Does DoorDash Track Mileage? – What Delivery Drivers Need To Know

If you're currently driving for DoorDash or are thinking about becoming a driver, you probably know that you have some expenses to account for.

You can make great money doing DoorDash, but DoorDash doesn't pay for gas, and you're also on the hook for things like vehicle repairs and depreciation.

But, if you could track your DoorDash mileage and potentially save money at tax time, that would help out with a lot of your food delivery expenses.

So, does DoorDash track mileage? Or better yet, should you start tracking it on your own to ultimately save money when filing taxes? Take a look at some of these tips!

Looking for other money-making ideas? Checkout:

- Uber Eats: Make money on your own schedule with Uber Eats!

- Branded Surveys: Share your opinion to earn PayPal cash and gift cards!

Does DoorDash Track Miles?

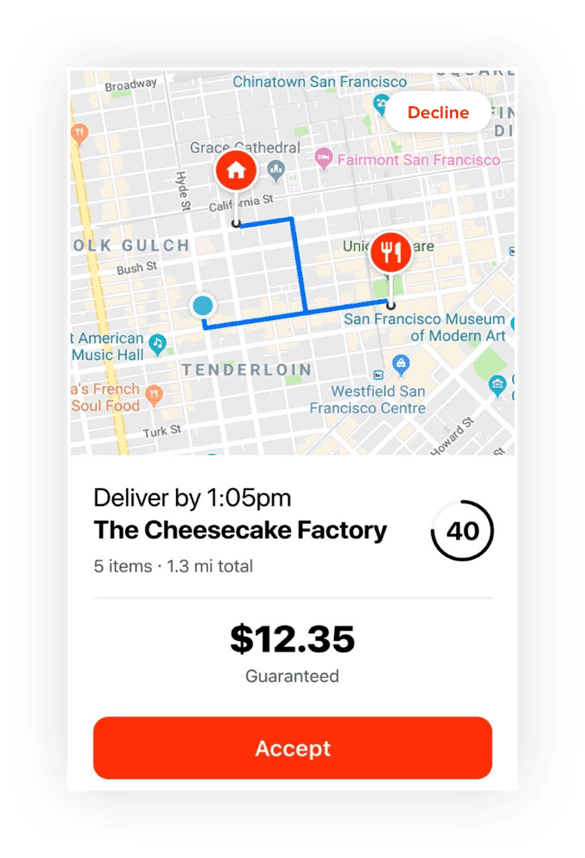

DoorDash provides a general estimate of how many miles you drive per year. However, it doesn’t do a great job at tracking your mileage perfectly, so you might miss-out on some of the miles you drive if you just rely on its estimates instead of tracking things yourself.

This is because DoorDash only tracks the mileage estimates on orders. But this doesn't include extra mileage if you take an alternate route or the miles you might drive between orders.

However, according to DoorDash: “Whether you’re in the US or in Canada, you may be able to deduct expenses from your earnings and only pay taxes on the remaining amount. If you keep track of things like your mileage and vehicle costs, this could add up to substantial savings.”

So, it's important to track your DoorDash mileage, but you won't have much luck if you just rely on your Dasher app.

This is the frustrating nature of many gig apps, and other delivery gigs like Instacart don't track mileage either.

Thankfully, you can still figure out how to track your DoorDash mileage so you can maximize your savings when filing your income taxes and looking for potential deductions!

Why Should You Track DoorDash Mileage?

There are numerous DoorDash expenses you might be able to write off in your tax return as an independent contractor, including:

- Vehicle repair costs

- DoorDash mileage

- Car insurance

- Tolls and parking fees

- Your phone and phone plan

- Accounting and banking costs relating to DoorDash

Of course, repairs and mileage are the two main categories here for potential savings.

After all, if you spend hundreds or thousands of dollars per year on gas while driving for DoorDash, you should try to write those expenses off.

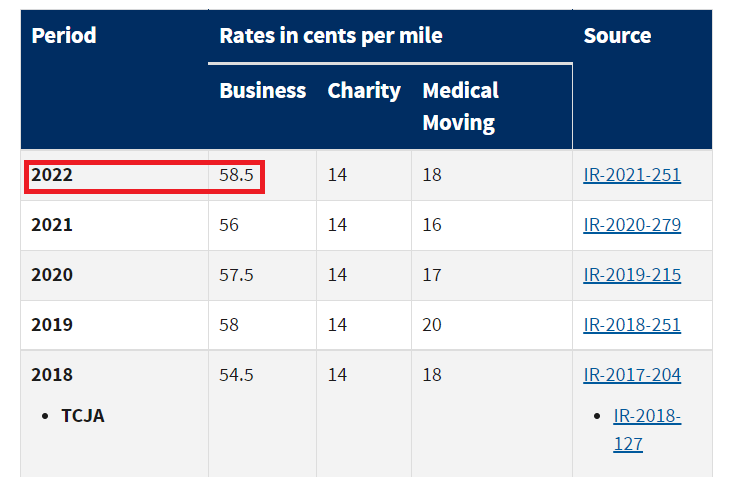

According to the IRS, the standard business mileage rate is $0.655 per mile in 2023. That money adds up when your main job is DoorDash and you’ve been working for an entire year.

Plus, you should track your business income and expenses anyway since the IRS requires you to keep track of your records anyways, in the case that they need proof from auditing you.

How to Track Miles For DoorDash

There are three main ways to track DoorDash mileage:

- Use A Mile Tracking App

- Create A Mileage Log Book

- Look Through Previous DoorDash Orders

My favorite method for any driving app that pays is to use a mileage tracking app since it handles everything automatically. And DoorDash actually recommends using Everlance and gives you 20% off its premium plan if you sign up with the code ‘EVERDASH.'

The video above covers how to track DoorDash mileage with an app like Everlance. But I'll explain how each of these DoorDash mileage tracking tips works down below.

1. Use A DoorDash Mileage Tracking App

One of the easiest ways to track your DoorDash mileage is to use a mileage tracking app that automatically tracks how many miles you drive for DoorDash deliveries.

DoorDash recommends using the Everlance app and actually partners with this mileage tracker.

The app helps you automatically track mileage, business expenses, and saves time since you don't have to manually log your DoorDash miles yourself.

Plus, Dashers can get three months of Everlance premium for free, so there's a compelling argument to use this mileage tracking app.

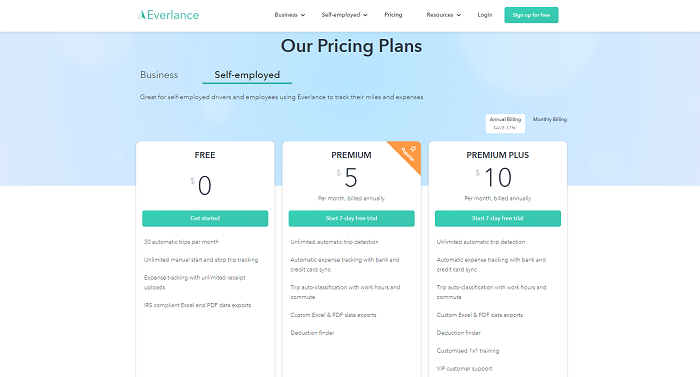

Here are the subscription prices for Everlance:

- Free: Tracks 30 automatic trips per month.

- Premium: $8/month or $5/month when paid annually. Tracks unlimited automatic trips.

- Premium Plus: $12/month or $10/month when paid annually. Includes individual training and an account manager.

However, there are several other DoorDash mileage trackers you can use to track how much you drive like:

Most of these apps run in the background as you drive for work. Many of them also include automatic reports which can be directly inputted into your taxes.

Tracking your miles like this is probably the easiest way to manage your driving expenses in the long run without manually inputting numbers.

Plus, these apps also work for other delivery gigs like Uber Eats and working for Instacart, so they're quite versatile!

2. Create A DoorDash Mileage Log Book

Another way to track your DoorDash mileage is just to create a logbook where you manually enter all of your delivery distances while you're on a shift.

If you don't want to use technology or a mileage tracking app, this could be the best solution to try.

A DoorDash mileage log book is also simple: it’s essentially a book that has sections such as date, odometer before, odometer after, total mileage, and notes.

You can manually track your mileage after each trip and add special notes that you normally wouldn’t be able to with an app.

Of course, manual tracking in a log book takes way more effort, but it’s a worthy option for those who want a more personalized feel.

You can grab a mileage log book on Amazon for around $5 – $10 and they’ll last you the entire year or more.

Most of the books are also small enough that you can fit into a glove box. You can tally up your miles while you’re on the move this way.

Pro Tip: Just remember to keep your gas receipts so you can also claim them on your tax return and have more proof that just your mileage book!

3. Look Through Your Previous DoorDash Orders

If you go into your delivery history on the DoorDash app, you can view previous orders that outline how much you made along with the distance driven per delivery.

So, you can track your DoorDash mileage by looking at all of your deliveries for a day and adding up the total mileage per trip.

This gives a fairly accurate number for how far you drive for DoorDash, but again, it takes more effort than using a mileage tracking app.

Just remember: tracking DoorDash mileage this way doesn't include any extra miles you drive between orders or to start and end your shift.

You can also combine this step with the step above (getting a mileage log book) and track your miles from your previous orders into the book.

This is probably the most tedious way to track your mileage on DoorDash, but if you’re already falling behind on tax season, it might be a good choice to catch up using some historical data.

In summary, use the apps to prevent tedious work in the future and use the manual ways to catch up on previous orders.

Other Ways To Save Money On DoorDash Mileage

Saving on taxes by claiming your gig economy mileage during tax time is one of the best ways to save money as a delivery driver.

But, figuring out other ways to save money on DoorDash fuel expenses also helps keep more money in your pocket.

Take a look at some of these extra tips to help you save money on DoorDash mileage…

1. Use Rewards Apps

Nowadays, there are so many reward apps that let you save money on everyday spending, from groceries to refuelling at the pump.

For starters, you can try the Upside app to earn cash-back rewards on your gas expenses.

In a nutshell, GetUpside shows you offers for nearby gas stations that can save you around $0.25 per gallon.

All you have to do is claim cash-back gas offers within the GetUpside app, refuel, and upload a picture of your receipt to the app to get cash back.

There are other receipt-scanning apps that also let you earn free gift cards and PayPal cash for uploading a variety of shopping receipts, including ones for fuel:

- Receipt Hog – Let's you earn free Amazon gift cards and PayPal cash.

- Pogo – Turn your shopping trips into cash and earn everytime you shop!

- ReceiptPal – Another receipt-scanning app that accepts gas receipts.

- CoinOut – One of the lower paying receipt-scanning apps, but there's no minimum withdrawal amount and every receipt is valid.

- Checkout 51 – A leading grocery and gas rewards app that lets you cash out through check.

None of these apps will save a lot of money on DoorDash gas, but every penny counts!

Extra Reading – Best Reward Apps Like Fetch Rewards.

2. Drive A Fuel Efficient Vehicle

A car with a poor mpg ratio is going to negatively impact your expenses over the long run.

So, if you plan on starting to deliver for DoorDash and will likely drive a lot, it's worth looking for a fuel efficient vehicle if you happen to be on the market for a new ride.

My friend drives for food delivery companies all the time and he’s never complained about his earnings being affected too much by gas. But, he leases a Prius! Go figure!

The point is, the less fuel that has to be used, the less money that needs to leave your pockets.

Some Dashers pay off their entire lease and then some with a fuel efficient vehicle. That’s also calculated after necessary vehicle expenses.

Extra Reading – How To Make $1,000 A Week With Uber Eats.

3. Use Fuel Rewards Programs & Cash-Back Credit Cards

Some of the most popular gas stations in your area have fuel rewards programs and you may have never heard of them.

This is usually because you need to download their app and sign up for the program, which no one really does when they need to fill up.

Here are a few popular gas station rewards programs you can try:

- Exxon Mobil Rewards +

- Shell Fuel Rewards

- Speedy Rewards Program

A lot of these companies give you discounts or cash back for filling up at their stations. Additionally, you can use a gas rewards credit card to earn rewards when you fill up.

For example, cards like the Amex Blue Cash Preferred or the BOA Cash Rewards credit card offer 3% cashback on gas stations.

Extra Reading – 15 Best DoorDash Driver Tips & Tricks.

4. Use Dasher Rewards

To help drivers make more money, DoorDash has rolled out its Dasher rewards program that provides perks like discounts on Everlance, TurboTax, and Stride.

However, the program also has a range of fuel and vehicle related perks, including:

- A $20 credit to CarAdvise for maintenance

- Fuel rewards and savings at Shell

- 30% off the purchase of a Dirwin e-bike

- 2% cash back on gas with the DasherDirect card

Tracking DoorDash mileage is the best way to save money at tax time. But you can use these discounts to save money on fuel and maintenance throughout the year.

Frequently Asked Questions

What Do I Do If I Forgot To Track My DoorDash Mileage?

DoorDash sends Dashers an email when it's approaching tax season with an estimate of how many miles they drove for that year. So, if you forgot to track mileage throughout the year, you can rely on this estimate for a starting point.

However, it's important to build good habits and track mileage on your own. This is why using mileage tracking apps or your own spreadsheet is important.

Even a simple Google spreadsheet where you enter your daily DoorDash mileage can work, as long as you're consistent!

What's The Best Mileage Tracker For DoorDash?

Everyone has their own preference for mile trackers, but I really like Hurdlr and Everlance. However, there are numerous free options on the Google and Apple app stores you can use, and a simple paper or online spreadsheet is best if you want to avoid paying for an app.

Extra Reading – How To Make $500 A Week With DoorDash.

How Do I Track Other Expenses & Income?

With gig economy jobs, you're an independent contractor. This means you have to track your own income and business expenses, like mileage, to properly file when it's tax season.

There's plenty of tax and bookkeeping software out there that you can turn to, like QuickBooks or FreshBooks. I also like apps like Everlance since they handle all of your mileage and income tracking automatically.

For example, Everlance helps you log all of your eligible business expenses automatically, like fuel and vehicle repairs. It also tracks your DoorDash income for you.

I still suggest working with an accountant if you have questions. But there's plenty of software out there that can help simplify your life.

Final Thoughts

So, does DoorDash keep track of mileage? No, it doesn't, but that doesn’t mean you shouldn’t.

You can take advantage of those tax benefits and save money where you can on gas, depreciation, and repairs. Every little bit counts when it comes to side hustling, so the extra effort is worth it!

Find the best way to track your DoorDash mileage that works for you and you’ll be saving money in no time!

It’s easy, passive, and has tools to help you during tax season! Happy driving!

Looking for other gig economy jobs to make money? Checkout these posts: