The 9 Best $25 Cash Advance Apps To Borrow Money Instantly

Need a few bucks to make it to your next payday? Could a bit of side cash help you buy a few groceries or partially fill up your tank to get you to work?

We all have times when we’re running short on cash. Sometimes all we really need is a few bucks to get by. And not everyone has family or friends that can help them out.

This is where cash advance apps that help you borrow $25 instantly (or even more) can help you make ends meet. So, let's explore some of our favorite $25 loan instant apps you can use to get paid ASAP.

The Best $25 Instant Loan Apps For Cash Advances

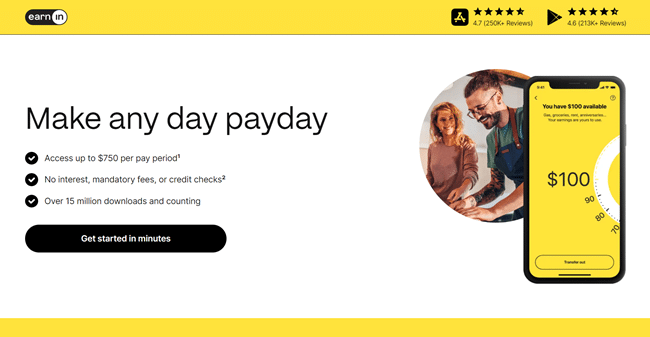

1. EarnIn

EarnIn is our all-time favorite borrowing app, and it's a very easy way to get a $25 cash advance, or even more, if you need quick money.

With EarnIn, you can borrow up to $100 per day – for $750 in total – in a given pay period. And this is super useful if you need to pay rent, bills, or cover some emergency.

EarnIn doesn't charge charge interest or mandatory fees. There's no credit check requirement either. Instead of fees, EarnIn asks for voluntary tips. You can also pay a variable fee if you want an instant cash deposit. Otherwise, you can get your deposit without fees in a few business days.

Like the other $25 loan apps in this article, EarnIn connects to your bank account and analyzes paycheck history to determine how much you're eligible to borrow. Not every user qualifies. But you can steadily increase your limit with more payment history and on-time payments.

Try out EarnIn today or read our EarnIn app review to learn more.

2. Cleo

You can get a $25 instant cash advance served up with a side of sarcasm with Cleo – an AI-powered financial app.

With Cleo, members can borrow anywhere from $20 to $250 in an interest-free cash advance. New members can borrow $20 to $100, but more established members can borrow up to $250.

There's no interest or credit check requirement either as with EarnIn. And Cleo monitors your bank account to determine how much you can borrow.

Advances deposit for free within 3 to 4 working days. You can also pay an express fee of $3.99 to get paid right away. Cleo also charges $5.99 per month for Cleo Plus, which unlocks advances.

We like Cleo for gig workers and freelancers since it doesn't require W2 deposits to qualify for an advance; any regular income can qualify. Plus, the app has budgeting features to help members save extra money.

Try out Cleo today or read our Cleo app review!

3. Dave

Dave³ offers its ExtraCash Advancements of up to $500 and is another excellent option to borrow $25 or much more if you're struggling financially right now.

Dave is one of our favorite apps alongside EarnIn and Cleo. And it simply charges a $1 monthly fee to let you access ExtraCash Advancements. The app also asks for optional tips and doesn't charge interest or require a credit check.

We like Dave because it also has a nifty tool to help you find the best side hustles. This includes various gig jobs, paid surveys, reward apps, part-time work, and even passive income ideas. Dave even has budgeting tools like Cleo.

Most qualifying users receive their funds from Dave in 1 to 3 business days. Express fees can apply if you need an instant transfer and transfers to some banks may take longer.

Get started with Dave or read our Dave app review to learn more!

4. Current

Are you looking for a digital savings solution that also helps you borrow $25 or even more?

Then Current could be for you. This FinTech company offers a no-fee checking and savings account to help you spend and save your money more easily. And it also has cash advances of up to $500 as well as free overdraft protection of up to $200.

Our favorite part about Current is that its savings account also pays 4% APY on up to $6,000 in savings. This is a great way to earn on autopilot, and you don't pay monthly account fees.

On top of that, there's even a $50 sign up bonus for new members if you sign up and set up qualifying direct deposits. And Current even offers early paycheck deposits of up to 2 days.

Get $50 from Current or read our Current bank review to learn more!

💵 Check out the best instant sign up bonuses without direct deposit requirements going on right now to earn even more!

5. Klover

Another simple way to get a $25 instant cash advance is to use Klover.

Like other apps in this list, Klover doesn't charge interest, late fees, or require a credit check. And its unique system is great for those with lower incomes or who might not have the best credit score.

Klover lets you borrow up to $200 with its cash advance feature. You can increase your borrowing limit by earning points in unique ways. For example, answering online surveys, saving money, watching videos, and other fun options can increase your limit.

