Cleo App Review – Is Cleo Legit & Worth Using?

Cleo is a popular AI-powered chatbot that can help users save more money and build good financial habits. And it's also a leading app for cash advances that can spot users up to $250 if they're in a pinch.

But is Cleo Plus worth paying for to unlock all its features? And what do other users have to say about this all-in-one finance app?

Our Cleo review is covering how it works, its pricing, and how to ultimately decide if this app is worth using.

Want more fast money-makers? Checkout:

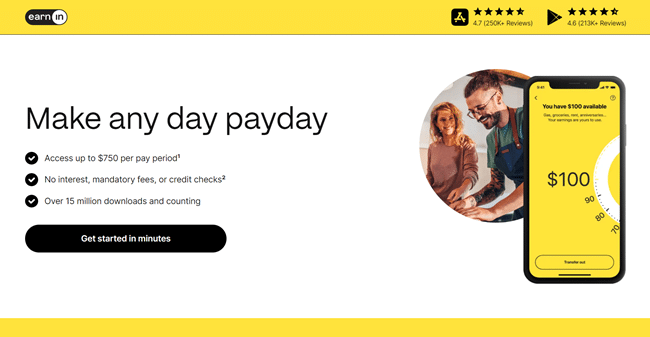

- EarnIn: Borrow up to $750 against an upcoming paycheck!

- TurboDebt: Get fast debt relief assistance if you have $10,000+ in debt!

Key Takeaways:

- Cleo lets users borrow $20 to $250 in a cash advance

- The app also offers budgeting, saving, and credit building tools

- You can use Cleo's humorous AI chatbot to roast your finances or to ask for advice

- There's no credit check requirement or interest on cash advances

- Cleo Plus costs $5.99 per month and unlocks many of its best features

Is Cleo Legit?

Cleo is legit and helps its members save more money, budget, and take out cash advances if they need a helping hand. The app is also popular, with a 4 star rating on Trustpilot with over 3,200 reviews.

If you're trying to save extra money each month, Cleo's AI chatbot and budgeting tools could be what you're looking for. We also like its cash advance feature since it's similar to apps like EarnIn and Super, which let you borrow up to $750 and $250 respectively.

If you just want a budgeting app, alternatives like Rocket Money are a better choice in our experience. But Cleo is a comprehensive app that also caters to gig workers and freelancers as well as full-time employees.

What Is Cleo?

Cleo is a London-based FinTech startup that was founded in 2016. The Cleo app, sometimes called Meet Cleo, is available on both the Android and iOS app store.

Currently, Cleo has more than 5 million users, and this app is pretty much the fastest growing app the FinTech world has ever seen.

Cleo has been incredibly popular for younger crowds/millennials, and this is by design. The Cleo app has a sleek interface, does all the work for the user, and mixes in witty bits of sarcasm to make managing your finances feel more engaging or humorous.

Its cash advance feature is also incredibly useful. It lets members borrow up to $250 against an upcoming paycheck and doesn't charge interest or require a credit check. And it's even available to gig workers and freelancers.

Overall, Cleo is a great solution if you need cash to pay rent or upcoming bills. And we like that it has a host of budgeting and saving tools for a long-term financial gameplan.

How Does The Cleo App Work?

Users have to connect their banking details to Cleo to allow the AI-powered chatbot to analyze spending patterns and actually get to work. You can use the platform through the mobile app version or Facebook Messenger.

Most major banks are supported, and setup only takes 2-3 minutes. If your bank isn't supported, you can request support with setup as well.

You can connect multiple accounts to the app, and actually using certain features is easy. For example, typing or saying ‘budget' will prompt the app to start working with you to create a budget.

Cleo operates on a freemium model like many other finance based apps. However, users still get some nifty features with the free version of Cleo, which makes it easy to test out the platform before trying out Cleo Plus (more on why this feature later on).

Here are some of the main Cleo features to know about:

1. Cleo Cash Advances

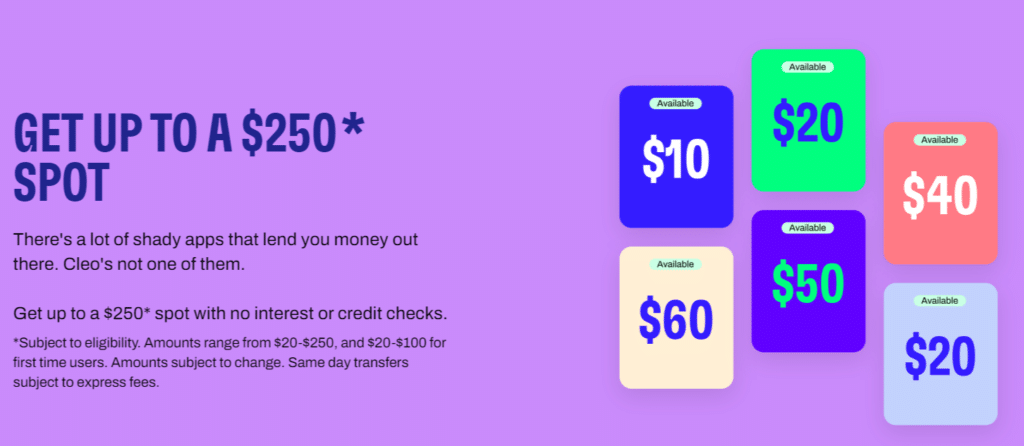

The Cleo app lets users borrow $20 to $250 against an upcoming paycheck without paying interest or going through a credit check.

First-time users can only borrow $20 to $100. But you can increase your limit over time, and Cleo connects to your bank account to monitor your income and determines how much you're eligible to borrow.

Most cash advance apps require having a full-time job and regular paychecks to qualify. But Cleo works with side hustlers and freelancers, which is certainly a unique selling point.

Once you take out an advance, you have 14 days to pay Cleo back. Also note that funds take up to 4 days to appear in your linked bank account if you don't want to pay fees. If you need money instantly, you pay a $3.99 express fee.

Apps like EarnIn offer higher cash advance limits of up to $750 per pay period. But EarnIn doesn't work with gig workers, so Cleo is certainly easier to qualify for and borrow money without a job.

2. Track Your Spending

The most basic feature Cleo offers is the ability to track your spending. Once you connect your bank account to the app, you'll be able to view your balance, spending categories, and get an easy overview of your bank account.

This isn't much different than most budgeting apps, like Rocket Money or YNAB. However, you can also ask the Cleo app several questions, such as:

- How much do I spend on a certain category? (Such as food, rent, etc.)

- What's my largest expense?

- How much have I spent on alcohol this month?

- Show upcoming bills.

- How am I doing on my budget?

You get the idea. The Cleo makes it pretty simple to get a general sense of how you're doing for the month in terms of spending.

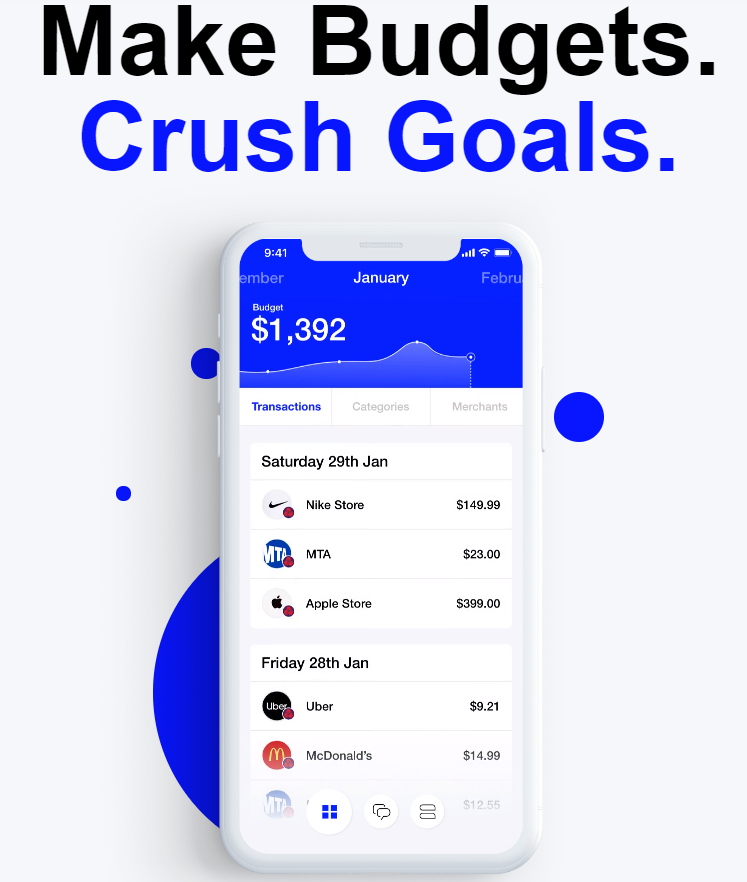

3. Budgeting Tools

Cleo is more of a financial assistant and less of a pure budgeting app. However, the app still makes it very easy to set budgets for different spending categories and to track your budget throughout the month.

Users can set their own budgets on Cleo or rely on AI-powered recommendations to set spending limits. This feature is great for anyone who struggles with budgeting or wants a bit of a helping hand to make sure their spending isn't off the rails.

Cleo monitors your purchases and alerts you if you are approaching a budget limit. As shown above, you can also ask Cleo if spending on a certain category, like dinner or drinks, is a good financial decision or not.

Additionally, you can set budgets for different time periods, which is useful if you want to monitor your spending during a vacation or a weekend retreat somewhere.

4. Cleo Savings

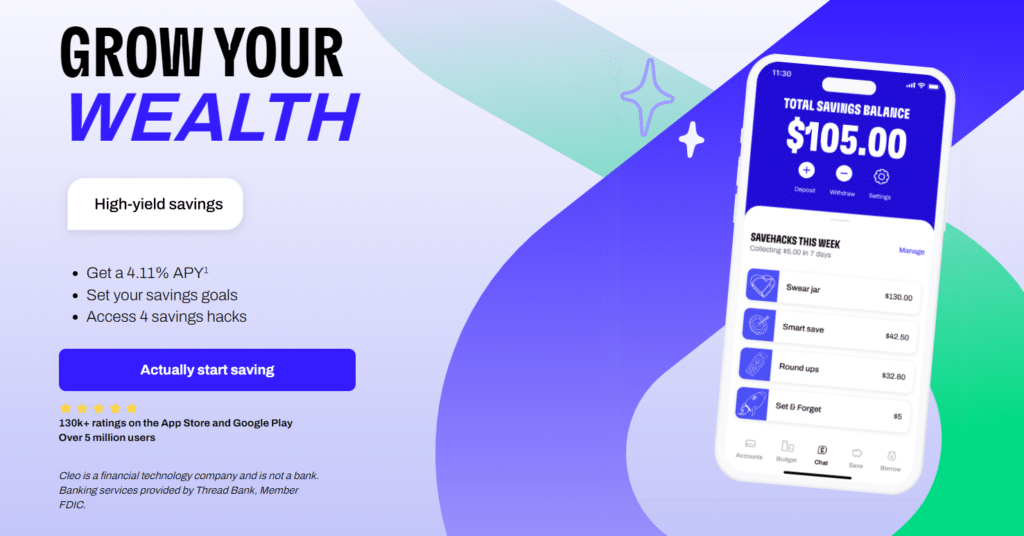

Cleo now offers a high-yield savings account that currently pays 4.11% APY. It doesn't charge any fees either, and this is a nice way to earn passive income on your emergency fund or idle cash.

Earning 4.11% APY is significantly higher than the national average. Users can set a savings goal, like their total savings target and timeframe, and the app then provides savings reminders to help members achieve this goal.

On top of that, Cleo savings offers 4 savings hacks: Set & Forget, Roundups, Smart Save, and Swear Jar.

These are all different methods of moving money from your paychecks into your savings account. Again, this is part of how Cleo makes financial management a bit more fun.

We also like that Cleo savings provides up to $3 million in FDIC insurance through its partner bank, Thread Bank. There's no minimum deposit requirement which is pretty neat too.

Just note: Cleo savings requires paying a $2.99 per month subscription for Cleo Grow. Alternatively, you can pay $5.99 per month for Cleo Plus, which unlocks all of Cleo's features.

If you want a free alternative, you can check out Current. This savings solution pays 4% APY and also has a nice $50 sign-up bonus for you to snag right now.

Pro Tip: Find the best high-yield savings accounts on the market with Raisin! This platform doesn't charge any fees and lets you find the best savings products for your goals.

5. Cleo Credit Builder Card

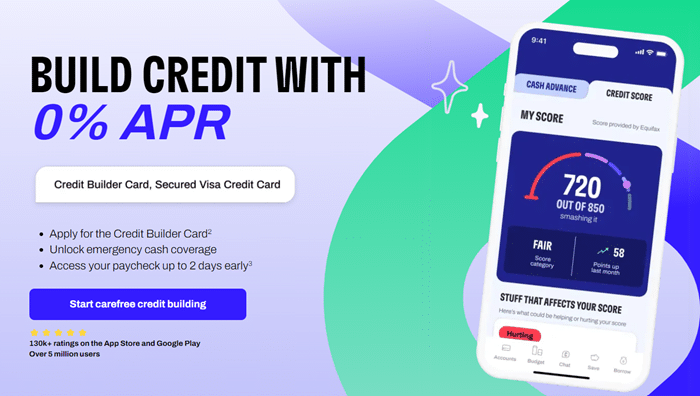

Another new Cleo feature is its credit builder card, a secured credit card that helps people improve their credit scores.

The main features of the Cleo Credit Builder card include:

- No minimum deposit requirement

- No fees

- No hard credit checks

- Access your paycheck two days early

You have to put cash into your security deposit to unlock a higher credit limit, but this is how secured credit cards work. But in exchange, you can start to improve your credit score as you use the funds to pay for things like gas, groceries, and everyday expenses.

And Cleo just has a $1 minimum direct deposit requirement, so you don't need to add a ton of cash to your card.

Requirements for Cleo's Credit Builder card include:

- Being 18 or older

- Have a SSN

- Get contacted by Cleo via the app and email to try out the card (it's still in testing)

Honestly, a secured credit card can be a useful tool to improve your credit score if you're struggling, so it's nice to see that Cleo is continuing to add these sorts of services.

Also note that Cleo lets you check your credit score if you're a Cleo Builder or Plus user. You just need to type in “credit score” to Cleo and it will provide your score from Equifax.

Pro Tip: Get a more comprehensive credit score and ongoing monitoring from CheckFreeScore.com. Stay in the loop about your credit score and learn how to improve it faster.

How Much Does Cleo Cost? – Cleo Plus Pricing & Other Plans

The basic version of Cleo is free. However, users have to upgrade to Cleo Plus for $5.99 per month to unlock most features, including cash advances. There's also the Cleo Grow plan for $2.99 per month and Cleo Credit Builder plan for $14.99 per month.

Here's a breakdown of Cleo's pricing and what you get with different plans:

| Feature | Free Plan | Cleo Grow | Cleo Plus | Cleo Credit Builder |

| Monthly Cost | $0 | $2.99 | $5.99 | $14.99 |

| Budgeting Tools | Yes | Yes | Yes | Yes |

| Cash Advances | No | No | Yes | Yes |

| Credit Scores | No | No | Yes | Yes |

| Credit Builder | No | No | Only Credit Scores | Scores + Credit Building Card |

| Savings Account | No | Yes | Yes | Yes |

As you can see, the free version of Cleo is really just a budgeting app with some AI-powered humor. And Cleo Grow only unlocks a decent high-yield savings account.

Cleo Plus is where the app really shines. And paying $5.99 per month to access cash advances is pretty competitive with a lot of other apps in the space.

As for the credit builder, it's a bit on the pricey side. We recommend using a solution like Kikoff instead if you're on a mission to improve your credit score.

The Best Ways To Get $500 By Tomorrow.

Is Cleo Worth It?

Cleo is worth using if you want a humorous budgeting app that also provides access to cash advances and a competitive high-yield savings account. However, we think most users should upgrade to Cleo Plus for $5.99 per month to unlock the app's best features.

If you just stick with the free app, there are plenty of better or similar budgeting alternatives out there. And we're fans of solutions like Rocket Money or a simple DIY spreadsheet.

But with Cleo Plus, you get a pretty decent savings account. And cash advances of up to $250 is another selling point.

Pros & Cons

Pros:

- Cleo works with gig workers and freelancers for cash advances

- Humorous AI-powered chatbot puts a fun twist on budgeting

- Competitive high-yield savings account

- Cash advances don't charge interest or require a credit check

- You can try Cleo for free to test it out

Cons:

- Most Cleo features require Cleo Plus

- Expensive credit builder plan

- Cleo's pricing has changed a lot over the years and can be a bit confusing

The Best Apps Like Cleo

We think Cleo is a leading budgeting and cash advance app for good reason. But there are several useful apps like Cleo you should consider, especially if you're fully employed and want larger cash advances.

Some of the best Cleo alternatives include:

- EarnIn (best overall)

- Dave (best for side hustles)

- Super.com (best for cash back plus cash advances)

- Brigit (best for building credit)

- Current (best savings solution)

- MoneyLion Instacash (best for loans)

EarnIn is our overall pick since you can borrow up to $100 per day, for a total of $750, within a given pay period. And it's more affordable than Cleo too. However, Cleo is our number one pick for freelancers or gig workers who don't qualify for most other cash advance apps.

How To Make $1,000 In 24 Hours.

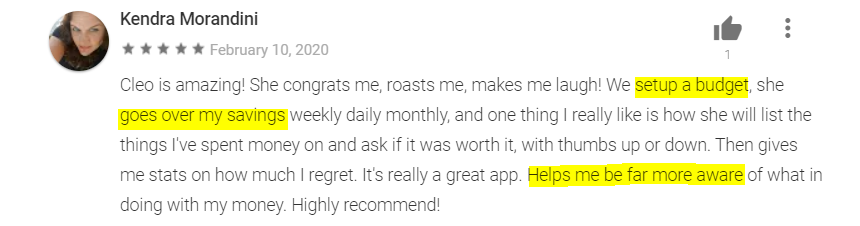

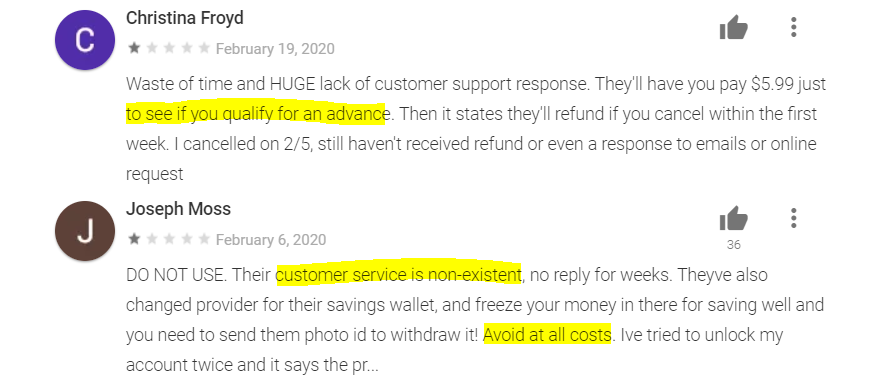

Other Cleo Reviews From Users

Cleo currently has a 4 and 4.6 star review average on the Google Play store and iOS store respectively, and the app certainly generates a lot of great press and feedback.

From the other Cleo reviews I've read, it seems like people generally like Cleo Plus for its cash advance feature. People also enjoy its humorous budgeting tools and how Cleo helps beginners understand a broad picture of their financial well-being and where they spend most of their money.

However, some negative Cleo reviews come from users who are unhappy with cash advances. This is because while Cleo can give you up to $250 in an advance, first-time users get a maximum limit of $100. And many users qualify for a lot less or don't qualify at all.

Again, your cash advance limit depends on your earning history. You can increase it over time, but you won't get a $250 limit as soon as you upgrade to Cleo Plus.

Is Cleo Safe?

Like pretty much any major FinTech product, Cleo uses bank-level encryption and doesn't save your personal information. It's a safe app to use overall.

Cleo also can't make changes to your account when viewing your banking information, and accounts are backed by a $250K guarantee. Confusingly, their support page states it's more of a £85,000 pledge, so I have no idea what's actually covered here.

Final Thoughts

I hope my Cleo app review helps you decide if this humorous little AI chatbot is worth using or not.

I love that Cleo continues to add new features, and I think the future is very promising for this app.

Whether or not you upgrade to Cleo Plus or Cleo Crusher is up to you. If you do, I hope the extra features help you stay more on top of your finances!

Want more ideas to make money? Checkout:

- Is The Oasis App Legit?

- Is The Dave App Legit?

- Is The Klover App Legit?

- What To Do When You're Struggling With Money.

Cleo App Review

Name: Cleo

Description: Cleo is an AI-powered budgeting app that helps you track your spending, save automatically, and even earn cash-back rewards.

Operating System: Android, iOS

Application Category: Cash Advance Apps

Author: Tom Blake

-

Budgeting Tools

-

Ease Of Use

-

Cash Advance

-

Fees