Can’t Afford to Move Out? – These 10 Steps Can Help

Rent is getting more and more expensive by the day it seems. And in some cities, it might seem outright impossible to get a place on your own, especially when you look at the most expensive cities for renters:

Plus, if you're young and focusing on wealth building, it might be difficult to afford moving out, especially if you're just getting started with your career or are still in school.

However, hope isn't lost. In fact, if you can’t afford to move out, there are plenty of ideas to implement to help you get there faster.

10 Steps To Take If You Can't Afford To Move Out

If you can't afford to move out on your own, following these steps can help you make or save more money so you have enough room in your budget to branch out on your own.

1. Create A Budget

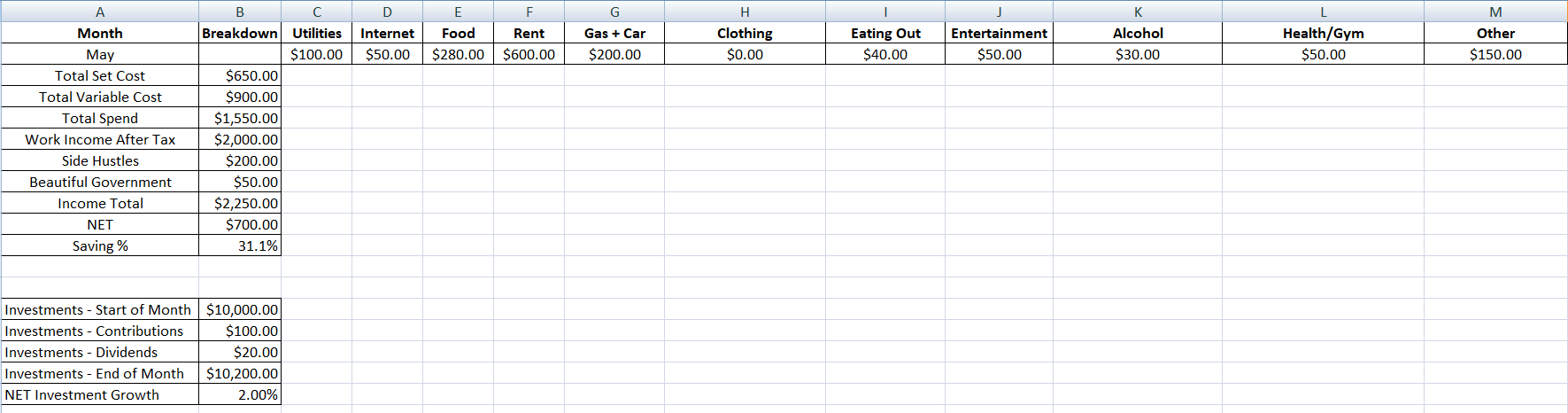

If you're tired of living with your parents or roommates you don't want to live with, the first thing you need to do is get on a budget.

Without a budget, you have no idea of where your monthly income goes, making it harder to save up enough money to live on your own. Plus, a budget helps you factor your monthly rent into your total living expenses, making sure you don't get into debt.

You also don't need to go crazy with budgeting software if you don't want to; a simple Excel file can get the job done:

You can also try budgeting apps like Rocket Money or You Need A Budget. Both of these apps help you track your monthly spending, identify areas of problem spending, and keep you on track.

Once you create your budget, track your expenses for the next few weeks and write them down. See which expenses are necessary and which ones can be reduced.

2. Set A Realistic Rent Budget

It can be tempting to sign a lease for the first rental unit you like or find. However, doing this without setting a rent budget is a recipe for disaster.

So, before you plan to move out, take a look at your budget and figure out what you can actually afford. There are tons of online rent calculators out there to help you set a realistic rent budget and figure out how payments are going to work.

Here's an example of a calculation from calculator.net for someone making $50,000 per year with $500 in monthly debt payments:

In this example, $1,000 is the absolute maximum this person could afford before rent payments start to get a bit out of hand.

Complete this exercise yourself to see what you can afford at your current income. Also factor in the monthly cost of things like utilities, gas, renter's insurance, and how much it would cost to potentially hire movers.

3. Pick Up Side Hustles

Another great idea if you can't afford to move out is to pick up some side hustles. This is because you can put a portion or all of your extra income towards paying rent and bills.