Klover also has other features like daily cash giveaway and budgeting tools. It can take up to 3 days for Klover to process a cash advance, so keep this in mind.

Users can also upgrade to Klover+ for $4.99 per month to unlock even more features including credit monitoring and access to a financial advisor.

Try out Klover today or read our Klover app review!

👉 How To Get $500 By Tomorrow.

6. MoneyLion

MoneyLion is an all-in-one financial solution that offers everything from a checking and savings account to options for income investing.

Its cash advance feature also lets you borrow $25 to $500 against your upcoming paycheck. And it can also help match you to the best personal loans for you to help you borrow $25 or way more.

You don't pay interest or mandatory fees for the advance. Some of MoneyLion's other features have monthly costs, but we like the company if you're looking for an all-in-one solution to make, save, and borrow.

Extra Reading – How To Make $1,000 In A Day.

7. Chime MyPay

You may know Chime for its lack of fees and high-interest savings accounts. But it also has a new feature called Chime MyPay that lets you borrow up to $500 before payday.

Like the other $25 loan apps I've covered, Chime MyPay doesn't charge interest or hidden fees. There's no credit check either. You get your money for free if you wait more than 24 hours or pay a $2 flat fee for an instant deposit.

Most new members get $50 to $100 as their advance limit, so your $25 is covered. You can then increase your limit with more pay cycles.

Chime also has other great features including access to over 60,000+ ATMs and the ability to earn passive income with Chime Savings. Read our Chime MyPay review or list of cash advance apps that work with Chime to learn more!

Extra Reading: The Best $200 Loan Apps For Instant Cash.

8. Varo

Varo is a digital bank that's best known for its lack of monthly fees and high-yield savings account.

But the company now offers cash advances. New members can qualify to advance up to $250. And this limit can increase to up to $500 as you make on-time payments.

We also like Varo since its checking account offers cash-back rewards. This lets you get paid while you shop without worrying about bank fees. And its high-yield savings account can pay up to 5% APY right now.

Read our post – is Varo legit? – to get all the details!

9. Super.com

Super.com is one of the most versatile cash advance options out there. And it can also help you borrow $20 to $250 against a future paycheck without paying interest or hidden fees.

This website is a mix of a rewards site and a get-paid-to site. It offers cash advances as well as coupons, cash-back deals, travel discounts, and even side hustle opportunities.

That's right: you can borrow $25 but also earn with options like cash games, shopping deals, and cash surveys. Not too shabby!

Just note you have to pay for Super+ to unlock advances and most of its features. This costs $15 per month. But you don't pay mandatory fees on advances and can easily offset your membership cost with its earning offers.

How Can I Borrow $20 Instantly?

If you want to borrow $20, then using cash advance apps like EarnIn or Cleo is one the most effective options. These apps are both low-fee and let you access future earnings from your paycheck and can lend most qualifying users $20.

You can also try options like a credit card advance or asking your friends or family to spot you $20. But for this small amount of money, a cash advance app is a great option to consider.

👉 The Best Ways To Borrow $100 Instantly.

What Are Some Other Alternatives To Borrow $25 Instantly?

You can turn to instant $25 loan apps to cover yourself until the next paycheck. But this is far from your only option when you need some fast cash.

Several other alternatives worth considering include:

- Asking friends and family to borrow the money

- Making money with an idea from our side hustle database

- Using a credit card

- Taking out a personal loan with a company like Possible Finance

- Making money with fast-paying side gigs

- Selling your unused things

- Getting an online job that pays daily

- Pawning stuff for cash

There are truly tons of options for increasing your income in short notice. And we cover these ideas all the time here at WebMonkey!

Final Thoughts

If you are wondering where to borrow $25, there are cash advance apps that can help. And these apps are often way cheaper than turning to something like a payday loan or your credit card.

Personally, EarnIn is my favorite choice. But you can try several of these $25 advance apps to find what works best for you. Just factor in any fees, membership costs, and extra features you get to pick the app that's right for your situation.

Want even more fast income ideas? Checkout:

- How To Make $200 Fast.

- The Best Instant $25 Sign Up Bonuses.

- Is The Empower Cash Advance App Legit?

- How To Get Free Money Today.

1 Cleo loans are subject to eligibility and the amounts are subject to change. Express fees may be applied to same day transfers.

3 New Dave customers have an average approved cash advance of $160.

EarnIn Disclaimers:

1: EarnIn is a financial technology company, not a bank. EarnIn services may not be available in all states. Bank products are issued by Evolve Bank & Trust, Member FDIC.

2: Subject to your available earnings, Daily Max and Pay Period Max. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

3: EarnIn does not charge interest on Cash Outs. EarnIn does not charge membership fees for use of its services. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

4: Fees apply to use Lightning Speed. Lightning Speed may not be available to all Community Members. Cash Outs may take up to thirty minutes, actual transfer speeds will depend on your bank. Restrictions and/or third party fees may apply, see Cash Out User Agreement for details.