10 Best Ways To Double 20K

So, you're wondering how to double 20k and are looking for some ideas to get started.

Well, the great news is there are plenty of ways to double your money if you know how to make your money work for you.

Some of these ideas are also completely passive, while others involve investing into assets and businesses that generate income for you. If you're ready to double $20,000, this is absolutely the post for you, so let's dive in!

The Best Ways To Double $20,000

We have lots of guides on WebMonkey about how to flip money or invest and make money daily.

But when it comes to doubling 20k, it's important to have realistic expectations.

Many of these ideas can take months or years to work. But this is the nature of investing and passive income, so it's important to have patience and to trust the process.

1. Invest In Real Estate

One of the best ways to double 20,000 dollars is to invest in income-generating real estate.

Historically, real estate has been a great tool for wealth building since it typically appreciates and also lets you earn recurring rental income.

And the great news is, you don't need to invest hundreds of thousands of dollars to get started with real estate.

For example, real estate investing companies like Arrived let you invest in shares of income-generating rental properties starting with only $100!

Arrived lets you browse different rental properties that you want to invest in. You can then buy shares of your favorite properties and begin earning passive income through both rental income and property appreciation.

Overall, Arrived helps people diversify their portfolios with real estate. And I like that you only need $100 to get started.

You also have plenty of other real estate investment options like:

- Fundrise This popular platform lets you start investing in real estate with only $10. Note, this is a Fundrise endorsement and we receive compensation if you sign up with the provided link.

- RealtyMogul: Invest in exclusive commercial real estate deals with RealtyMogul.

- Streitwise: A popular dividend income investment option that also invests in real estate.

The bottom line is that real estate investing is one popular way to double $20k. And you can keep things completely passive if you want.

Start investing with Arrived today!

2. Start An Online Business

If you're feeling entrepreneurial, you can always try starting an online business to turn 20k into 40k.

Online businesses are great because they traditionally have lower start-up costs versus brick and mortar businesses. In fact, some ideas like making money with a blog or making money on YouTube don't even need more than $200 to $300 to get started.

And the income ceiling for these types of businesses is truly massive.

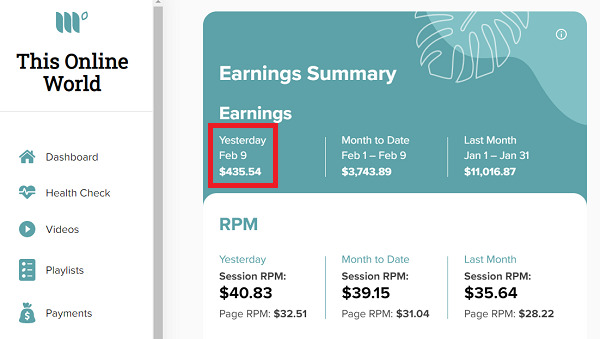

For example, WebMonkey makes $400 a day or more just from Mediavine ads. Affiliate income and other sources bring total daily revenue to around $600.

Some other online businesses you can start with 20k or less include:

- An ecommerce store with platforms like Shopify

- Selling stuff on Etsy

- Starting a print on demand business

- Starting an online coaching or services businesses

For ecommerce options like Shopify or Etsy, your $20,000 investment could help fund initial inventory, store setup, and marketing.

But again, there's a chance you don't even need to spend this much money, and it's nice to have money in the bank to help fund growth down the line.

3. Invest In Stocks & ETFs

Another simple way to double $20,000 dollars is to invest in stocks and exchange-traded funds (ETFs).

This sort of basic investing might not sound exciting, but it's a proven way to build wealth thanks to the power of compound interest and time.

For example, here's how long it would take to double $20,000 if you invested in a variety of stocks and funds that return 7% annually on average.

As you can see, at a 7% annual rate of return, it takes about 10 years to turn $20,000 into $40,000.

But this assumes you don't make any additional contributions to your investment portfolio. This isn't exactly realistic, and you could always invest in dividend-paying stocks and reinvest dividends into more shares.

The bottom line is investing is a proven way to make money on autopilot. And for doubling $20,000, it's one of the most realistic methods, provided you have patience.

You can start investing through your bank. There are also plenty of commission-free online brokers that are perfect for getting started.

For example, M1 is a commission-free broker, so you can invest in stocks and ETFs for free.

Learn more about investing with M1!

Pro Tip 💵 Get 50% off The Motley Fool Stock Advisor program and join over 500,000 investors receiving professional stock recommendations and tips right to their inbox!

4. Invest In Small Businesses

Traditionally, investing in small businesses meant you had to be a venture capitalist or have some serious capital to help fund startups.

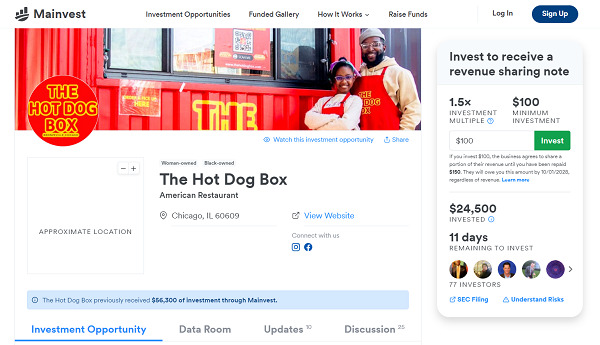

But thanks to companies like Mainvest, you can invest in small businesses across America with only $100.

Some of the most popular businesses you find on the platform include:

- Bakeries

- Breweries

- Food trucks

- Restaurants

Mainvest typically targets a 1.5x return on investment, but some opportunities can pay more, letting you double $20,000 if businesses grow as expected.

What's nice about Mainvest is that it only accepts around 5% of applicants to its program. This means the investment opportunities on the platform are promising and have been checked over by Mainvest's team.

There's still risk in this type of investing strategy, and you should always do your own due diligence or ask for professional finance advice if you have questions.

But for a way to potentially turn $20,000 dollars into $40,000 dollars, you can explore investing with Mainvest.

5. Start A Service-Based Business

One more idea for how to turn $20k into $40k is to use the money to start a service-based business.

Equipment is often the most expensive aspect of starting a service-based business. Licensing and legal costs can also be upfront expenses.

But a $20,000 starting investment might be enough to start a small side business. If you get enough clients, you can easily double your $20,000 investment and even find a new career.

Examples of popular service-based businesses you can start include:

- Cleaning

- Cutting hair

- Landscaping

- Painting

- Pet grooming

- Pet sitting

- Professional chef and catering

- Window washing

It might take a while to find clients, but you can use various gig apps or websites like TaskRabbit to find your first leads.

Even posting gigs on local classifieds like Craigslist can help you drum up business, so don't be afraid to get creative.

6. Try Crypto Investing

Another potential way to double $20,000 is to invest in cryptocurrency.

Crypto investing has been all the rage for the last few years. But what's exciting about crypto is just how many new passive income opportunities there are in the space.

For example, you can buy popular cryptos with leading exchanges like Coinbase and then stake those coins. In exchange, it's possible to earn up to 5% APY through staking.

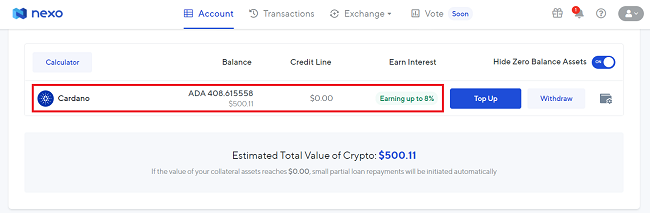

You can actually use crypto interest accounts like Nexo to deposit crypto and earn up to 20% APY on different coins.

I've been experimenting with Nexo and deposited around $500 worth of Cardano. I'm currently earning around 7% APY on my crypto now.

Of course, crypto investing carries risk, and you need to do your research.

But between potential asset appreciation and crypto interest accounts, it's possible to double $20,000 dollars by investing in digital assets and leveraging passive income opportunities.

7. Retail Arbitrage

Retail arbitrage involves purchasing popular merchandise from discount retailers and then selling it online for a profit.

Typically, retail arbitrage business owners purchase products from stores like Walmart and Kohl's that have clearance aisles.

Popular products to flip include apparel, electronics, toys, video games, and books. But almost anything that sells quickly online is fair game.

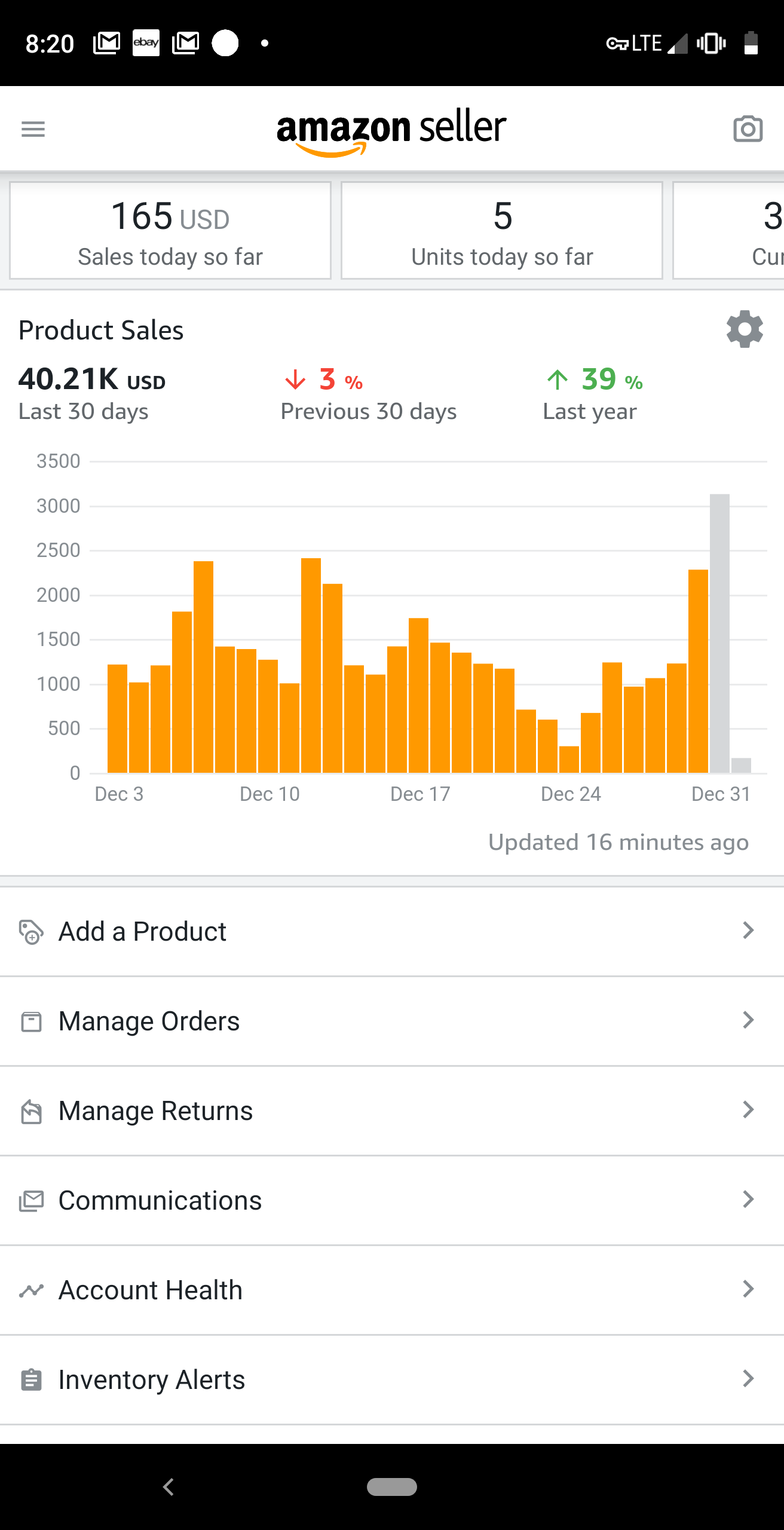

From there, many retail arbitrage sellers sell their inventory through Fulfillment by Amazon, or Amazon FBA.

My YouTube video on making $10k a month actually covers this idea, but I'll explain a bit more about Amazon FBA specifically.

Amazon FBA is popular because with this program, Amazon handles all order fulfillment. You just ship your inventory to its warehouses, and if you make a sale, Amazon ships it for you for a fee.

Now the two main downsides of Amazon FBA retail arbitrage is the startup capital requirement and competition with other sellers.

But $20,000 is more than enough to buy some test products, launch your Amazon store, and to see how you like this side hustle.

I've interviewed a couple on WebMonkey about how they started retail arbitrage, and they've actually done over $1 million in sales through the business.

This just goes to show the income potential of retail arbitrage.

And you don't need to invest $20,000 all at once. You can start by flipping $500 or $1,000 to see how your first batch of sales go and reinvest more as you scale.

8. Lend Out Your Money

If you want a hands-off way to potentially turn 20,000 dollars into 40,000 dollars, you can always lend out your money through debt investing.

This type of peer-to-peer loan arrangement basically turns you into a lender. You can lend people or businesses capital, and in exchange, you charge interest on loan repayments until you're repaid in full.

Companies like Groundfloor let you do this by funding real estate development loans.

Now the main risk of debt investing is that some borrowers default, which usually means investors lose everything or close to everything.

However, since Groundfloor only requires $10 to begin investing, you can spread out your capital across numerous loans. This reduces the risk of a single default draining your investment.

Again, this is a potential way to double $20,000, but make sure you read loan terms carefully and ask a professional for financial advice if you have questions.

9. Invest In A New Skill

While this isn't a traditional way to double $20,000, you can always use your money to invest in a new, valuable skill.

People do this all the time by going back to college or completing short diploma programs.

And while some argue this is a waste of money given how much info is available for free online, this isn't always true.

I mean, if going back to school helps you land a job that pays $5,000 a month, or $10,000 a month, I'd argue that's a pretty solid investment.

And you can always try cheaper online education options as well if you don't want to invest $20,000.

For example, platforms like Skillshare have courses on almost any subject you can think of. Many courses cost under $100 as well, so it's incredibly affordable.

Want to make money coding? Or want to learn data analysis skills, graphic design, or how to be a freelance writer?

Udemy has a course that can teach you anything. Plus, as mentioned, you can learn almost any skill for free thanks to the power of the Internet.

10. Buy & Rent Out Assets

One final idea to double $20,000 is to buy things you can rent out for money.

People do this with Airbnb all the time. And while $20,000 isn't enough to buy a house to rent out, it's potentially enough to finish a spare room or basement that you can then rent out for a nice passive income side hustle.

A $20,000 investment also opens the doors for other ideas.

For example, some people buy and rent cars out on Turo, a peer-to-peer car rental marketplace.

With a handful of rentals, you might be looking at a few hundred dollars extra per month in profit after accounting for expenses.

And people really take this idea to another level. For example, in this video from Financial Wolf, a couple shares how they earn over $150,000 a year from their Turo fleet.

Of course, this is an extreme example where a couple has 10+ cars to make about $20,000 per month in revenue.

But it just goes to show how you can get creative and invest in assets that begin earning income for you.

Extra Reading – The Best Ways To Make $3,000 Fast.

Final Thoughts

I hope this guide on how to double 20k gives you some ideas for how to put your money to work.

A $20,000 nest egg is a large amount of money. So, don't be afraid to explore a few options to find what works best for you.

This could involve making money online with a business, real estate investing with Arrived or Fundrise, or funding a service-based business.

Whatever you decide, make sure you set a timeframe and track your progress. In time, you can turn 20k into 40k if you put in the work.

Best of luck!

Looking for even more ways to make more money? Checkout: