Earny Review – Is This Money Saving App Worth The Price?

Did you know that according to some estimates, 95% of all purchases will be made online by the year 2040?

Ecommerce is a growing, convenient beast. It doesn't matter if you do nearly all of your shopping online or prefer traditional retail stores, there's no denying that online shopping will continue to be a growing trend.

Since we're entering Black Friday and the Christmas shopping season, I decided to spin up a quick post on the number one price protection app there is: Earny.

I've already written a post on the best money saving browser extensions to help prepare online shoppers for the next few months of madness.

However, I wanted to write an individual Earny review to tackle this price protection system independently given its popularity and relevance for this time of year.

I also wanted to write this review because I think there are way better Earny alternatives out there for most users, and I think the majority of shoppers should steer clear of this money saving platform (more on the reasons why and some great alternatives near the end of this post).

What Is Earny?

These days, many major brands and credit card companies have policies in place that offer consumers price protection guarantees.

Essentially, price protection safeguards consumers from unfairly losing out on significant price drops within a given amount of time. Generally, price protection lasts between 30-60 days for most purchases.

So, as a consumer: let's say you buy a pair of sneakers for $100 with your credit card, only to find out that that same pair of sneakers went on sale three weeks later for $60. If you shop with a popular credit card that offers price protection, you can usually open a claim and receive the difference in price to save some money.

Now, since securing price protection savings requires time and the awareness of price drops in the first place, automating this process is definitely the way to go these days.

That's where popular platforms like the Earny app have found their place in the market.

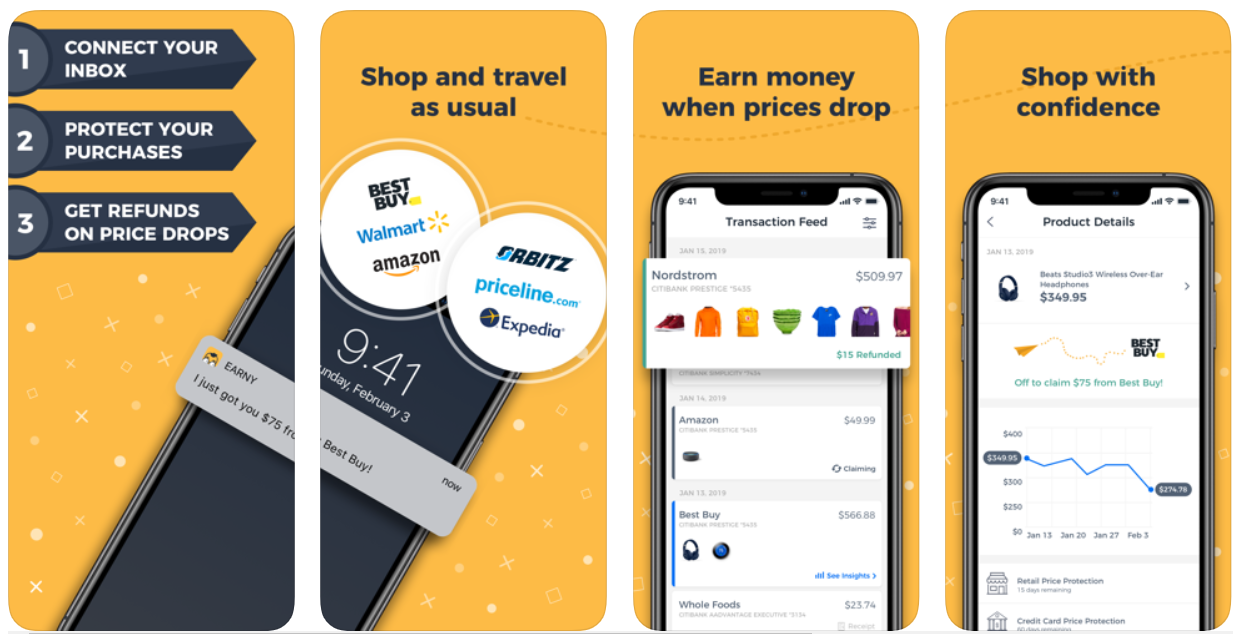

How Does Earny Work?

Earny is very similar to price protection apps like Parbius.

Essentially, Earny connects to the inbox where you receive the majority of your online sales receipts and automatically monitors your purchases for price drops.

If Earny can find lower deals and your price protection claim is successful, you end up saving money without having to do a thing.

Since people obviously love free money and easy savings, it's isn't surprising that Earny has over 3 million users and has allegedly found savings on more than 85 million purchases, resulting in ‘billions in protected purchases.'

Sounds good so far, but what exactly does Earny cover?

Earny Partner Retailers

Currently, Earny tracks items purchased from the following retailers according to the Earny support page:

- Best Buy.

- Bloomingdale's.

- Costco.

- The Gap Group.

- Banana Republic.

- Old Navy.

- Athleta.

- JCrew.

- Jet.

- Kohl's.

- Macy's.

- Newegg.

- Nike.

- Nordstrom.

- Overstock.

- Sears.

- Target.

- Walmart.

- Zappos.

- Home Depot.

Earny states they are continually working to update their list of partners, but this is the most recent data provided in July 2019.

Credit Card Price Protection

If you enable Earny credit card protection (which involves connecting your credit card to the app), Earny will also be able to monitor your Amazon purchases to watch for price drops.

Many popular credit cards can offer up to 90 or even 120 days of price protection for their users, and the process of connecting your credit cards to Earny is straightforward: simply find your specific card and bank and enter the your credentials into the app.

Currently, Earny works with all Citibank cards and all Mastercards.

Earny also offers support for the following banks and cards:

- Bank of America.

- US Bank.

- Capital One.

- Barclays.

- First Premier Bank.

- USAA.

- Wells Fargo.

- Fifth Third Bank.

- Chase.

- Visa.

- Discover.

Even if your specific credit card isn't listed on Earny's app or website, you can most likely connect you card through the Mastercard section.

Just note that many Mastercards have a limit of 4 price protection claims per year.

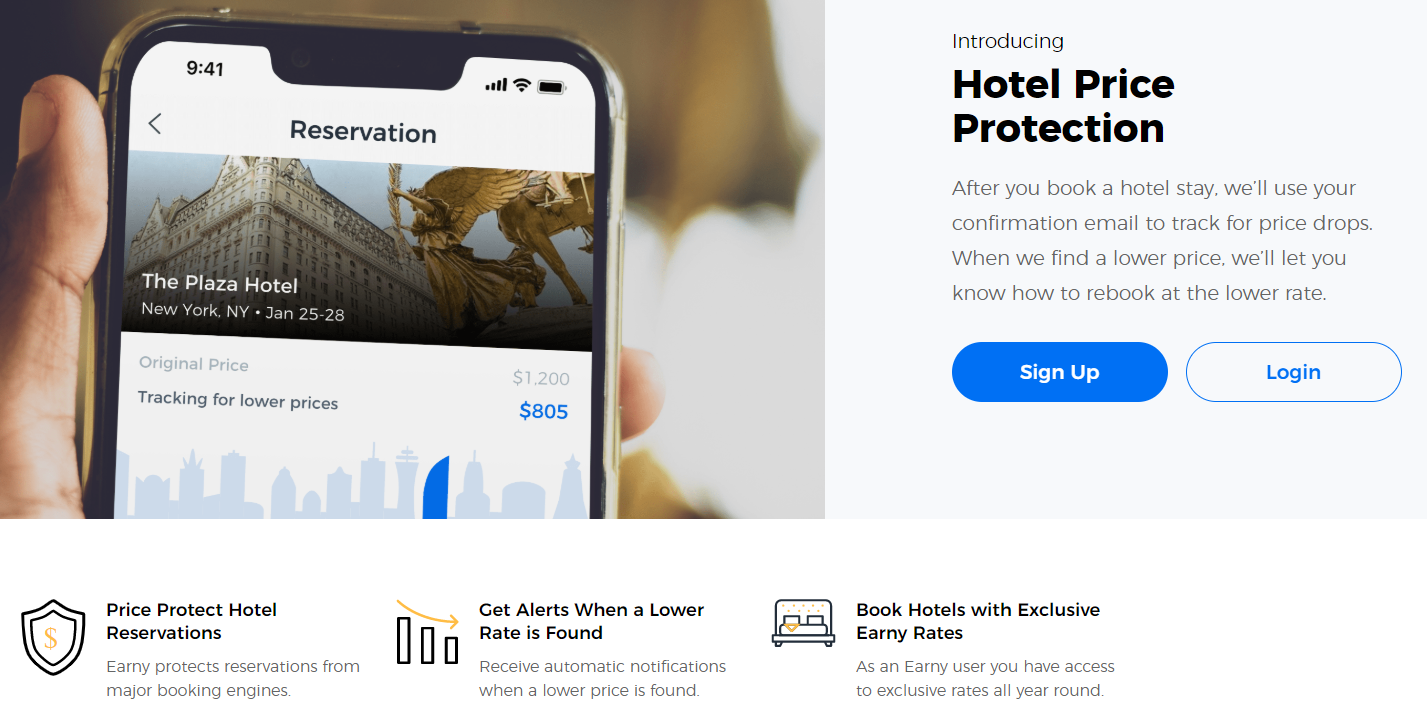

Earny Hotel Savings & Deals

Finally, Earny can also monitor hotel confirmations and help users rebook their stays in lower rates become available. Earny scans many major hotel booking sites and engines, enabling their system to find the best current rates.

Earny also states that their members can enjoy “access to exclusive rates all year round,” but their hotel search engine is just powered by Priceline, so this isn't anything special or exclusive in reality.

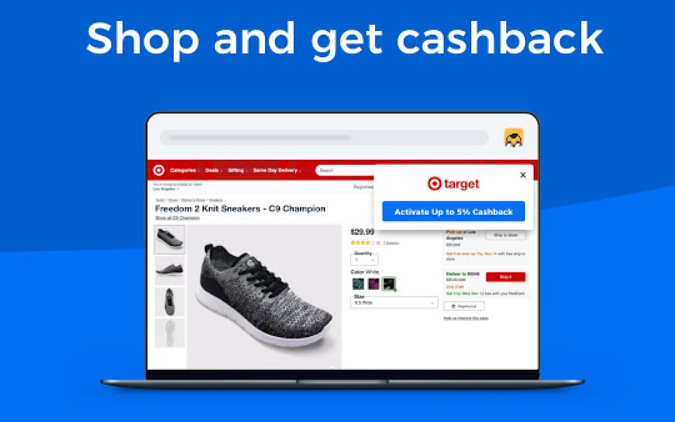

Earning Cash Back

Earny has recently put out an update that allows their users to earn cash back by shopping through the Earny app or browser extension.

I've covered different money saving browser extensions before and use several myself, so it's nice that Earny has at least added this new feature to their platform to allow users to save more money.

Earny Pricing & Signing Up

Unlike other price protection platforms, Earny is not free.

However, I have to admit, I'm a little confused about Earny's pricing model. When I signed up for Earny and also did some searching around the web, I found a slew of different information regarding how much Earny costs.

Signing up for Earny is free and fast. All you have to do is connect your inbox to the platform and create an account and boom, you're essentially done.

However, if you want to actually save money from price protections or get nifty hotel deals, you'll have to pay.

Personally, my Earny account gives me the option to pay $1.99/month to actually start benefiting from the service.

I've seen other Earny reviews state that the cost is actually $4.99 a month or even as high as $7.99 each month.

I'm not sure if Earny somehow knows I'm a student, if this is a temporary deal, or if other reviews are simply outdated. Whatever the case, just know you'll be paying for Earny if you want to reap the possible rewards.

Getting Paid By Earny

Once you've created an Earny account, you can update your profile section to finish linking your Amazon account and to setup your payment options/link any cards you may have.

You can also setup the specific account you want your Earny savings to be deposited to. There will be a small transaction applied to your card to make sure it's legit, but this will be reversed.

How Much Can You Save With Earny?

According to Earny, their average user saves $75 by using their service (according to the homepage).

However, when I checkout my pricing plan page (screenshot above), the potential savings are listed as being in the $160+ range if you factor in hotel deals, late delivery fees (this isn't mentioned anywhere else on their website), and general price drops.

This ultimately leads me to conclude that none of these numbers are exactly trustworthy seeing as their own funnel is full of inconsistencies.

So, what do the good people of Reddit have to say?

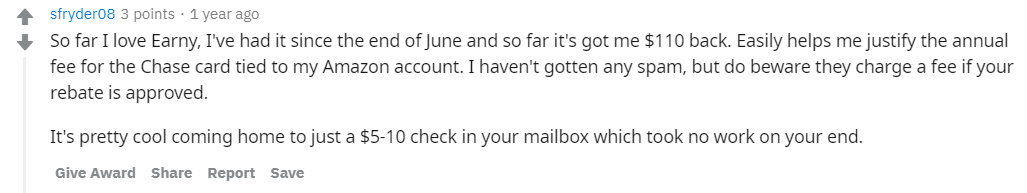

Well, it seems like Earny was a pretty decent way to save about a year ago:

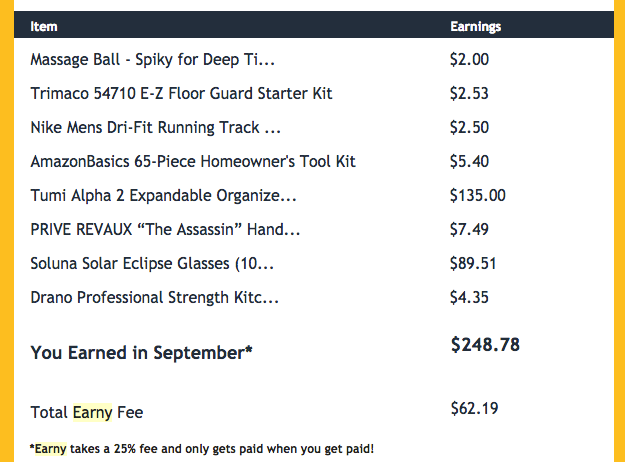

Another user also shows a screenshot of over $180 in savings (Earny used to take a 25% fee a year ago).

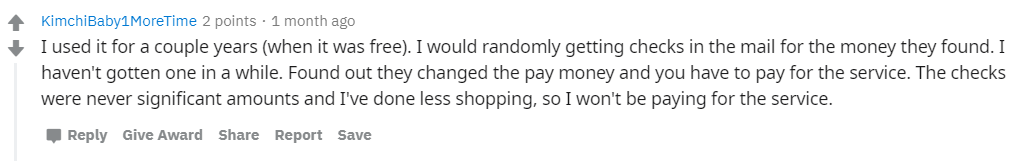

More recent Earny reviews, however, are generally quite negative.

The final comment in this particular thread also brings up a good point: cash back platforms might be more powerful.

Sure, automatic price protection is nice, but since you have to pay for a service like Earny, I would only recommend this app to someone who spends hundreds or even thousands of dollars a year on online retailers (that are also Earny partners).

If you only spend a couple hundred bucks, forget it.

Plus, many popular cash back platforms and passive income apps are also free and mostly hands-off anyway, so I personally think your time might be better spent researching these avenues.

Earny Alternatives – Paribus, Cash Back Platforms, & More

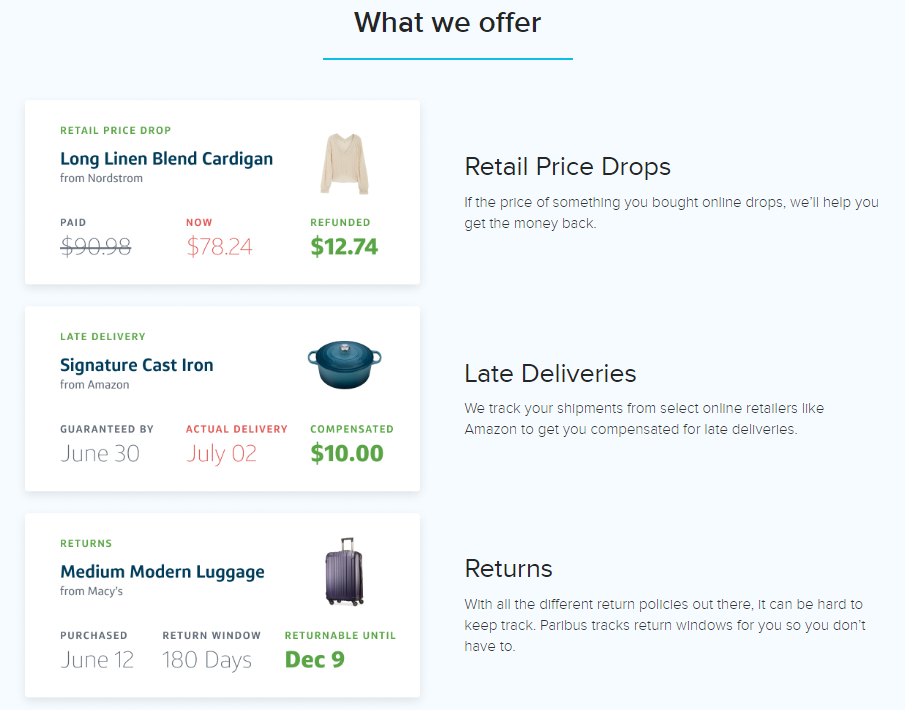

If the idea of automatically benefiting from price protection and late deliveries appeals to you, I think Paribus is better than Earny for several reasons.

Firstly, Paribus is completely free, so there's really no downside to hooking this app to your email if you aren't too worried about your personal data (more on this later).

Secondly, Paribus currently monitors 29 retailers for price drops – 9 more partners than Earny can currently offer.

I think the fact that Paribus is free and monitors more retailers makes this decision a no-brainer when it comes to the Earny vs. Paribus debate I've seen online.

In terms of other alternatives or money saving ideas, I think keeping it simple is your best friend.

You really don't need to pay anything to start saving bits of extra money every year. Other than certain credit cards that may justifiably carry fees for the benefits they provide, top-tier companies are often more interested in data collection than monthly fees.

Currently, here is my 100% free money saving regimen for getting the most out of my wallet when shopping online:

Honey – I use this free browser extension to automatically apply coupons at checkout, and have saved over $70 to date from the platform.

Rakuten – I use this free cash back portal to earn rewards for shopping at merchants like Amazon. Checkout my Rakuten review to see how I've earned around $400 with the platform.

A Cash Back Credit Card – I use a basic American Express to earn 1-2% cash back on all my purchases. I don't pay any fees for this card and even had a 6 month signup bonus that granted higher cash back amounts. Shop around for a free credit card and possible signup bonuses if you haven't incorporated cash back into your life yet!

Drop – I currently earn free Starbucks/Amazon gift cards when I spend money at Walmart, Starbucks, Uber, Shoppers Drug Mart, and the LCBO (Canada's draconian version of liquor stores, for any U.S. reader). Drop is a free app and partners with dozens of merchants, so there's plenty of ways to earn.

That's about it.

You can experiment with other free savings apps or rebate programs, but as long as you can find a few that work for you, you can easily find hundreds of dollars in savings each year.

Just think about it: a cash back credit card alone will save you 1-2% on so many purchases you make per year.

Long story short, don't waste time with Earny or other paid rebate programs unless you spend an insane amount of money online.

Final Thoughts & Privacy Concerns

At the end of the day, if you're getting something for free, you're the product.

Data collection is a massive business these days. In fact, data is now more valuable than oil for the first time in human history.

Personally, I'm alright with selling a decent amount of my user data to companies in exchange for freebies and cash. However, this is ultimately a very personal decision, and an important one.

Yes, companies like Earny are secure and legit. All these apps and services have top level encryption and amalgamate data sets/say they don't sell your personalized data.

Regardless, if you opt-in to these services, you are letting a third party company scan your personal data and transaction history. Keep this in mind when deciding if you want to use price protection services or other money saving apps.

People may recommend platforms like Earny because of juicy $15 referral bonuses.

Hell, half the reason I'm writing this post is because I found some nice keywords and also like promoting Paribus/Honey (I use them both, and they pay me up to $5 for referring people…there I said it!)

Regardless of what people say, just be smart, do your research, and find what works for you! Hopefully, this Earny review helped guide you in the right direction.

Thanks for reading! If you want to find more unique ways to save money, I suggest checking out my post on extra money saving hacks to take things one step further!