Does Instacart Track Mileage? – What Shoppers Need To Know

If you currently drive for Instacart, you probably know by now that you're on the hook for all your expenses.

It's possible to make money with Instacart every week, but, of course, you're an independent contractor.

This means that Instacart doesn't pay for gas, vehicle repairs, or your car insurance payments.

But, does Instacart track mileage? And, how should Instacart Shoppers go about tracking the miles they drive on deliveries to save as much money as possible when it comes to filing taxes.

Well, let's dive into how to track mileage for Instacart so you know exactly how many miles you're putting on your vehicle as an Instacart Shopper.

Looking for other high-paying side hustle ideas? Checkout:

- Freecash: Play games and download apps to earn gift cards and cash!

- Uber Eats: Sign up to deliver with Uber Eats and make money on your own schedule.

Does Instacart Track Mileage?

Currently, the Instacart Shopper app doesn't track the miles you drive in a single, easily readable form. However, you can look through all of your completed batches and see how many miles you drive for Instacart in total.

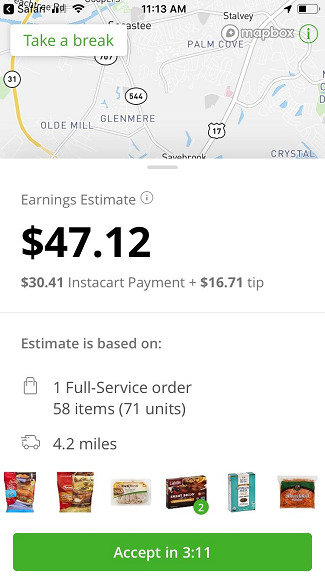

As you can see in the example above, this Instacart batch is a total of 4.2 miles, so you know approximately how far you're driving to complete this batch.

Note: Instacart only tracks the miles you drive while you're driving to the grocery store to begin shopping and the miles you drive to the customer; the miles you drive from your home to the store to begin shopping aren't included.

So, in short, Instacart doesn't track miles in an individual report, but you can calculate how much you drive for Instacart if you go through your batch history.

Why Should I Track Instacart Mileage?

There's a common misconception that Instacart pays you for mileage because how far you drive for a delivery is a factor in how much you earn per batch.

This isn't the same as getting reimbursed.

Instacart pays you for completing deliveries, which involves driving, but this isn't the same as being explicitly reimbursed for driving.

So, it's important to track your Instacart mileage, and doing so has two benefits:

- Depreciation. By tracking how much you drive, you can factor in vehicle depreciation with a vehicle depreciation calculator to get a more accurate picture of how much money you're making.

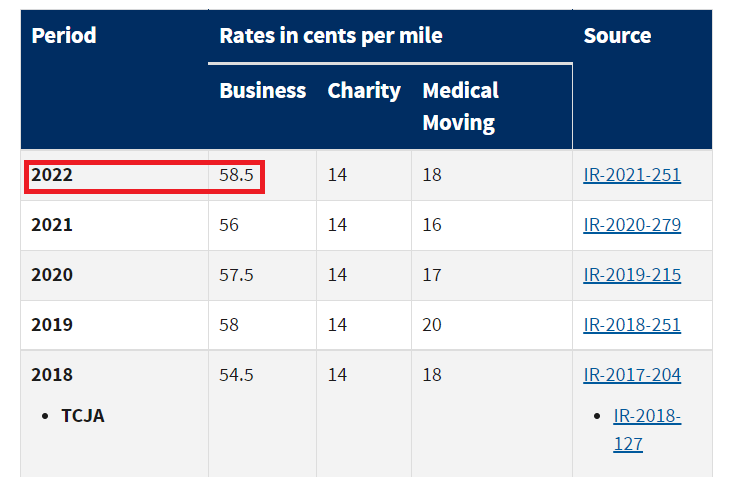

- Mileage Reimbursement. According to the IRS, the standard business mileage rate is $0.585 per mile. This means you might be able to score tax deductions depending on how much you drive for Instacart and how much money you make per year.

Even if you only drive for gig apps like Instacart or DoorDash every once in a while, it's important to track your mileage so you know how much you're driving and can potentially get a bit of a tax break.

How To Track Mileage For Instacart

There are several ways you can track Instacart mileage, and different drivers have different preferences.

In my opinion, the best solution is to use a mileage tracking app, which I'm about to cover, but here are the three main ways you can keep track of how much you drive,

1. Create A Mileage Tracking Log Book

One way to track the miles you drive for Instacart is to keep a mileage log book in your car.

In this Reddit thread, different Instacart Shoppers share their tricks for logging miles, and the log book is actually quite popular.

Here's what user AlwaysRoseGoldWings says about using a log book:

- “My husband actually logs miles, costs etc, so he has me use a mileage book. I hate the stuff but he loves it. It’s not hard to use, you just write your mileage pretty much every time you start your car (leaving house, stopping to deliver etc). It also has a long underneath the miles so I write batch payments and tips after I get home for the day. They are around $8 on amazon and last awhile. I have an old Honda Civic so there aren’t many expenses but I keep receipts of things.”

I like this idea because you can easily record your earnings at the end of a shift and you have a physical copy to hold onto for referencing.

You can also find cheap mileage log books on Amazon for under $10, so this isn't a significant upfront expense.

However, you have to make separate calculations for the miles you drive while you're not on active deliveries and the miles you drive for Instacart, so keep this in mind.

2. Use An Instacart Mileage Tracker App

One of the best ways to track your Instacart mileage is to use an Instacart mileage tracker that logs all of your mileage and earnings automatically.

There are so many driving apps that pay, so it's no surprise there's also lots of mileage tracking apps that are meant for gig economy workers.

These apps automatically track your Instacart mileage. All you have to do is download an app, go online when you're making deliveries, and the apps will track how much you're driving.

Apps like Hurdlr are a popular choice, and it can automatically track your Instacart mileage and even how much you earn as a shopper.

Another way to track Instacart mileage is to use Gridwise, a rideshare and delivery assistant app that helps you monitor your earnings and find mileage deductions and other savings.

Gridwise is actually pretty neat, and the app lets you track your mileage for each app you use. So, if you use other apps like Instacart like DoorDash or Uber Eats, you can monitor how much you drive and which app is most profitable.

What I like about Gridwise is that it also has a tax reports section that calculates how much money you can save when filing your taxes with things like mileage reimbursement.

In my opinion, using Instacart mileage tracking apps beats using a log book since you can do everything automatically.

Just note that these apps can drain your battery a bit faster, and you also want to ensure you have unlimited data or enough data to use the Instacart Shopper app while you're out on delivery.

Extra Reading – Instacart Shopper Tips To Make More Money.

3. Look Through Previous Batches

A final way to track your Instacart mileage is to look through previous batches and to manually record the miles you drive.

As mentioned, Instacart batches display how far you have to drive to complete the order. So, you could theoretically set aside time every week or month to go through old batches and jot down how much you're driving.

I like this idea the least since there's a chance you forget to do it. And besides, you're better off using a mileage log book if you want to avoid using a mileage tracking app.

How Do Other Instacart Shoppers Track Mileage?

If you look on Reddit's Instacart Shopper sub, you can see what a lot of other Instacart Shoppers do to track mileage and work as efficiently as possible.

Here's what a few real Instacart Shoppers said in a thread on mileage tracking for Instacart and various other gig economy apps:

- Fantastic_Relief says: “I use Everlance. Automatically tracks my mileage so I don't have to worry about turning it on/off. At the end of the year i can export everything to excel. Makes it easy to sort through everything and send what's relevant to my CPA.”

- Alyssa_Hargreaves says: “I use stride. It seems to work fine but I tend to forget to shut it off so it gets stupid.”

- Head-Berracuda1038 says: “TurboTax self employed has been so great! I use it every year and it’s been fantastic. I can label my trips for other gigs and add all of my expenses right there in app. It’s beautifully incorporated. I’ll review it once a month when my phone bill hits and then forget about it.”

As you can see, using mileage tracking apps is definitely a popular option, and you have lots of options available!

However, notice how one Instacart Shopper mentions that they still use a CPA to help file their taxes. And you can do the same thing or use soft taxware like Turbo Tax to handle your gig economy earnings.

Everlance also has a helpful video on how to properly file your taxes and deal with your mileage in this YouTube video:

I recommend watching this video and doing some reading on this subject, especially if you're going to drive a lot for Instacart.

In this video, the Everland host states that some Instacart Shoppers can drop their taxable rate from 20% down to around 4% just by deducting expenses, so this is definitely worth the effort if you ask me!

Extra Reading – Instacart vs DoorDash For Drivers – The Ultimate Guide.

Frequently Asked Questions

Does Instacart Track Mileage For Taxes?

Instacart doesn't track mileage for tax purposes, and as an independent contractor, you're responsible for tracking your own mileage and accurately filing your extra income.

You can use software like Everlance or other freelance bookkeeping software to track your income and expenses throughout the year.

This helps you stay prepared when filing your taxes. And it also helps you claim potential deductions to keep more of your money.

If you have questions, I suggest speaking with an accountant so you can make a plan for your unique situation.

What Is The Instacart Mileage Deduction?

You can deduct Instacart mileage on your tax return to keep more money in your pocket. Mileage that is eligible for deduction includes:

- Driving to pick up Instacart batches

- Driving to deliver to a customer

- Driving between different Instacart batches

- Driving to the gas station or garage for car repairs

Now for how to deduct Instacart mileage, you have two options:

- IRS Mileage Deductions: You can use the IRS' standard mileage rate of $0.585 and deduct all of the miles you spent driving for Instacart.

- Actual Expense Method: Another way to calculate your Instacart mileage deductions is to add up all of your actual business expenses. This means adding up your gas bills, repairs, tolls, depreciation, and anything that cost money to work as an Instacart Shopper.

You can talk to an accountant to find the right method for you, but many Instacart Shoppers keep things simple and use the IRS' mileage rate when filing taxes.

What Do I Do If I Forgot To Track Miles For Instacart?

If you forget to track your Instacart mileage, your best option is to look through your previous batches within the app to see how far you drove. You can also make a rough estimate of this based on all of the batches you've completed, but make sure to be on the conservative side with this estimate.

Again, it's vital to keep gas receipts and to stay organized so you're ready for filing taxes and dealing with potential Instacart mileage deductions.

What's Instacart's Average Mileage Per Delivery?

Unfortunately, there isn't a reliable Instacart mileage average because this varies greatly by market. Large cities likely have shorter delivery distances than rural areas, so try to get an average for your market after completing 50 to 100 deliveries.

Extra Reading – How To Make $5,000 Fast.

Final Thoughts

At the end of the day, Instacart doesn't really track mileage for you or help you much when it comes to filing your taxes.

But, learning how to track mileage for Instacart is super easy, especially if you use Instacart mileage tracking apps to do most of the work automatically.

My suggestion is to stick with an app, deligently track your mileage, and also keep every receipt!

This last point is super important: you need to keep your receipts so you can claim expenses like gas and prove how much you're spending as an Instacart Shopper.

Plus, you can use various reward apps like CoinOut, GetUpside, and Receipt Hog to earn free PayPal cash and free gift cards for your gas receipts, so this is even more of an incentive to track those miles!

And remember, you can always try other delivery gigs like DoorDash if you want to add more delivery apps to your routine and make more money!

Anyway, I hope this Instacart mileage tracking guide helps you maximize your Instacart earnings by keeping your expenses down!

Catch you guys in the next one.

Looking for more gig economy jobs? Checkout: