The 11 Best $50 Cash Advance Apps For Fast Cash

Maybe it's a few days until your next paycheck and you need a bit of money to hold you over until you get paid. Or, maybe you need a quick $50 to pay off your phone bill this month.

Whatever the case, money can be tight sometimes for a variety of reasons. But the last thing you want to do is turn to expensive loan options or a high-interest credit card.

So in this post, I'm covering some of the best $50 cash advance apps you can use to get 50 bucks fast.

The Best $50 Cash Advance Apps

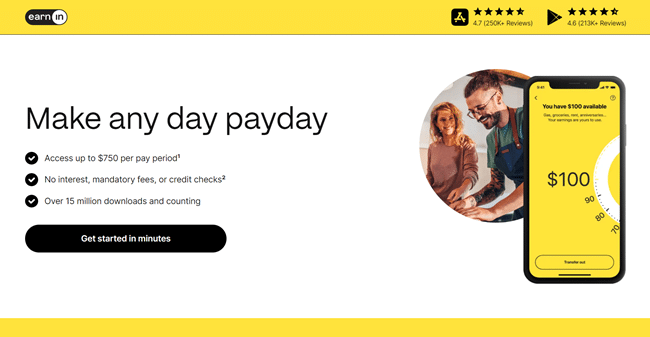

1. EarnIn

Out of all the cash advance apps out there, EarnIn¹ is our favorite since it's super easy to use and offers some of the highest advances per pay period.

With EarnIn, you can access $100 per day of your paycheck² and up to $750 per pay period! Plus, you don't pay any membership fees for using the app³.

You heard that right: you don't pay any service fees, interest, or membership fee. That's because EarnIn uses a “pay what's fair model” where you decide how much to tip, which can be $0 or a small amount you decide.

You can also access the cash advance in a couple of minutes. This Lightning Speed payment charges a small fee⁴. Otherwise, you'll get your free cash advance in just a few days.

Again, there's no credit check or interest payments, which is why EarnIn is top of our list. To get started, just visit EarnIn, create an account, and then link your bank and employment info. EarnIn then verifies your paycheck and you're off to the races.

👉 Try out EarnIn today or read our EarnIn app review.

2. Dave

Dave lets you borrow up to $500 instantly with its ExtraCash Advancement Feature, which can help cover larger expenses like your car breaking down or paying rent tomorrow.

You also slowly build your credit score as you repay the money you borrowed. And Dave only charges a $1 monthly membership for its services.

Just note that you pay small express fees if you want cash advances instantly; otherwise, you have to wait a day or two for money to deposit.

I also like Dave since it has budgeting tools too. There's also a side hustle section where you can find local cash gigs or online money-making ideas to increase your income.

I think these kinds of apps are better when they include side hustle resources so you can find multiple ways to make money in a pinch, but that's just me!

Get Started With Dave or read our Dave app review for all the details.

3. Cleo

If you're still looking for $50 cash advance apps to try out, another option you can try is Cleo, an AI-powered budgeting assistant.

I've actually used Cleo in the past, and the app is known for its sarcastic budgeting bot that pokes fun at you if you're not saving enough money.

But Cleo also has a range of other features, like a credit builder, automatic savings tools, and a feature called Spot Me.

With Cleo's Spot Me, you can get up to $100 from Cleo without interest or credit checks. First-time users generally qualify for $20 to $70, and you can unlock $100 after paying back a Spot Me.

Eligibility depends on several factors like previous paycheck history. And note that Cleo Plus costs $5.99 per month.

I think Cleo is a useful app if you really need help on the budgeting front as well. But for $50 cash advances, I'd probably stick with something like EarnIn or Dave instead.

4. Current

If you're on the market for a new mobile bank and also want to borrow $50 instantly, then Current should be on your radar.

This fee-free mobile bank lets you earn 4% APY on up to $6,000. And with Current Overdrive, you can overdraft up to $200 without paying any fees.

Plus, Current has a new advance feature that lets you borrow up to $500. All you have to do is sign up and connect your paycheck or set up direct deposit to begin increasing your cash advance limit. You don't pay deposit fees either if you wait 1 to 3 days for the deposit.

Overall, Current really helps you stretch your money if you're in a pinch. And I also like it since it has a nice $50 sign up bonus for new customers if you use the code WELCOME50.

Plus, the 4% APY on its savings pods isn't anything to scoff at. And you can manage your entire account right from your phone with Current's app.

Learn more about Current or read our Current review to learn more.

5. Chime

Chime is a FinTech company that's known for its high-yield savings account and lack of banking fees. But it also has a feature called Chime SpotMe where you can overdraft up to $200 without paying any fees.

Plus, right now, Chime is rolling out a new feature called Chime MyPay. If you get approved, this lets you get up to $500 of your upcoming pay. And this happens without fees, credit checks, or interest!

The fact Chime doesn't charge interest or membership fees for this service is a massive selling point. And Chime also lets users get paid up to two days early if they set up direct deposit.

On top of that, Chime is packed with other features. For example, you get 60,000+ fee-free ATMs and free-transfers to friends and family. You can even earn 2% APY in passive income through Chime Savings.

Overall, we like that Chime is so fee-free and user friendly. Just note that SpotMe is currently available to many members but MyPay is rolling out to new states and customers. You can read our list of loan apps that work with Chime for some alternatives as well.

6. Klover

Klover is a budgeting and cash advance app lets you borrow up to $200 against upcoming paychecks. And I like Klover since it doesn't have any mandetory fees, interest fees, or credit check requirements.

You can borrow $50 or more after you connect your bank account to the app, even if your next paycheck is two weeks away.

Just note that money takes about three business days to reach your account. You can get $50 instantly, but you need to pay fast-transfer fees that can get a bit pricey.

But Klover has other nifty features I think are cool. For example, you can get free money since Klover gives away $200 every day to its members in random prizes.

Plus, the app also has useful budgeting tools to help you save. And you can pay $3.99 per month to upgrade to Klover+, which provides perks like access to a financial advisor and credit monitoring.

Try out Klover today or read our Klover review for all the details.

7. Yendo

If you have a vehicle and want to unlock up to $10,000 in credit, then Yendo is the perfect fit.

This revolutionary credit card lets you unlock $450 to $10,000 in a revolving credit line by using the value of your car. So, you can actually benefit from the equity of your vehicle for a change!

On top of that, Yendo provides cardholders with up to $400 in daily cash advances. This is one of the highest limits out there. And you can actually borrow up to 50% of your credit limit.

The best part is that there's no impact to your credit score to get pre-approved. Plus, Yendo reports your payments to all three credit bureaus to help you build your credit.

Yendo charges a $40 annual fee. But this fee is much lower than most cash advance apps charge in the long run. And it's way lower than solutions like payday loans.

👉 Get started with Yendo or read our Yendo review for all the details.

8. Brigit

Brigit is another popular option you can consider, and the app is backed by some famous figures like Ashton Kutcher and Kevin Durant.

But Brigit is more than just some app with famous backers. For starters, it lets you borrow up to $250 as a cash advance instantly without a credit check or paying interest.

What's great about Brigit is that it can also help you build your credit score while you save with its Credit Builder program.

Plus, Brigit also has some nifty tools to help you budget and analyze your spending habits. And there's even a side hustle section of the app that helps you find various gig jobs to increase your monthly income.

Overall, Brigit is one of the more comprehensive apps that loan you $50 or more, and I love the fact it includes side hustles as well.

The free Brigit plan includes budgeting tools and financial alerts. Brigit Plus costs $9.99 per month and lets you borrow cash and build your credit.

Get Started With Brigit or read our Brigit review for all the details.

9. Albert

Albert is a FinTech app that has lending, banking, and investing features all wrapped into a single app.

With the Albert app, you can get your paycheck up to two days early to help you if you're in a tight spot. Plus, you can get up to $250 in fee-free cash advances without needing a credit check!

The lack of interest payments, a credit check, and late payment fees is what makes Albert great. Plus, you can start investing with just $1 with its investing option to put your money to work.

I like Albert since it also has some nifty savings tools to encourage you to build an emergency fund. Just note that you have to subscribe to Albert Genius if you want to invest money and use its savings tools. This plan costs between $6 to $16 per month, and you choose how much to pay.

Read our Albert app review to learn more!

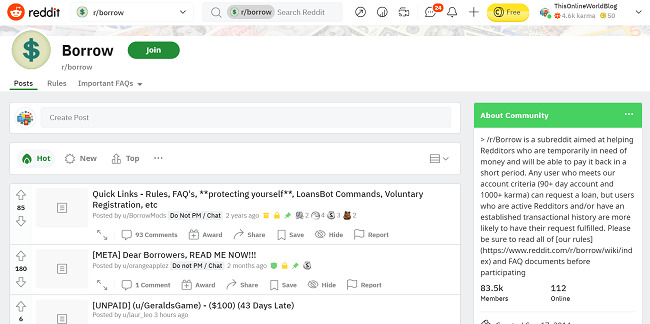

10. Reddit r/Borrow

I've covered plenty of ways to make money on Reddit before on this blog, ranging from freelancing to flipping money.

But did you know another option to borrow 50 dollars instantly is to borrow the money from your fellow Redditors?

With r/Borrow, you can ask for peer-to-peer loans from other Reddit users. As a borrower, you post how much you need, how much you're willing to repay in interest, and your payment date.

You need at least 1,000 karma and an account that's 90 days old or older to request money. And the entire subreddit uses a trust-based system, and borrowers with good track records of repayments are more likely to receive funds.

It's not a guaranteed source of quick money or a $50 instant loan app, but it's another option you can try out that doesn't require a credit check!

11. MoneyLion

One final app you can borrow $50 instantly with is MoneyLion, a newer mobile banking app with a host of features.

With MoneyLion, you can open its fee-free checking account called RoarMoney and get your paycheck up to two days in advance. You also get free ATM withdrawals at 50,000+ ATMs, and you can even round-up purchases to automatically save more money.

Plus, with its InstantCash feature, MoneyLion lets you borrow up to $250 without interest fees or a credit check.

You start at a $50 cash advance limit, but as your account gains more history and payments, you can increase your limit.

MoneyLion also lets you invest in different portfolios that match your goals and risk tolerance. It's a similar concept to apps like Acorns, and it's nice that the app has features for building wealth, saving, and borrowing.

Read our MoneyLion Instacash review for all the details!

Other Alternatives To $50 Cash Advance Apps

Now that I've covered some of the best apps in this space, here are a few more ideas for how you can get this amount of money in a short time period.

1. Your Emergency Fund

Financial advisors often recommend building an emergency fund that can cover at least three to six months of living expenses.

Of course, if you're looking to borrow $50 instantly, you might not have an emergency fund laying around and that's okay.

However, building an emergency fund should be a goal if you don't have one. This is your rainy day fund for when life throws emergencies at you, and it helps prevent the need to borrow in the first place.

Even if you start out by putting a bit of money aside from paychecks into a high-yield savings account, building your fund slowly is better than having no fund at all.

Pro Tip: Use Rocket Money to get your budget on track and save money on monthly bills!

2. Get-Paid-To Websites

Another alternative to $50 cash advance apps is to use various get-paid-to websites that pay you for completing short tasks like paid surveys or downloading different apps.

Some reputable and popular websites you can use include:

- Branded Surveys: Lets you cash out with PayPal money and a variety of free gift cards.

- Freecash: A popular GPT site that pays you to play games, answer surveys, watch ads, and more.

- Swagbucks: This website pays you to answer surveys, play games, watch ads, shop online, and install apps.

- Survey Junkie: Another leading survey site that has PayPal rewards and plenty of gift card options.

- Pinecone Research: Pays you $3 for every short survey you complete.

I also made a video that covers some of my favorite survey apps and sites you can use instead. Beermoney sites like these can't replace your day job or make you rich. But they do work for making some extra money on the side, and you can probably earn $50 over the course of a few days.

👉 Start earning with Freecash!

3. Gig Economy Apps

One more idea for getting $50 fast is to use different gig apps that let you get paid the same day.

For example, gigs like DoorDash or Uber Eats both have instant pay options that let you cash out daily earnings for a small fee. Same goes for leading grocery delivery service Instacart.

These gigs can make $50 in a couple of hours of work, and options like Uber Eats and DoorDash even let you deliver via bike, car, or scooter, so it's very flexible.

As you can see in the video above from DoorDash driver Nuggs, he was able to make $50 with DoorDash in just a few hours of deliveries, so this is quite realistic.

My friends also make money with Uber Eats and Amazon Flex, so you have plenty of alternatives to using $50 cash advance apps.

Extra Reading – How To Sign Up And Get $25 Instantly.

4. Friends & Family

If you need a quick $50, I think this is the sort of money you might be able to ask friends or family for. Of course, you need to be comfortable with this, and you know your social circle better than I do. But this method is often fast, free, and for a smaller amount like $50 it might not be too big of an ask.

You can read our guide on how to ask to borrow money for some tips on taking this route.

👉 The Best $100 Loan Instant Apps.

5. Sell Stuff You Own

I've done this before by selling clothing, guitars, and furniture to people in my city back in college on the Facebook Marketplace. And this is an effective way to find some local buyers in short notice.

My video covers some of my all-time favorite selling apps and tips for getting started. As for what you can sell, some popular pieces that tend to sell quickly include:

- Clothing

- Electronics (TVs, headphones, tablets, smartphones, etc)

- Furniture

- Jewelry (you can use Worthy to safely sell your jewelry and diamonds online)

- Home goods

- Shoes

- Toys

- Video games

- Watches

If you can't find local buyers, you can also consider pawning stuff instead at your local pawn shop. This works well for jewelry and high-value items, but be prepared to negotiate a bit.

Extra Reading – The Best $100 Sign Up Bonuses.

Final Thoughts

I hope this list of the best 50 dollar cash advance apps that don't need a credit check helps you if you're in a bit of a financial pickle.

Again, I prefer side hustling and online money-making ideas over borrowing. And I can't stress the importance of building up an emergency fund enough.

However, these apps can be better than turning to your credit card, and they can also help you avoid overdraft fees.

Looking for other quick money-making ideas? Checkout:

- The Best $25 Instant Cash Advance Apps.

- Is The Beem App Legit?

- How To Get $500 By Tomorrow.

- Is The Empower App Legit?

EarnIn Disclaimers:

1: EarnIn is a financial technology company, not a bank. EarnIn services may not be available in all states. Bank products are issued by Evolve Bank & Trust, Member FDIC.

2: Subject to your available earnings, Daily Max and Pay Period Max. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

3: EarnIn does not charge interest on Cash Outs. EarnIn does not charge membership fees for use of its services. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

4: Fees apply to use Lightning Speed. Lightning Speed may not be available to all Community Members. Cash Outs may take up to thirty minutes, actual transfer speeds will depend on your bank. Restrictions and/or third party fees may apply, see Cash Out User Agreement for details.

Chime MyPay Disclaimers:

MyPay™ line of credit provided by The Bancorp Bank, N.A. or Stride Bank, N.A. MyPay services

provided by Chime Capital, LLC (NMLS 2316451).

To be eligible for MyPay, you must receive Qualifying MyPay Direct Deposits to your Chime Checking Account as set forth in the MyPay Agreement. A Qualifying MyPay Direct Deposit is a deposit from an employer, payroll provider, gig economy payer, government benefits payer, or other permitted source of income by Automated Clearing House (“ACH”) or Original Credit Transaction (“OCT”). Your MyPay Credit Limit and Available Advance Amount may change at any time. MyPay is a line of credit and available limits are based on estimated income and risk-based criteria. Eligible members may be offered a $20 – $500 Credit Limit per pay period. Your Credit Limit and Maximum Available Advance will be displayed to you within the Chime app. MyPay is currently only available to eligible Chime members in certain states. Other restrictions may apply. See Bancorp MyPay Agreement or Stride MyPay Agreement for details.

Option to get funds instantly for $2 per advance or get funds for free within 2 days. See Bancorp

MyPay Agreement or Stride MyPay Agreement for details.