used the app before. After the trial, a subscription costs $8 per month, which gives you access to an Empower loan, automatic savings, and a Thrive credit line.

Empower also charges additional fees for instant deliveries of a cash advance, based on the amount of your cash advance, from $1 to $8. However, advances often deliver within a day without extra charges.

Overall, paying $8 per month for this kind of advance is likely cheaper than turning to your credit card or payday loans. However, apps like EarnIn don't charge mandatory fees and have a higher advance limit. And Dave's membership cost is only $1 per month; way lower than Empower's fees.

How Does The Empower App Work? Here’s How to Get Started

Ready to see what Empower is all about? Here’s what to do to get started.

- Download the Empower app from the App Store or Google Play.

- Fill out your information to create an account.

- Connect your bank account using Plaid. Empower connects to U.S. financial institutions. If you can’t find your bank in the list, use the search bar to locate it.

- Enter your bank account’s login credentials to connect to your account.

- The Empower app will show you the amount of the cash advance you qualify for instantly after connecting your account, from $10 to $300.

- If you’re eligible for a cash advance, you can request one immediately.

- Review the details of the cash advance offer from Empower, including the amount of the advance and the repayment date.

- Accept your offer and wait for your cash advance to arrive. In most cases, you’ll see your advance reach your bank account within 15 minutes.

The Best Free Real Money Apps That Pay Instantly.

Pros & Cons

Pros:

- Empower is easy to use

- There's a 14-day free trial

- Cash advances don't charge interest or late fees

- No credit check requirement

- You can use Empower Thrive to potentially build credit and access up to $1,000

Cons:

- Empower has a high monthly membership cost

- Lower cash advance limit than many competitors

- Negative reviews complain about slow customer service and random charges

- Customers can't use Empower Thrive and its cash advance feature at the same time

The Best Apps Like Empower For Cash Advances

Empower is a popular advancing app, but we think it falls short due to monthly fees and many negative reviews.

Some of the best apps like Empower you can use instead include:

- EarnIn (best overall)

- Current (best bank with advances)

- Dave (best for side hustlers)

- Super.com (best for cash-back deals)

- Cleo (best for gig workers)

- Brigit (best for building credit)

- Yendo (best for credit lines)

- Chime MyPay (best for low fees)

- Varo (best bank rewards)

- Albert (best for financial advice)

Of course, you can always turn to other options, like asking friends and family to spot you. Alternatively, you can try various side hustles that pay daily for some fast cash.

The Best $200 Cash Advance Apps.

Other Empower Cash Advance Reviews From Customers

Empower has mixed reviews from customers. As of this writing, Empower’s rating on Trustpilot is 1.9 of 5 stars, although less than 30 people have left reviews or ratings. On the Better Business Bureau, Empower has a 1.07 rating out of 5 stars from a couple of dozen customer reviews. While these ratings are low, it’s important to remember that there aren’t many reviews of Empower yet on these platforms.

As for the positives, several users like that Empower gives them a little bit of cushion between paychecks, allowing them to quickly and easily get small cash advances to cover a bill or two until they get paid again. Many users admit that the process is incredibly easy and like that they can grow their cash advance amounts over time.

The negative ratings mostly center on miscellaneous fees charged by Empower and difficulty finding out what the charges are for. Some customers have also mentioned getting their cash advances deducted from their bank accounts on dates they didn’t originally agree to, leaving them to face overdrafts with their banks. Other complaints are regarding the $8/month subscription fee, which some believe is higher than necessary for Empower’s services, and the lack of customer support.

The Highest Paying Apps To Try This Month.

Is The Empower App Safe?

Yes, Empower is safe to use. The Empower app uses 256-bit SSL end-to-end encryption to secure your data, plus other security features like Touch ID and multi-factor authentication, to keep your information safe. It also uses Plaid, a trusted and secure fintech company, to connect your bank account without holding onto any of your account data.

Is There Customer Service?

Yes, Empower has a customer service team, but some customers note that it’s difficult to get a hold of someone quickly when needed. To contact Empower customer service, email [email protected] at any time or call (888) 943-8967 from 6 AM to 3 PM Pacific time, Monday through Friday, excluding holidays.

Is Empower Worth It?

Empower cash advance is worth it if you need a quick solution to borrow money and don't want to turn to a personal loan or your credit card. However, it has a steep monthly fee. And we think there are plenty of better alternatives like EarnIn or Cleo that you should try first.

Additionally, Empower won't work if you don't have steady income. Once again, in this case, something like Cleo or Klover might be the better choice.

Hopefully, our Empower review helps you decide if this popular app belongs on your smartphone!

Want even more money-making guides? Checkout:

Empower Cash Advance Review

Name: Empower

Description: Empower is a leading cash advance app that lets members borrow up to $300. It also provides access to a line of credit.

Operating System: Android, iOS

Application Category: Cash Advance Apps

Author: Tom Blake

-

Cash Advance Limit

-

Requirements

-

Fees

-

Ease-Of-Use