This is what many of my friends and I did during college. And there are plenty of weekend side hustles or flexible gig jobs you can use to make money, including:

- Using online survey websites

- Delivering food for apps like Uber Eats or Instacart

- Trying out micro task websites for quick beermoney jobs

- Doing cash gigs in your area, like cleaning or babysitting

- Making money online with a remote gig

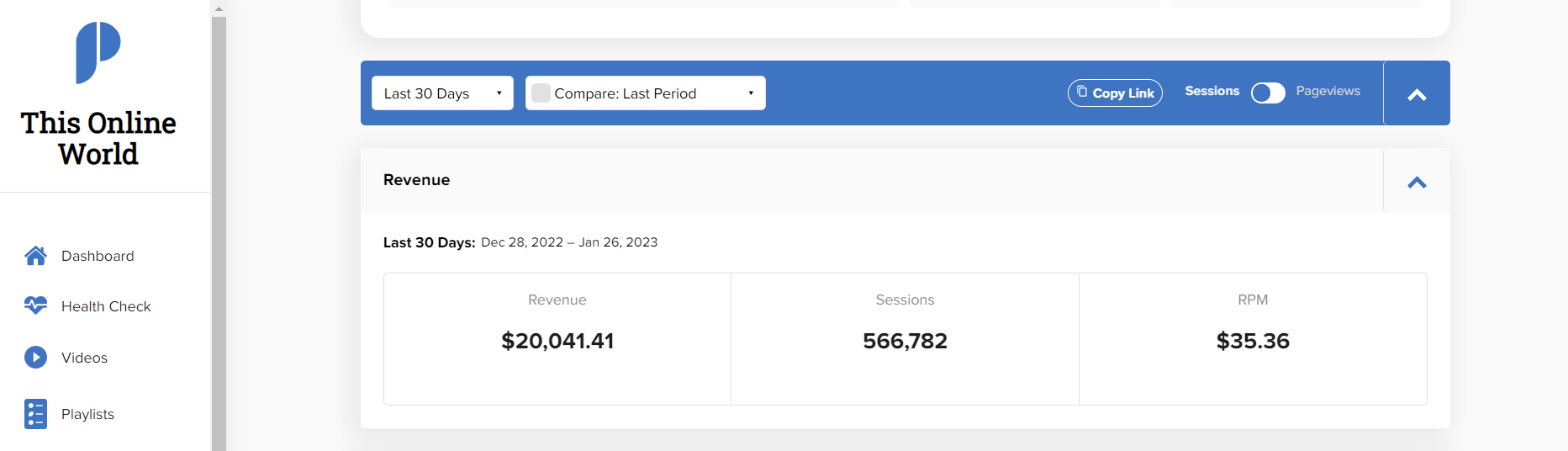

You can also try slightly longer-term side hustles like starting your own blog. This is what I've done, and WebMonkey now makes over $20,000 per month between affiliate marketing and display ads; way more than the cost of rent:

Just ensure you're not using your side hustle to pay more in rent than you can really afford. The last thing you want is to feel like you have to hustle constantly just to have a roof over your head.

Extra Reading – How To Earn Money Online As A Beginner.

4. Consider Low Cost Of Living Areas

The city you're living in has a lot to do with your monthly rent budget. And this is why many FIRE advocates suggest living in low cost of living, or LCOL, areas. After all, living in a small town in Utah is probably going to be much cheaper than living downtown New York City.

My advice is to start out by thinking about what's important to you. Are you living on your own? How much space do you really need? Do you need to live in a city, or would a small town work?

Ask yourself these questions and be honest with your answers. Lying will only result in trouble with late payments down the road.

5. Create An Emergency Fund

An emergency fund is a fund that you use to cover sudden life expenses, like your car breaking down or the loss of income from a job. And experts generally suggest having at least three to six months of your expenses in this fund.

The real goal of this fund is to enable you to cover emergencies without relying on credit cards, loans, or cash advances. In the long-run, this helps people avoid debt and provides a more stable foundation if you can't afford to move out.

Plus, you can also earn some nice passive income with your emergency fund if you park it in a high-yield savings account.

For example, companies like Current pay 4% APY right now, and you also get a $50 sign up bonus to sweeten the deal. It also helps members build their credit and get paid up to two days early, all without charging any fees.

When in doubt, build up your emergency fund to six months or even more. You want to feel secure when you decide to move out, and this fund is one of the best ways to gain that sense of financial security.

6. Consider Moving In With Roommates

If you can't afford to move out on your own, moving in with roommates is the next best thing. Not only can it be fun to live with friends or meet new people, but it also reduces the cost of living significantly.

Remember: your first place outside of home is likely not going to be your future home with beautiful renovations and no roommates. This is your time to live a little sloppy and cheap in order to get things going with your career and eventually move to a much better place.

My friends and I did this for years in cheap student housing. It wasn't glamorous, but it helped keep costs down for everyone and was also very fun.

Extra Reading – 23 Ways To Save Money In College.

7. Don’t Go Crazy With Furnishing

Again, your first place isn’t supposed to be your dream home unless you’ve actually got the money to make it that way. So don’t go crazy with furnishing; not everything needs to be brand new.

Second hand stores, reuse stores, or even handed down furniture is all you need to get your new place furnished.

I also recommend checking Facebook Marketplace and Craigslist listings in your area that are offering used furniture. Typing in “Free & For Sale” on Facebook can find you hundreds of used furniture items, especially in college towns!

Apps such as Nextdoor also include a feature where people list their furniture (a lot of times for free).

Extra Reading – The Best Freebies For Students To Help Save Money.

8. Set A Deadline For Moving Out

Setting a deadline is crucial for moving out on your own since it helps hold you accountable. Plus, it also gives you a goal to reach towards.

With this goal, you’ll feel more obligated to work harder at finding a new place, make more money, and save as much as you possibly can.

Just be realistic with this deadline. Give yourself at least a few months to get things together depending on how much you already have saved up. Also keep in mind that the spring and summer months are popular times to find housing, so adjust accordingly to increase your options.

9. Hack Free Accommodation

One alternative path you can consider if you can't afford to move out on your own is to hack free accommodation elsewhere.

There's a surprising number of ways to find free housing in exchange for work or through the kindness of other people. Some popular options include:

- Getting a housesitting gig (you can look on Trusted Housesitters or Nomador)

- Going on a work exchange that provides accommodation

- Trying to couch surf for a while (you can use CouchSurfing.com)

- Visiting other family for a while

- Staying with a friend

- Being a pet-sitter (apps like Rover can have these opportunities)

- Staying at a cheap hostel for a while

- Being a live-in nanny or Au Pair

- Moving somewhere with relocation benefits

Personally, I love the hostel idea. A year after graduating, I actually quit my job and moved to Colombia and lived in lots of hostels and Airbnb.

In Colombia, I never paid more than $500 a month for rent. And I was able to make money with my laptop as a digital nomad, exploring new countries while keeping my monthly rent costs down.

10. Be Flexible

One final tip if you can't afford to move out is to just stay flexible.

It might be hard to settle for a place that’s not up to your standards at first. And although you may find a great place at a decent price, you can’t be too picky when it’s your first time moving out.

If you can’t afford to move out right now, chances are you’re low on cash. However, you could also be looking at places that simply aren’t in the right price range.

Adjust your search filters when you’re house hunting. Maybe there are great apartments for cheaper or a house with an extra bedroom that can ultimately cost less with a roommate. Be flexible with your options and you’ll thank yourself later.

How Much Money Should I Save To Move Out?

The amount of money you should save to move out differs based on the cost of living where you live. However, you should generally save at least 3-6 months worth of rent. Additionally, rent should cost no more than 30% of your income.

Use this rule as a guideline to determine how much money you should actually save, but don’t follow it religiously.

Keep in mind, that amount should be on top of your emergency fund. Meaning, you might need to save somewhere closer to 6-9 months worth of expenses before you find a new place.

How Can I Make Enough Money To Move Out?

Landing a higher-paying job or picking up a second job can help you afford to move out. Alternatively, you can create a side hustle stack with a few easy side hustles to make some extra cash each month.

Ultimately, lowering your monthly expenses while increasing your income is the combination you need to succeed. So, set a budget, find ways to reduce spending, and then dive into some hustles to boost your monthly income.

Extra Reading – How To Make Money Fast.

Final Thoughts

If you can’t afford to move out and don’t know where to start, hopefully this article helped you take off in the right direction.

I’ll admit, saving up enough money to move out without worry is hard. There are simply a lot of expenses and processes to deal with.

But if you follow the steps above, work hard to earn/save money, and just be honest with yourself about what you truly need, then moving out won’t be as daunting as it seems. Plus, the joy of being independent is a feeling like no other and you’ll be happy you moved out sooner than later.

Want more ways to make money? Checkout: